As 2020 draws to a close, and with a new US President due to take office in a few weeks, we want to mark – if a little late in the year – the 80th anniversary of Karl Polanyi’s five lecture series at Bennington College, Vermont, which he called “The Present Age of Transformation”. PRIME is proud to have published these in pdf format back in February 2017, with the much appreciated consent of the college, which ‘houses’ the original lecture manuscripts. We were particularly delighted that...

Read More »Economics without Gaps: on Ibn Khaldun and non-Western traditions in the history of ideas

Ibn Khaldun, Arab scholarA piece* from a few years ago, has again become somewhat popular and it has been making the rounds. It suggests that the Arab scholar Ibn Khaldun developed the ideas of classical political economics in the late XIV century, about half a millennia before Adam Smith, often seen as the father of classical economics, and of modern economics. Some would suggest that Khaldun was the real father of economics (or stepfather in the first essay on top). To a great extent, the...

Read More »To save the climate – don’t listen to mainstream economists

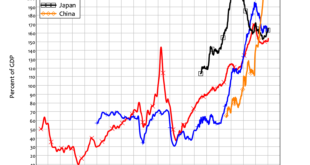

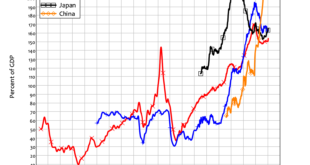

Ann Pettifor’s The Coming First World Debt Crisis (Pettifor 2006) was the first book to warn of the approaching 2007 Global Financial Crisis. More than decade after that crisis, its cause—excessive private debt, created primarily to finance asset bubbles rather than productive investment—is still with us, while we are entrapped in a pandemic crisis, and on the cusp of a climatic one.Figure 1: Private debt levels over the history of capitalismLooking forward to the next ten years, and given so...

Read More »To save the climate – don’t listen to mainstream economists

Ann Pettifor’s The Coming First World Debt Crisis (Pettifor 2006) was the first book to warn of the approaching 2007 Global Financial Crisis. More than decade after that crisis, its cause—excessive private debt, created primarily to finance asset bubbles rather than productive investment—is still with us, while we are entrapped in a pandemic crisis, and on the cusp of a climatic one.Figure 1: Private debt levels over the history of capitalismLooking forward to the next ten years, and given so...

Read More »To save the climate – don’t listen to mainstream economists

Ann Pettifor’s The Coming First World Debt Crisis (Pettifor 2006) was the first book to warn of the approaching 2007 Global Financial Crisis. More than decade after that crisis, its cause—excessive private debt, created primarily to finance asset bubbles rather than productive investment—is still with us, while we are entrapped in a pandemic crisis, and on the cusp of a climatic one. Figure 1: Private debt levels over the history of capitalism Looking forward to the next ten years, and given...

Read More »Austerity: a symptom of globalised rentier capitalism’s failure

Even while the economy is recast for today’s pandemic on the back of the dismal failures of the past decade, austerity is already rearing its ugly head. At one level there must be politics here. The public must not be allowed to think that socialising the economy to meet a pandemic means the economy might be socialised when the pandemic is over. Likewise, obsessing about excessive debt means the greatly more pressing and more dangerous reality of deficient expenditure is side-lined. But it’s...

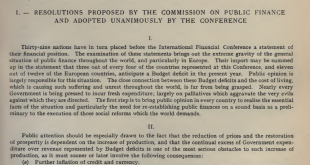

Read More »Confronting twin perils of pandemic and austerity – some lessons from 1920 & 2020

Extract from Resolutions of Brussels International Financial Conference 1920 SummaryThe UK is experiencing, as a result of the COVID 19 crisis and response, its most severe economic downturn on record; the largest in the last century was in 1921, when annual GDP fell by 9.7%. In assessing the likely level of the fall, the Office for...

Read More »100 years ago: the dignity of labour affirmed in the Royal Courts of Justice

“I say that if captains of industry cannot organise their concerns so as to give Labour a living wage, then they should resign from their captaincy of industry” - Ernest Bevin, February 1920One hundred years ago this month, a public inquiry held at the Royal Courts of Justice in London marked a significant change in industrial relations and...

Read More »Rohan Grey — Administering Money: Coinage, Debt Crises, and the Future of Fiscal Policy

Abstract The power to coin money is a fundamental constitutional power and central element of fiscal policymaking, along with spending, taxing, and borrowing. However, it remains neglected in constitutional and administrative law, despite the fact that money creation has been central to the United States’ fiscal capacities and constraints since at least1973, when it abandoned convertibility of the dollar into gold. This neglect is particularly prevalent in the context of debt...

Read More »Quebec Issued the First Paper Money in the New World — Martin Armstrong

Factoid.Armstrong EconomicsQuebec Issued the First Paper Money in the New World Martin Armstrong

Read More » Heterodox

Heterodox