Interview with Ms Christine Lagarde, President of the European Central Bank, in "Challenges" magazine, conducted by Mr Pierre-Henri de Menthon and Ms Sabine Syfuss-Arnaud, and published on 8 January 2020. BISChristine Lagarde: Interview in "Challenges" magazine

Read More »Bill Mitchell – Euro policy elites deliberately destroyed jobs and income to achieve erroneous fiscal goals

As Mario Draghi’s tenure at the helm of the ECB draws to a close, he becomes (slightly) more pointed and looser with his public statements. On Friday (October 11, 2019), he gave a speech – Policymaking, responsibility and uncertainty – at the Università Cattolica in Milan on the occasion of receiving the Laurea Honoris Causa (honorary degree). He broadened the scope of his policy ambit by saying that “I will not focus strictly on monetary policy or the business of central banking, but I...

Read More »Bill Mitchell — When old central bankers know what is wrong but can’t bring themselves to saying what is right

Last Friday (October 4, 2019), a group of former central bank governors and/or officials in Europe, issued a statement damming the conduct of the European Central Bank. You can read the full text at Bloomberg – Memorandum on ECB Monetary Policy by Issing, Stark, Schlesinger. The timing of the intervention is interesting given the change of boss at the ECB is imminent. As I explain in what follows, the Memorandum should be disregarded. Its central contentions are mostly correct but the...

Read More »Bill Mitchell — ECB confirms monetary policy has run its course – Part 2

This is Part 2 of my two-part commentary and analysis of the – Monetary policy decisions – by the ECB (September 12, 2019). In Part 1, I discussed the shifts in the deposit rate and the changes to the Targeted longer-term refinancing operations (TLTROs). In Part 2, I am focusing on the decision to introduce a two-tiered deposit rate on excess reserves, which is designed to reduce the costs of the penalty arising from the negative deposit rate regime that the ECB has had in place since June...

Read More »Bill Mitchell — ECB confirms monetary policy has run its course – Part 1

I will have little time to publish blog posts in the next two weeks. But as I travel around I have to sit in trains, planes and cars and that is when I tend to write when I am away from my desk(s). Today, I am in Maastricht – after travelling by train from Paris. I have two events – one on framing and language and the other on Reclaiming the State and Modern Monetary Theory (MMT) basics. Then I am heading to Berlin for a talk at PIMCO and on Friday I am presenting an MMT workshop at the...

Read More »Bill Mitchell – A leopard never changes its spots–Jens Weidmann, ECB President aspirant

Various people are vying for the key positions in the European structures (EC President, ECB head, and a range of other positions) at the moment. The presence of French and German interests typically dominate these outcomes, although as a result of the Treaty of Lisbon changes, more weight was given to the jockeying of the various political coalitions that find their way into the European Parliament. But that process has new been compromised by the decline of the traditional parties as...

Read More »Bill Mitchell — Fiscal policy paralysis and ECB credibility in tatters

Last week, the EU finance ministers (the ‘Eurogroup’) met (June 13, 2019) in Luxembourg as part of their regular schedule. There was a lot of talk in the lead-up to the meeting whether Emmanual Macron’s push for a more coherent EU fiscal capacity to act as a counter-stabilisation capacity for the beleaguered Economic and Monetary Union (EMU). As is normal, there was no progress made and the press reports said that the finance ministers “continued to clash over almost every feature of the...

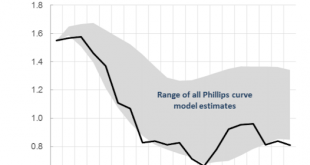

Read More »Dissecting the Eurozone’s (lack of) inflation

Eurozone inflation is in the doldrums again. After perking up to 1.7% in April, it slumped back to 1.2% in May. According to Bloomberg, this was "lower than expected". But I wonder who, apart from the ECB, really expected anything else. Core inflation has been well below target for the last five years: (chart from Bloomberg)And although the headine HICP measure increased in 2016-18, this was mostly due to the oil price bouncing back from its 2014-15 slump: (chart from Macrotrends)The...

Read More »Bill Mitchell — ECB denial is just embarrassing

Bill takedown of Sabine Lautenschläger, member of the Executive Board of the ECB and former Vice-President of the Bundesbank, presents a suitable opportunity for me to inject my own experience over the past several weeks following many hits from Google alerts on "MMT" and associated topics, including the MMT economists. I have not posted these since they are so off-base they are not even worth commenting on, and they are also repetitious. All wrong in pretty much the same ways. There as...

Read More »ECB forecasting is a joke

Over at Bruegel, Zsolt Darvas takes the ECB to task for systematic forecasting errors in the last five years. He shows that the ECB has persistently overestimated inflation and unemployment, and on this basis he questions the ECB's decision to end QE in December 2018. I share his concern that the ECB has tightened too soon, though as the ECB's QE program is seriously flawed and very damaging, I am not sorry to see the back of it.But I think that in focusing on the last five years, he has...

Read More » Heterodox

Heterodox