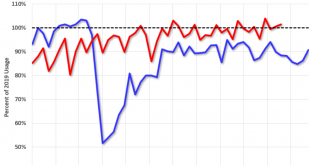

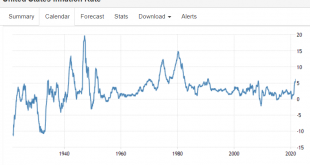

Back to pre covid levels as fewer people are being let go: Looks to me like the increases will subside if energy prices stabilize: Still looks to be on the decline, as federal deficit spending is quickly fading and inflation reduces the value of savings, causing people and businesses to spend less as they try to sustain a comfortable level of savings:

Read More »Trade, Japan, fading savings

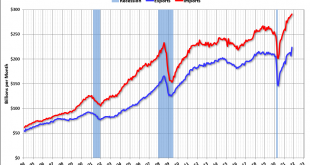

The slowdown in imports could indicate a slowing domestic economy: Both exports and imports increased in October. Exports are up 18% compared to October 2020; imports are up 22% compared to October 2020. Japan not doing so well: Personal income and savings went up with the fiscal transfers, and now they’re fading:

Read More »Gasoline supplied, private payrolls, construction spending

Recovered and then some: Closing the gap but a ways to go to ketchup: Not adding much to growth:

Read More »Existing home sales, new home sales, durable goods orders, consumer sentiment, personal consumption and income, tax receipts

Higher prices brought out a few more sellers: The blip up seems to have reversed: Softening: Looks like inventories have recovered: These largely involve buying intentions: Seems to be back on trend, without have ‘made up for’ the covid dip: The rate of growth is declining and has about settled back to the pre covid trend.The higher personal savings from the extra income from fiscal spending is largelyin the form of reduced personal debt: There’s a history of...

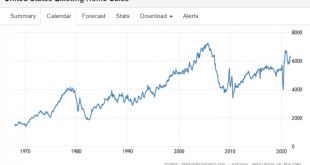

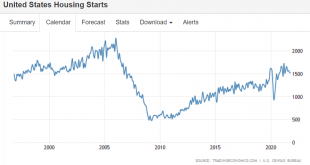

Read More »Housing starts, nat gas, retired workers returning

Softening from historically low levels: Another commodity that seems to have had a spike that’s ending: Retirees are ‘unretiring’ — and that’s good for the labor market

Read More »Industrial production, retail sales

Just muddling along: Sales dropped when covid hit, and have subsequently recovered and the total now appears to be about what it would have been without the covid interruption:

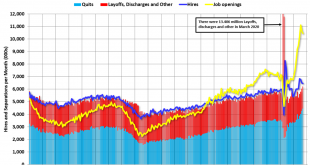

Read More »Jolts, consumer sentiment

Note the ‘Hires’ in blue:

Read More »CPI, commodity charts

Quite a few price increases, which the media now calls ‘inflation’ even though inflation is a continuous increase in the price level: The annual inflation rate in the US surged to 6.2% in October of 2021, the highest since November of 1990 and above forecasts of 5.8%. Upward pressure was broad-based, with energy costs recording the biggest gain (30% vs 24.8% in September), namely gasoline (49.6%). Inflation also increased for shelter (3.5% vs 3.2%); food (5.3% vs 4.6%, the...

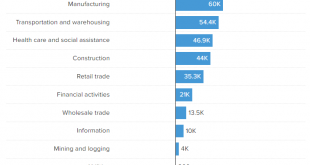

Read More »Employment, US oil production

Progress, but at a decelerating rate: The US economy added 531K jobs in October of 2021, the most in 3 months and above market forecasts of 450K as Covid-19 cases dropped and employers offered higher wages and more flexible hours. The biggest job gains occurred in leisure and hospitality (164K), in professional and business services (100K), in manufacturing (60K), and in transportation and warehousing (54K) while employment in public education declined (-65K). So far this...

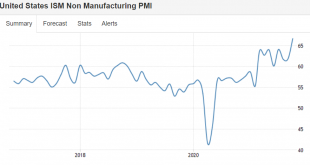

Read More »ISM services, ADP, unemployment claims, trade

Good news here. The back to work story may be happening: Same here, if it’s any indication of the Friday employment report: This would be a good thing if the government understood it meant lower taxes or more public services. Instead, it’s simply incomes not being spent on domestic goods and services:

Read More » Heterodox

Heterodox