from Peter Radford This is not a time to dwell on the inconsistencies and even contradictions of the recent uprising of populism in the western world. Treat it as a fact. It just is. For there can be no mistaking the trend: people, large numbers of people, in a large swathe of Europe and America really are unhappy with their lot in life. Really unhappy. Fully 52% of Republican supporters of Donald Trump tell pollsters that they are angry with the way the country is going. Not just unhappy...

Read More »“The continuing tension between Neoliberal economics and democracy” – William R. Neil

Today’s Neoliberalism had nearly silenced serious left dissent by the late 1990s, or successfully isolated it in remote academic corners. Bill Clinton’s two terms in the 1990s are proof of that. And there is the continuing tension between Neoliberal economics and democracy: notice the desperate, barely concealed attempt by the Republican Right to shrink the franchise, using as one of its main levers the racial stigmas from “The Great Incarceration” and the yet to be proven accusations of...

Read More »Economic Theory as Ideology

from Asad Zaman Ideology and Science are diametrically opposed to each other. An ideology is a set of beliefs that is maintained even in face of strong empirical evidence to the contrary. Science is primarily concerned with explaining the empirical evidence. Theories which conflict with observations are rejected. This does not mean that ideology is necessarily wrong or bad – we must maintain our belief in justice, morality, honesty, trust, integrity without any empirical evidence;...

Read More »The U.S. supremacy in the age of high finance: expansion and crisis

from Maria Alejandra Madi In the post-war boom era of 1945 to 1971, the U.S. surplus was at the center of the global economic order. Throughout the Bretton Woods period, the United States recycled part of its surplus via foreign direct investment – mainly in Western Europe and also in Japan. Within the system of international economic flows, the U.S. exported goods to the rest of the world and also finance these purchases. Besides, the United States created demand for the exports of...

Read More »“The two necessary words to describe the dominant economic “regime” of the past 35 years” – William R. Neil

It’s hard not to notice, during the American Presidential election drama, that despite all the debates and speeches, and multiple candidates, the terms “Neoliberalism” and “austerity” have yet to be employed, much less explained, these being the two necessary words to describe the dominant economic “regime” of the past 35 years. And this despite the fact that most observers recognize that a “populist revolt” driven by economic unhappiness is underway via the campaigns of Donald Trump and...

Read More »Paul Krugman’s stock market advice

from Dean Baker Paul Krugman actually did not make any predictions on the stock market, so those looking to get investment advice from everyone’s favorite Nobel Prize winning economist will be disappointed. But he did make some interesting comments on the market’s new high. Some of these are on the mark, but some could use some further elaboration. I’ll start with what is right. First, Krugman points out that the market is horrible as a predictor of the future of the economy. The market...

Read More »A Travesty of Financial History – which bank lobbyists will applaud

from Michael Hudson Review of William Goetzmann, Money Changes Everything:How Finance Made Civilization Possible (Princeton University Press, 2016) Debt mounts up faster than the means to pay. Yet there is widespread lack of awareness regarding what this debt dynamic implies. From Mesopotamia in the third millennium BC to the modern world, the way in which society has dealt with the buildup of debt has been the main force transforming political relations. Financial textbook writers tell...

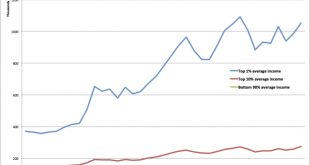

Read More »Average incomes in the US 1979-2015

from David Ruccio This is my own chart—showing the dramatic changes in the average incomes of the bottom 90 percent, the top 10 percent, and the top 1 percent—from the World Wealth and Income Database. Incomes are in thousands of real 2015 dollars. Thus, for example, the average income of the bottom 90 percent fell between 1979 and 2015 (from $34.6 thousand to $33.2 thousand), while the average income of the top 10 percent rose (from $149.1 thousand to $273.8 thousand) and that of the...

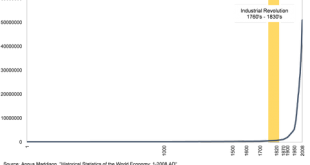

Read More »“Paradox of thrift was the norm before industrial revolution” Richard Koo

Exhibit 1. Economic growth became norm only after industrial revolution Looking further back in history, however, we can see that economic stagnation due to a lack of borrowers was much closer to the norm for thousands of years before the industrial revolution in the 1760s. As shown in Exhibit 1, economic growth had been negligible for centuries before that. There were probably many who tried to save during this period of essentially zero growth, because human beings have always been...

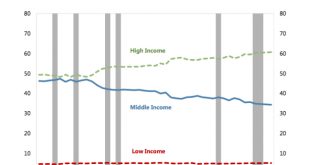

Read More »Inequality and polarization in the United States

from David Ruccio The problem of the growing gap between the small group of haves and all other Americans is (as I noted a week ago) so bad even the International Monetary Fund is sounding the alarm. Despite the ongoing expansion, the U.S. faces a confluence of forces that will weigh on the prospects for continued gains in economic well being. A rising share of the U.S. labor force is shifting into retirement, basic infrastructure is crumbling, productivity gains are scanty, and labor...

Read More » Real-World Economics Review

Real-World Economics Review