Germany's Finance Minister Wolfgang Schaueble has long been critical of ECB monetary policy,. But now, as Reuters says, the gloves are off. In a speech at a prizegiving for an ordoliberal economics foundation last Friday, Dr. Schaeuble demanded that the ECB raise interest rates.The justification? Very low interest rates hurt Germany's savers, which are the bedrock of its economy.There is a political dimension to this. Dr. Schaueble's party, the CDU, is losing popularity and desperate for...

Read More »A plan to turn the Euro from zero to hero

Guest post by Ari Andricopoulos It is difficult to read the history of inter-war Europe and the US without feeling a deep sense of foreboding about the future of the Eurozone. What is the Eurozone if not a new gold standard, lacking even the flexibility to readjust the peg? For the war reparations demanded at Versailles, or the war debts owed by France and the UK to the US, we see the huge debts owed by the South of Europe to the North, particularly Germany. The growth model of the...

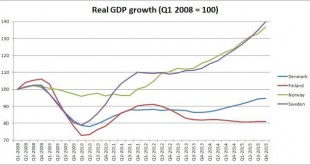

Read More »The Great Scandinavian Divergence

From @MineforNothing on Twitter comes this chart: Now, we know Finland is in a bit of a mess. A series of nasty supply-side shocks has devastated the economy. When Nokia collapsed in the wake of the 2007-8 financial crisis, ripping a huge hole in the country's GDP, the government responded with substantial fiscal support. This wrecked its formerly virtuous fiscal position: it switched from a 6% budget surplus to a 4% deficit in one year, and although its deficit has improved slightly since,...

Read More »Steve Keen on Why the Euro is Destroying Europe

Steve Keen speaks below on the catastrophe that is the Eurozone, and this is lecture 7 that is part of Keen’s course at Kingston University in the UK.[embedded content]

Read More »The European Union must reform before it’s too late

At the Bank of England's Open Forum in London's Guildhall on Wednesday 11th November, an increasingly desperate-sounding Mario Draghi said this: As the majority of money is issued by private banks - bank deposits - there can only be a single currency if there is a single banking system. For money to be truly one, it has to be truly fungible, independent of its form and independent of its function. This is far from being the first time that Signor Draghi has pushed the case for common...

Read More »A Post-Keynesian Interpretation of the Spanish Crisis

New paper with Esteban Pérez published by the Levy Economics Institute.From the abstract: The Spanish crisis is generally portrayed as resulting from excessive spending by households, associated with a housing bubble and/or excessive welfare spending beyond the economic possibilities of the country. We put forward a different hypothesis. We argue that the Spanish crisis resulted, in the main, from a widening deficit position in the nonfinancial corporate sector—the most important explanatory...

Read More »Unlimited Targets? Some pointers

By Sergio Cesaratto (Guest Blogger)In this short note I will not add anything of substantial to the debate with Marc Lavoie on the nature of the Eurozone (EZ) crisis in view of Target 2 (T2). Readers have numerous papers to look at (including Lavoie 2015a/b, Cesaratto 2013, 2015a/b) and posts (Vernengo 2015, Ramanan, 2015). However, although most of relevance has already been said, there is perhaps still some space for few qualifications.1. Subject of the dispute is on whether the EZ crisis...

Read More »Roundtable on the European Crisis

If you're around Lewisburg next Tuesday.

Read More »Variable geometry bites back: Schäuble’s motives

In-depth analysis on Credit Writedowns Pro. By Fabio Ghironi As originally written at Vox. Success of the German-inspired solution for the latest Greek crisis is far from assured. If it fails, the Eurozone may be changed forever. This column argues that the failure would lead to an outcome that has been favoured for decades by Germany’s Finance Minister, Wolfgang Schäuble. Perhaps the package the Eurozone agreed is just a backdoor way of getting to the ‘variable geometry’ and monetary...

Read More »Mario Draghi and the Holy Grail

In a reply to a comment on my recent post about Target2 and ELA, I said this:There are no "Greek euros" or "German euros". There are only European euros. So the ECB is not exchanging Greek and German euros at par. Both countries are using the same currency, which is produced by the Eurosystem. The NCBs are not autonomous entities, they are part of the Eurosystem. They do not create their own currencies : collectively, they create the single currency.This is how a single currency works. If...

Read More » Heterodox

Heterodox