Last week of federal unemployment benefits: Dallas surprises on the downside, but inline with other indicators:

Read More »New home sales, Richmond Fed, vehicle sales

Fading back to trend: Falling back:

Read More »Manufacturing, services, existing home sales

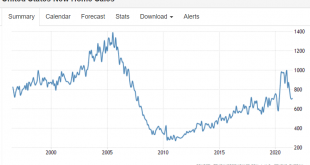

And federal unemployment benefits expire in 2 weeks: Back to about where it was heading pre covid, way below last cycle and notwhere it was expected to be with record low mortgage rates:

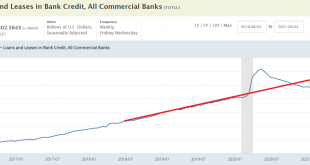

Read More »Bank loans, rig count, iron ore

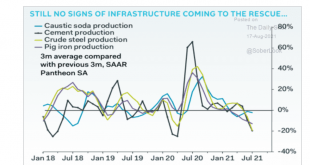

Still weak: Coming back slowly, but now oil prices are lower: Lots of spiky commodities like iron ore:

Read More »Philly manufacturing, $US index

Not the kind of thing that happens when policy is ‘hyperinflationary’ as feared by many:

Read More »China, housing starts, purchase apps, architecture billings

Weakness continues: Still declining: Same covid dip, bounce, decline pattern:

Read More »Retail sales, homebuilder sentiment, lumber, industrial production, steel

Retail sales jumped up with the Federal transfer payments and have more recentlystarted to decline as transfer payments subsided. And the remaining Federal unemployment compof $300/week expires Labor day for approximately 7 million beneficiaries: More evidence of a housing decline, even with the lowest rates ever: Lumber and housing often move together: This number is seasonally adjusted, and was higher in July because auto plants typically shut down in July didn’t this year...

Read More »Small business index, lumber price, mortgage purchase apps

Working its way lower: Inflation fears may be fading? Getting worse. I guess low rates aren’t the end all for housing…;)

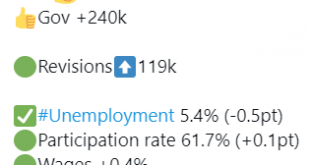

Read More »Employment, Trade, consumer credit, rails

Steady improvement but still a ways to go: And this doesn’t look good: We’re spending more on net imports which is fundamentally a direct benefit for us, if only our govt. knew the appropriate policy response: Consumer credit growth has picked up as jobs are added and as Federal unemployment benefits expire: These charts have turned down:

Read More »ADP, vehicle sales, mtg purchase apps, durable goods

Not good. Analysts/politicians/voters expected more gains as Federal benefits expired: Not good: Not good: Typical bounce after the covid dip that followed the tariff decline, but so far only back to prior levels, and less when adjusted for inflation:

Read More » Heterodox

Heterodox