Germany looks to the future. Uncle Sam won't be pleased. HSBC chief executive Stuart Gulliver, speaking at the same conference in Hong Kong, said that the Belt and Road Initiative (BRI) will increase the usage of RMB even further. China’s central bank announced new measures earlier this month to encourage cross-border yuan transactions in support of BRI projects. Asia TimesGerman central bank to add RMB to currency reserves: Follows ECB’s move to include China’s currency last year

Read More »Accommodative Officials and Synchronized Upturn Drive Markets

By Marc Chandler (originally posted at Marc to Market) The investment climate is being shaped by two powerful forces. First is the very accommodative policy stance. This includes the United States, where despite delivering the fifth rate hike in the cycle, adjusted by headline CPI, remains negative. As the balance sheet has begun being reduced, financial conditions in the US are easier now...

Read More »Bill Mitchell — The sham of ECB independence

One of the major claims the founders of the EMU made was that by creating an independent ECB – by which they meant ‘independent’ of the influence from the Member States or other EU bodies (such as the Eurogroup) – they were laying the foundations of financial stability and disciplining the fiscal policy of the Member States. This so-called independence was embodied in the – Treaty on the Functioning of the European Union – where Article 123 prevents the ECB from giving “overdraft facilities...

Read More »Michael Roberts — Beware the ECB bearing gifts for Greeks

The announcement by the European Central Bank that it has so far made €7.8bn in profits from its holdings in Greek government debt reveals the true nature of the so-called bailouts of Greek government finances that the EU leaders organised in return for massive austerity measures from 2012 onwards.... Michael Roberts BlogBeware the ECB bearing gifts for GreeksMichael Roberts

Read More »J. D. Alt — The Great Italian Experiment (part 2)

As I said, Italy, is now experimenting with paying for public services with tax credits. Presumably, this is happening because Italy doesn’t possess enough Euros to pay its citizens to provide all the goods and services needed to maintain and run the public sector of its social economy. And Italy can’t “create” the additional Euros it needs because that prerogative is the exclusive right of the EU Central Bank which Italy, even as a sovereign member of the EU, has no control over. But, as...

Read More »Corporate Europe Observatory — Corporate capture at its most extreme: 98% of ECB advisors represent industry

ECB advisory groups are used as lobby platforms by the financial industry, Corporate Europe Observatory’s newest report shows. Published today, “Open door for forces of finance at the ECB” reveals that the advisory groups counselling the European Central Bank have become largely dominated by representatives of some of the most influential global financial corporations. European parliamentarians are urged to act. Like many other EU institutions, the European Central Bank (ECB) actively...

Read More »Bill Mitchell — Mainstream macroeconomics credibility went out the window years ago

The Vice President of the European Central Bank, Vítor Constâncio, gave the opening speech – Developing models for policy analysis in central banks – at the Annual Research Conference, Frankfurt am Main, on September 25, 2017. Last time I heard Constâncio speak in person, in Florence 2015, he was in typical Europhile central bank denial. He thought the Eurozone was fine, a great success given the low inflation, inferring that the ECB’s conduct had something to do with that. He didn’t talk...

Read More »Germany’s negative-rates trap

Germany's Finance Minister Wolfgang Schaueble has long been critical of ECB monetary policy,. But now, as Reuters says, the gloves are off. In a speech at a prizegiving for an ordoliberal economics foundation last Friday, Dr. Schaeuble demanded that the ECB raise interest rates.The justification? Very low interest rates hurt Germany's savers, which are the bedrock of its economy.There is a political dimension to this. Dr. Schaueble's party, the CDU, is losing popularity and desperate for...

Read More »ECB, Fed, Rail traffic

Looks like they are again making hawkish noises, taking the lead of the Fed: ECB wary of further action despite uncertain future By: Balazs Koranyi and John O’DonnellJan 14 (Reuters)* Many governors sceptical of need for further action in near term* Governors urge countries to act instead with reform* Oil price and inflation expectations:Many European Central Bank policy makers are sceptical about the need for further policy action in the near term, conversations with five of them indicate,...

Read More »ECB comment, Retail Sales, Fed Atlanta, Oil comment

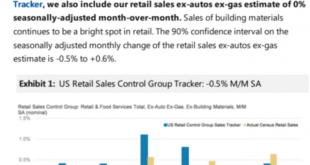

Seems there’s no wisdom on the topic of ‘money’ anywhere of consequence: No ‘plan B’ for ECB despite still low inflation: Praet Jan 6 (Reuters) — Executive Board member Peter Praet said various factors, notably low oil prices and less buoyant emerging economies, meant it was taking longer to reach the goal of inflation of close to but below 2 percent. “We need to be attentive that this shifting horizon does not damage the credibility of the ECB,” he added. “There is no plan B, there is just...

Read More » Heterodox

Heterodox