Your access to this site has been limited Your access to this service has been temporarily limited. Please try again in a few minutes. (HTTP response code 503) Reason: Exceeded the maximum number of page requests per minute for humans. Important note for site admins: If you are the administrator of this website note that your access has been limited because you broke one of the Wordfence blocking rules. The reason your access was limited is: "Exceeded the maximum number of page requests per...

Read More »Poverty Reduction in Alberta

Your access to this site has been limited Your access to this service has been temporarily limited. Please try again in a few minutes. (HTTP response code 503) Reason: Exceeded the maximum number of page requests per minute for humans. Important note for site admins: If you are the administrator of this website note that your access has been limited because you broke one of the Wordfence blocking rules. The reason your access was limited is: "Exceeded the maximum number of page requests per...

Read More »Lessons from the Reagan Era on Managing Twin Deficits

Your access to this site has been limited Your access to this service has been temporarily limited. Please try again in a few minutes. (HTTP response code 503) Reason: Exceeded the maximum number of page requests per minute for humans. Important note for site admins: If you are the administrator of this website note that your access has been limited because you broke one of the Wordfence blocking rules. The reason your access was limited is: "Exceeded the maximum number of page requests per...

Read More »The Federal Role in Poverty Reduction

Your access to this site has been limited Your access to this service has been temporarily limited. Please try again in a few minutes. (HTTP response code 503) Reason: Exceeded the maximum number of page requests per minute for humans. Important note for site admins: If you are the administrator of this website note that your access has been limited because you broke one of the Wordfence blocking rules. The reason your access was limited is: "Exceeded the maximum number of page requests per...

Read More »Will Trumponomics be expansionary?

Deficit vultures A few days ago, Trump announced South Carolina Rep. Mick Mulvaney to be the director of the Office of Management and Budget. He is a Tea Party nut (he was for Rand Paul, and might have libertarian tendencies), and more importantly a fiscal hawk, and for a balanced budget amendment. Mulvaney is really for cutting spending, including, somewhat surprisingly, military spending, even if he thinks that defense is the first priority of the federal government. So this has...

Read More »“Stimulus” Isn’t the Best Reason to Support (or Oppose) Infrastructure Spending

A little while back, Pavlina Tcherneva appeared with Bloomberg’s Joe Weisenthal to talk about the potential infrastructure policy of president-elect Donald Trump. She noted that, contrary to initial assumptions, the upcoming administration may not end up pushing public-debt-financed infrastructure spending, and that if the program simply amounts to tax incentives and public-private partnerships, it won’t be nearly as effective. But Tcherneva added another important dimension to this...

Read More »Interest rates are up, and what is the real problem with that

Not by much. To 0.75%, and yes it wasn't necessary because we're not at full employment yet (Krugman thinks we're; his point is that wages are increasing again, but not that much and participation rates remain low). Two things worth mentioning. One is that Yellen agrees with Krugman, and that signals that the Fed doesn't get what's the current state of the economy. She said: "I believe my predecessor and I called for fiscal stimulus when the unemployment rate was substantially higher than...

Read More »How Housing Policy Benefits from a Socioeconomic Perspective

Your access to this site has been limited Your access to this service has been temporarily limited. Please try again in a few minutes. (HTTP response code 503) Reason: Exceeded the maximum number of page requests per minute for humans. Important note for site admins: If you are the administrator of this website note that your access has been limited because you broke one of the Wordfence blocking rules. The reason your access was limited is: "Exceeded the maximum number of page requests per...

Read More »The in-betweeners

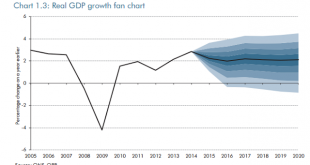

How effective is monetary policy?Highly effective, according to the Governor of the Bank of England. In a speech earlier this week, Mark Carney robustly defended the Bank of England's record: "Simulations using the Bank’s main forecasting model suggest that the Bank’s monetary policy measures raised the level of GDP by around 8% relative to trend and lowered unemployment by 4 percentage points at their peak. Without this action, real wages would have been 8% lower, or around £2,000 per...

Read More »The unaffordable George

On March 16th, George Osborne unveiled his shiny new Budget. Full of populist tax giveaways to help "hard working people", it was the sort of budget that we might expect from a Chancellor riding the crest of an economic recovery. UK plc is growing well, profits are rising and the Board can afford to increase the dividend.But this is not the current economic situation. Far from an economic recovery gathering pace, the latest figures from the OBR show that UK plc is slowing. In its March 2016...

Read More » Heterodox

Heterodox