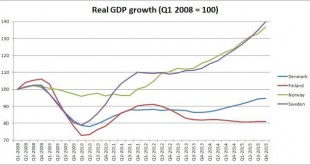

From @MineforNothing on Twitter comes this chart: Now, we know Finland is in a bit of a mess. A series of nasty supply-side shocks has devastated the economy. When Nokia collapsed in the wake of the 2007-8 financial crisis, ripping a huge hole in the country's GDP, the government responded with substantial fiscal support. This wrecked its formerly virtuous fiscal position: it switched from a 6% budget surplus to a 4% deficit in one year, and although its deficit has improved slightly since,...

Read More »Lord Eatwell in the Financial Times

A short Letter to the Editor, but worth reading. He clearly explains the policy failure since the global crisis and the reasons for the current problems in financial markets in developed and developing countries. He says: The adage that, in the absence of the prospect of growing demand, cheap money amounts to “pushing on a string” has been once again confirmed in advanced economies by the slowest recovery from any modern recession. Instead of funding real investment, monetary expansion has...

Read More »Scalia, Partisanship bias, and Long Term Stagnation

So a student asked me if the nomination for the Scalia vacancy at the Supreme Court would have any macroeconomic impact. Can't imagine what kind of effect he was thinking about, but there is a relevant question on what are the effects of the inability of the legislative to get things done. The most obvious is the inability to pass a budget that deals with the slow recovery.It used to be the case that both parties had a a very different fiscal agenda, with Democrats being for tax and spend,...

Read More »Robert Skidelsky: Lecture 3: Fiscal Policy

Here Skidelsky gives lecture 3 of a series at the University of Warwick on economics. This lecture concerns fiscal policy.[embedded content]

Read More »The Basic Income Guarantee: what stands in its way?

Guest post by Tom Streithorst The Basic Income Guarantee (BIG) is back in the news. The Finns are considering implementing it, as are the Swiss, replacing all means tested benefits with a simple grant to every citizen, giving everyone enough money to survive. Unlike most current benefits programmes, it is not contingent on being worthy or deserving or even poor. Everybody gets it, you, me, Rupert Murdoch, the homeless man sleeping under a bridge. Last seriously proposed by Richard...

Read More »Eurodespair

In my last post, I warned about "siren voices" calling for tighter monetary policy while the Eurozone economy is stuck in a toxic equilibrium of low growth, zero inflation and intractably high unemployment. Specifically, the so-called "German Council of Economic Experts (GCEE)" has called for the ECB to reduce or unwind QE: ...the European Central Bank should slow down the expansion of its balance sheet or even phase it out earlier than announced. Of course, the GCEE is only concerned...

Read More »The Slough of Despond

I'm bored.Bored with this crisis. Bored with endless calls for bank reforms. Bored with never-ending stories of inadequate bank resolution and legal battles which benefit no-one but lawyers. Bored with ineffectual monetary policy and fiscal gridlock. Bored with seeing the same things proposed over and over again, even things we know don't work and will never happen.Today, Mike Konczal wrote a piece on why restoring Glass-Steagall wouldn't solve anything. He's right, of course. But it is now...

Read More »Austerity, class warfare and weak labor markets

Labor market still weak. New BLS report says that: "total nonfarm payroll employment increased by 142,000 in September, and the unemployment rate was unchanged at 5.1 percent." Also: "average hourly earnings of private-sector production and nonsupervisory employees were unchanged" and revisions meant that "employment gains in July and August combined were 59,000 less than previously reported." Not enough job creation, labor participation falling, and wages stagnant. Secretary of Labor said,...

Read More »Rethinking government debt

There is a huge amount of hysteria about government debt and deficits, not just in the UK but throughout much of the world. As I write, Brazil has been downgraded by Standard & Poors because of concerns about rising government debt and weakening commitment to primary fiscal surpluses in a context of political uncertainty and deepening recession. It is the latest in a long line of downgrades and investor flight over the last few years. The global economy is a very stormy place.The UK,...

Read More »The real purpose of central banks

One of the things that has emerged from the PQE debate is a suggestion that it is time to consider ending the Bank of England's inflation-targeting mandate. Unfortunately this got mixed up with calls for ending the operational independence of the Bank of England (Richard Murphy), or abolishing central banks (Bill Mitchell, stated in response to a question at Reframing the Progressive Agenda).What we might call the "twin peaks" approach to macroeconomic policy-setting has been adopted the...

Read More » Heterodox

Heterodox