from Lars Syll Along with the Arrow-Debreu existence theorem and some results on regular economies, SMD (Sonnenschein-Mantel-Debreu) theory fills in many of the gaps we might have in our understanding of general equilibrium theory … It is also a deeply negative result. SMD theory means that assumptions guaranteeing good behavior at the microeconomic level do not carry over to the aggregate level or to qualitative features of the equilibrium. It has been difficult to make progress on the...

Read More »We need doughnut economics. But we also need GDP growth. Lots of it.

Some ‘alternative economics’ have reently been published: we are moving from criticism to alternatives. Which is a good thing: Kate Raworth broke ground with Doughnut economics. Jamie Morgan et all recently published ‘Quest for a new paradigm in economics. A synthesis of views of the New Economics working group’. We can also mention the people publishing in the Journal of Industrial Ecology, who do not look at the circular monetary economy but at the circularity (or not) of flows of...

Read More »“Less than 2 °C warming by 2100 unlikely”

from Nature Climate Change Less than 2 °C warming by 2100 unlikely Adrian E. Raftery, Alec Zimmer, Dargan M. W. Frierson, Richard Startz & Peiran Liu The recently published Intergovernmental Panel on Climate Change (IPCC) projections to 2100 give likely ranges of global temperature increase in four scenarios for population, economic growth and carbon use1. However, these projections are not based on a fully statistical approach. Here we use a country-specific version of Kaya’s...

Read More »Culture beyond capitalism

from David Ruccio Culture, it seems, is back on the agenda in economics. Thomas Piketty, in Capital in the Twenty-First Century, famously invoked the novels of Honoré de Balzac and Jane Austen because they dramatized the immobility of a nineteenth-century world where inequality guaranteed more inequality (which, of course, is where we’re heading again). Robert J. Shiller, past president of the American Economic Association, focused on “Narrative Economics” in his address at the January...

Read More »Problems with Pareto optimality

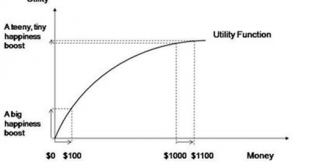

from Gary Flomenhoft, “The triumph of Pareto”, real-world economics review, issue no. 80, 26 June 2017, pp. 14-31. There are several serious problems with the use of Pareto Optimality as the central goal of economics. One of the primary implications of “Pareto Optimality” is that it accepts the current distribution of wealth as a given. If any income distribution can lead to an “optimal” outcome, there is no need to be concerned about just distribution. Mainstream economists generally...

Read More »Hunter-Gatherer Societies

from Asad Zaman As a preliminary demonstration, and an explanation of the “Three Methodologies“, we assess how they work in primitive hunter-gatherer societies. A hunter-gatherer is a human living in a society in which most or all food is obtained by foraging (collecting wild plants and pursuing wild animals), in contrast to agricultural societies, which rely mainly on domesticated species. There are many characteristics of such societies forced by the material conditions of production....

Read More »When ignorance is bliss

from Lars Syll The production function has been a powerful instrument of miseducation. The student of economic theory is taught to write Q = f(L, K) where L is a quantity of labor, K a quantity of capital and Q a rate of output of commodities. He is instructed to assume all workers alike, and to measure L in man-hours of labor; he is told something about the index-number problem in choosing a unit of output; and then he is hurried on to the next question, in the hope that he will forget...

Read More »Myth of “the market”

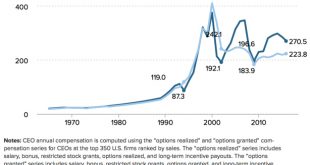

from David Ruccio We’ve all heard it at one time or another. Why is the price of gasoline so high? Mainstream economists respond, “it’s the market.” Or if you think you deserve a pay raise, the answer again is, “go get another offer and we’ll see if you’re worth it according to ‘the market’.” And then there’s CEO pay, which last year was 271 times the average pay of workers. Ah, it’s what “the market” has determined the appropriate compensation to be. “The market” explains...

Read More »The Hidden Wealth Grab (w/ Dean Baker)

Subscribe to The Zero Hour with RJ Eskow for more: http://bit.ly/TheZeroHour If you liked this clip of The Zero Hour with RJ Eskow, please share it with your friends... and hit that "like" button! Some of the music bumpers featuring Lettuce, http://lettucefunk.com.

Read More »What so many critiques of economics gets right

from Lars Syll Yours truly had a post up the other day on John Rapley’s Twilight of the Money Gods. In the main I think Rapley is right in his attack on contemporary economics and its ‘priesthood,’ although he often seems to forget that there are — yes, it’s true — more than one approach in economics, and that his critique mainly pertains to mainstream neoclassical economics. Noah Smith, however, is not too happy about the book: There are certainly some grains of truth in this standard...

Read More » Real-World Economics Review

Real-World Economics Review