In yesterday’s short blog post – Some Brexit dynamics while across the Channel Europe is in denial (January 2, 2019), I noted that various European Commission officials were boasting about how great the monetary union had been over the last 20 years. European Commission President Jean-Claude Juncker had the audacity (and delusion) to claim it had “delivered prosperity and protection to our citizens. it has become a symbol of unity, sovereignty and stability”. I think he was either drunk or...

Read More »Don Quijones — ECB Just Launched “Better Than Blockchain” Instant Payments System

On Friday the ECB launched, with minimal fanfare, a brand new system aimed at enabling banks to settle payments instantaneously across Europe, helping them to compete with PayPal and other global tech giants. Developed in little over a year, the ECB’s not-for-profit TARGET Instant Payment Settlement (TIPS) system will let people and businesses in Europe transfer euros to each other almost instantly, at extremely low cost, and irrespective of the opening hours of their local bank.... Wolf...

Read More »10 years after – and nothing has changed.

The following is an interview with Yena Yoon – a financial journalist with Chosen Ilbo “the largest newspaper in South Korea” conducted on 12 February, 2018, but still relevant. What is the most remarkable change in financial market after 2008 global crisis do you see? Why do you think so? The most striking outcome from the global financial crisis of 2007-9 was that there was no structural change to the international financial architecture/system – the system that was at the heart of the...

Read More »Vítor unbound

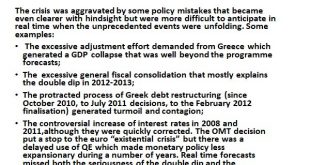

I always find the views of former policymakers fascinating, not least because of their tendency to become much more outspoken once they are out of office. Some express much more radical views than they did while in office: Larry Summers springs to mind, and Adair Turner. Others become critical of the institutions that they ran: Mervyn King, for example. The latest former policymaker to reveal what he really thinks is Vítor Constâncio, Vice President of the ECB from 2010 to 2018. In a...

Read More »Barkley Rosser — The Minsky Moment Ten Years After

… as Neil Schirmer in The Alchemists (especially Chap. 11) documented, the crucial move that halted the collapse of the euro and the threat of a fullout global collapse was a set of swaps the Fed pulled off that led to it taking about $600 billion of Eurojunk from the distressed European banks through the ECB onto the Fed balance sheet. These troubled assets were gradually and very quietly rolled off the Fed balance sheet over the next six months to be replaced by mortgage backed...

Read More »Bill Mitchell – European-wide unemployment insurance proposals – more bunk!

The Europhiles have been tweeting their heads off in the last week or so thinking that the corner has been turned – by which they mean that Germany is about to get all cuddly with France and agree to fundamental shifts in thinking which will make the dysfunctional Economic and Monetary Union (EMU) finally workable, without the need for the ECB to break Treaty law by propping up the private bond markets. The most recent incarnation of the ‘saviour’ is a few words that the new German Finance...

Read More »Ambrose Evans-Pritchard — Bundesbank back in charge of ECB, sending shivers through Italy

The European Central Bank has dropped its long-standing pledge to boost stimulus if conditions deteriorate, signalling the triumph of German-led hawks and marking a major turning point in the eurozone’s monetary regime. The approaching end to the QE-era pulls away the protective shield for Italy and the high-debt Latin states, and for thousands of “zombie companies” kept afloat on monetary life-support. Italy is the lynchpin of the euro. If Italy fails, the EZ fails. Stay tuned.The...

Read More »Michael Hudson — Greek debt update

Taken from a short interview with Greece’s Banking News. Q. According to the IMF, Greece’s debt isn’t manageable in the long-run without being either extended or forgiven. Where do you stand towards this claim? How important is the Greek debt relief? Michael Hudson — On Finance, Real Estate, and the Powers of NeoliberalismGreek debt updateMichael Hudson | President of The Institute for the Study of Long-Term Economic Trends (ISLET), a Wall Street Financial Analyst, Distinguished Research...

Read More »Reuters — ECB hits out at Washington for talking down the dollar

European Central Bank chief Mario Draghi took a swipe at Washington on Thursday for talking down the dollar, a move he said threatened a decades-old pact not to target the currency and might force his bank to change its own policy. ReutersECB hits out at Washington for talking down the dollarBalazs Koranyi, Francesco Canepa

Read More »Norbert Häring — The curious silence of the British media regarding Mark Carney and the secretive G30

Central bank "independence." Say again?Oh, right. Central bank independence means political indolence of technocrats from influence or intrusion on the part of elected representatives. It has nothing to do with influence by financial industry cronies.Real-World Economics Review BlogThe curious silence of the British media regarding Mark Carney and the secretive G30 Norbert HäringAlsoJean-Claude Trichet cannot be chairman of the ECB’s ethics committee any longer

Read More » Heterodox

Heterodox