We’ve been hearing that a lot lately, being asked about things like the proposed US-Mexico border wall, the possibility of universal health care, and even regarding existing programs like Social Security. It’s a relevant question, to be sure, but 99 times out of 100 (or maybe 999 out of 1000), the context in which it is placed is completely wrong.I say this because the question is almost always asked regarding whether or not we have enough money. If there is one place where the economics...

Read More »Z. Byron Wolf — Debt? What debt? At $22 trillion, here’s the argument the national debt doesn’t matter

So much ink has been spilled for so long on the national debt, it might be nice if that $22 trillion plus on the red side of the US balance sheet just didn't really matter.That's exactly the thinking behind a new school of economic theory that the government should be spending more, not less.… But people like Stephanie Kelton, Sanders' economist in 2016, a professor at Stony Brook University, and a proselytizer for this view toward currencies and national economies, argues that the...

Read More »Ten considerations for the next Alberta budget

Over at the Behind The Numbers website, I’ve written a blog post titled “Ten considerations for the next Alberta budget.” The blog post is a summary of a recent workshop organized by the Alberta Alternative Budget Working Group. The link to the blog post is here. Enjoy and share:

Read More »Brian Romanchuk — Do Central Governments Need To Issue Bonds (Again)?

The old "should the government issue bonds" debate has come up again. I would point the reader to this article at Mike Norman Economics, as well as the Richard Murphy article it refers to. I would argue that there is limited room for debate. The Treasury of the central government certainly can stop issuing bonds, conditioned on there being changes to the legal/regulatory framework for the central bank. The more important question is whether such a policy is a good idea. My argument is that...

Read More »Heiner Flassbeck — The economic situation in Bulgaria and Romania – Part 2

How little the two Eastern European countries that we have focused on can be compared with Western countries can be seen very clearly in the development of unemployment (Graph 1). Following the major crisis of 2008/2009, the unemployment rate in Romania hardly rose at all. In Bulgaria it increased significantly, but despite weak economic development after 2013 it is falling at an astonishing rate, almost to the relatively low Romanian level.For Romania, this can only mean that unemployment...

Read More »The EU’s dysfunctional fiscal rules empower the far right, both in Italy and elsewhere

PRIME’s co-director Jeremy Smith and Progressive Economy Forum Council member John Weeks analyse the “bar room budget-brawl” between the Italian government and the European Commission, and argue that the Commission’s wrong-footed response threatens to strengthen the far right – to avoid opening the door to fascism, the EU must ditch its bias towards austerity.No one doubts that Italy’s economy is in a mess. It has been for a long time. It was not always so. From 1971 until...

Read More »Budget Special: To tackle austerity, Britain needs (at least) a £50 billion increase in public spending

The old View of the Treasury… Photo with acknowledgment to Social.shorthand.com “The Treasury building: a surprising history” This article was first published on the Progressive Economy Forum websiteAusterity has severely damaged Britain’s physical and social infrastructure. Coupled with a fall in real...

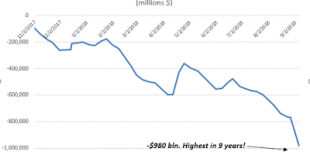

Read More »Deficit balloons to $980 bln. Where are all the MMT gods cheering this??

A giant end-of-month spending spree in August has ballooned the Federal defiicit to $980 bln and 4.8% of GDP.This is the largest nominal deficit since 2009 and the largest as a percentage of GDP since 2012.The MMT gods should be cheering this. They're not. Weird.

Read More »Charles Adams — Fiscal policy is a matter of life and death

MMT. And he also talks about rent extraction! "So why are UK politicians obsessed with balancing the books rather than helping their citizens to lead healthier lives? The answer seems to be that the many UK politicians are strongly influenced by the desires of a powerful financial sector. While a finance sector is important, it is also predominantly a rent extraction industry. It mainly acquires wealth either on the backs of other people’s labour or their debts (interest). Progressive...

Read More »Ontario Electricity Sector VI – Meet the new boss…

The provincial election of June ended 15 years of Liberal electricity policy in Ontario. Anger over high electricity prices continued to be an election issue, contributing to the Liberal loss of power and official party status (reduced from 55 to 7 seats). The PCs have formed Government with 76 seats, while the NDP is official opposition with 40 seats, and the Green Party won their first seat. The PC Government has moved quickly to act on some of their election promises and other unannounced...

Read More » Heterodox

Heterodox