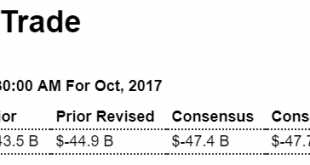

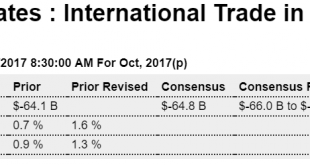

As previously discussed, the US bill for oil imports went up: Highlights Fourth-quarter net exports get off to a weak start as October’s trade deficit, at $48.7 billion, comes in much deeper than expected and well beyond September’s revised $44.9 billion. Exports, at $195.9 billion in the month, failed to improve in the while imports, at $244.6 billion, rose a steep 1.6 percent. Price effects for oil, up more than $2 to $47.26 per barrel, are to blame for much of the rise in...

Read More »Factory orders, Cash bonuses, Oil prices

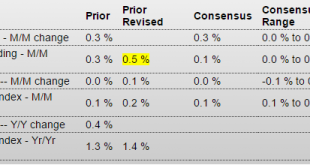

As the chart shows, year over year growth has gone to near 0 since the election, and the hurricane replacement effect has since dissipated: Highlights A big upward revision to core capital goods highlights today’s factory orders report which closes the book on what was a mixed October for manufacturing. The month’s 0.1 percent decline, which is better than expected and actually hits Econoday’s high estimate, reflects a 33 percent downswing for commercial aircraft orders that...

Read More »Gross domestic income

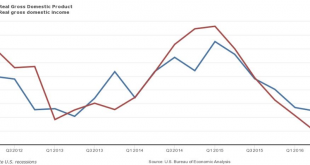

GDI (gross domestic income) = GDP (gross domestic product) by identity. The funds spent to buy the output are the income of the sellers of the same output. But the government gets the data for each independently, which includes estimates of various categories, so the reported numbers don’t equate when initially released, but do tend to come together over time as more data is collected. And right now it looks to me like GDI has been running quite a bit weaker than GDP:...

Read More »Personal income and spending, Chicago PMI, corporate profits, Comments on tax reform

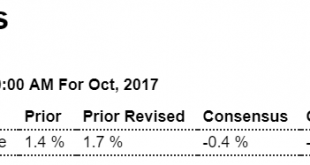

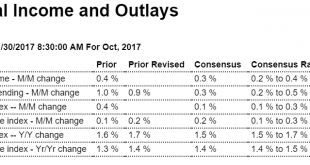

Income a bit higher than expected due to higher interest income, but as per the charts income growth has slowed and seems the only thing keeping spending growing even at these very modest levels is consumers dipping into savings: Highlights Inflation is showing the slightest bit of life yet probably more than enough to assure a rate hike at this month’s FOMC. The core PCE price index, which is the inflation gauge FOMC members most closely watch, rose an as-expected 0.2...

Read More »GDP, Profits, Pending home sales, Mtg purchase apps

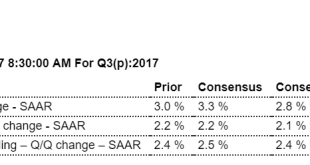

First revision has the consumer a bit weaker than expected, which means the savings rate isn’t quite as weak as initially reported. The savings rate, however, is still unsustainable weak, meaning either consumer spending falls further or personal income growth reverses its deceleration. The other revisions include an increase in already too high inventories that have already turned negative in Q4, and a smaller trade deficit that is now showing increases in q4. And the...

Read More »Trade, New home sales chart, Redbook retail sales, Consumer confidence

As previously discussed, the food export spike was a one time event: Highlights With housing and manufacturing showing strength the outlook for fourth-quarter GDP was building, until that is this morning’s advance trade and inventory data. October’s goods deficit was much higher-than-expected, at $68.3 billion for a very sizable $4.2 billion increase from September. The details speak to weakness with exports down 1.0 percent, reflecting declines for food products and...

Read More »Personal income and spending, ISM manufacturing, construction spending

Spending still not good, and GDP *is* spending. Personal income growth remains low, but is higher than spending. I suspect this gets reconciled with downward revisions to income over time, perhaps due to downward revisions to employment. With GDP growth near flat employment growth implies more employees are being hired to produce the same levels of output, which sends up a red flag for downward revisions to employment. Personal Income and OutlaysHighlightsConsumers had a healthy December...

Read More » Heterodox

Heterodox