Excerpts from the Speech by Mario Draghi, President of the ECB, Economic Club of New York, 4 December 2015: There is no particular limit to how we can deploy any of our tools. True- limits are political And in this context it is important to recall that we operate under a clear framework of monetary dominance – we are ultimately driven by our mandate of maintaining price stability. True Indeed, it is inevitable that unconventional policy settings, ranging from negative interest rates to...

Read More »Factory orders, ISM non mfg, ECB news

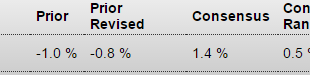

Yes, they were up, but there is a ‘seasonal’ aspect to it, including an air show, so the year over year chart is a bit more indicative of what’s going on and it’s still in negative territory. Also, vehicle orders declined, and inventories remained at levels that beg continuing production cuts. Factory OrdersHighlightsFactory orders bounced sharply higher in October and, together with the bounce higher for manufacturing in the industrial production report, confirm what was a very solid month...

Read More »Eurodespair

In my last post, I warned about "siren voices" calling for tighter monetary policy while the Eurozone economy is stuck in a toxic equilibrium of low growth, zero inflation and intractably high unemployment. Specifically, the so-called "German Council of Economic Experts (GCEE)" has called for the ECB to reduce or unwind QE: ...the European Central Bank should slow down the expansion of its balance sheet or even phase it out earlier than announced. Of course, the GCEE is only concerned...

Read More »Euro area depression, charted

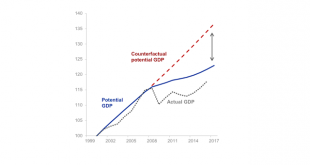

"The euro area economy is gradually emerging from a deep and protracted downturn. However, despite improvements over the last year, real GDP is still below the level of the first quarter of 2008. The picture is more striking still if one looks at where nominal growth would be now if pre-crisis trends had been maintained." So said Peter Praet, Member of the Executive Board of the ECB, in a recent presentation to the FAROS Institutional Investors' Forum.He's not wrong. From his presentation,...

Read More »Draghi Comments, Global Comments

ECB will do what is needed to keep inflation target on track: Draghi By Stephen JewkesOct 31 (Reuters) — “If we are convinced that our medium-term inflation target is at risk, we will take the necessary actions,” ECB president Draghi told Il Sole 24 Ore. “We will see whether a further stimulus is necessary. This is an open question,” he said, adding it would take longer than was foreseen in March to return to price stability. Draghi said inflation in the euro zone was expected to remain...

Read More »In defence of the (conflicted) ECB

Everyone has been so transfixed by Yanis Varoufakis's "Plan B" revelations that his defence of the ECB's Mario Draghi passed unnoticed. Here it is, transcribed from the Lamont tape by Peter Spiegel at the FT:Mario Draghi has handled himself as well as he could, and he tried to stay out of this mire, the political mire, impressively. I have always held him in high regard. I hold him in even higher regard now, having experienced him over the last six months. Having said that, the European...

Read More »The coming Greek bank nationalization, bail-in and privatization

In-depth analysis on Credit Writedowns Pro. By Frances Coppola The banks are re-opening, though just for transactions, so people can pay their bills and their taxes, pay in cheques, that kind of thing. The cash withdrawal limit has been changed to a weekly limit of 420 EUR per card per person, enabling households to manage their cash flow better. But the capital controls remain: money cannot leave the country without the agreement of the Finance Ministry. And the banks remain short of...

Read More »Greece on the verge

Jean François Ponsot, Jonathan Marie and @NakedKeynesI'm in France for a talk at the Université de Paris XIII, invited by Jonathan Marie and Dany Lang. The Greek crisis looms large in everybody's minds. I gave a talk based on two papers, one published here, and the other (specifically on the Spanish crisis) just finished, which will soon come as a working paper. But I discussed to a great extent the debate between Sergio Cesaratto and Marc Lavoie on the nature of the European crisis, that is,...

Read More »Stiglitz and Krugman on Troika’s Attack On Greek Democracy

By Joseph StiglitzThe rising crescendo of bickering and acrimony within Europe might seem to outsiders to be the inevitable result of the bitter endgame playing out between Greece and its creditors. In fact, European leaders are finally beginning to reveal the true nature of the ongoing debt dispute, and the answer is not pleasant: it is about power and democracy much more than money and economics. Of course, the economics behind the program that the “troika” (the European Commission, the...

Read More »Grexit: The staggering cost of central bank dependence

In-depth analysis on Credit Writedowns Pro. By Charles Wyplosz originally posted at Vox on 29 Jun 2015 This weekend’s dramatic events saw the ECB capping emergency assistance to Greece. This column argues that the ECB’s decision is the last of a long string of ECB mistakes in this crisis. Beyond triggering Greece’s Eurozone exit – thus revoking the euro’s irrevocability – it has shattered Eurozone governance and brought the politicisation of the ECB to new heights. Bound to follow are...

Read More » Heterodox

Heterodox