There is a psychological bias to believe that exceptional events eventually give way to a return to “normal times.” But the world economy is far from a return to pre-2008 normality, with most of the obstacles to more robust recovery to be found on the demand side. Project Syndicate The Normalization DelusionAdair Turner

Read More »Bill Mitchell — Fiscal policy is effective, safe to use, and markets know it

The Federal Reserve Bank of Kansas City has just hosted its annual Economic Policy Symposium at Jackson Hole in Wyoming where central banks, treasury officials, financial market types and (mainstream) economists from the academy and business gather to discuss economic policy. As you might expect, the agenda is set by the mainstream view of the world and there is little diversity in the discussion. A Groupthink reinforcing session. One paper that was interesting was from two US Berkeley...

Read More »Alan Auerbach and Yuriy Gorodnichenko — Fiscal stimulus in downturns is safe even when debt is high

Government spending in a recession can boost a country’s economy without permanently bloating its public debt, even if the debt is already quite large, researchers told an influential group of central bankers in Jackson, Wyoming, on Saturday. “Expansionary fiscal policies adopted when the economy is weak may not only stimulate output but also reduce debt-to-GDP ratios,” University of California, Berkeley, professors Alan Auerbach and Yuriy Gorodnichenko said in a paper presented at the...

Read More »Bill Mitchell — Europe – the deliberate wastage of its youth continues

Earlier this month (August 11, 2017), Eurostat published the latest European Union data for – Young people in the EU: education and employment. This data now allows us to track the fortunes of three age cohorts – 15-19, 20-24 and 25-29 years since before the crisis to the end of 2016. So a teenager prior to the crisis (2007) would be transiting into the 25-29 years cohort in 2016. One of the disturbing trends shown in the data is the increasing number of young people in the older ‘youth’...

Read More »The collapse of social democracy

Acknowledgements to wikimedia. https://commons.wikimedia.org/wiki/File:Historia_del_partido_socialista.jpg Dear readers. The article below was written in April, 2017, and submitted to Spain's socialist party (PSOE) for publication. It remains relevant to wider debates about the collapse of social...

Read More »Fiscal situation of Canada’s ‘oil rich’ provinces

I’ve just written a blog post about the fiscal situation of Canada’s ‘oil rich’ provinces (i.e., Alberta, Saskatchewan and Newfoundland and Labrador). It consists of a summary of key points raised at a PEF-sponsored panel at this year’s Annual Conference of the Canadian Economics Association. Points raised in the blog post include the following: -The price of oil is impossible to accurately predict, and there’s no guarantee it will rise to past levels. -Each of Canada’s ‘oil rich’ provinces...

Read More »OECD ignores deficit hawks, backs higher public investment in infrastructure & people

The Financial Times’ economics editor, Chris Giles, has had a busy few days. He has written several interesting articles, covering the absence of “the deficit” as a big election issue (as a hawk he’s really not happy about that), the OECD’s new forecast for the UK economy, and the marked similarities between the economies of...

Read More »The IFS: viewing the economy through wrong end of a telescope

“Government debt should not be measured in pounds; it should be measured in GDPs. When GDP is high, so are tax revenues, and so is the ability of the government to repay.” Prof. Roger Farmer, NIESR, November, 2016 Three Facts about Debt and Deficits Today the Institute for Fiscal Studies produced a review of political manifestos prepared for General Election 2017. Predictably, the respected, and largely independent IFS researchers review the tax and spending proposals of the...

Read More »Ten things to know about social assistance in Canada

I’ve just written a blog post about social assistance in Canada. Points raised in the blog post include the following: -Social assistance has two contradictory objectives: 1) to give people enough money to live on; and 2) to not give people enough money to live on. -Very few immigrants receive social assistance (relative to the general population). -Several Canadian provinces have seen a rise in persons with disabilities receiving social assistance. -The inadequacy in social assistance...

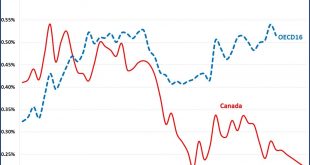

Read More »A tale book-ended by two Trudeaus: Canada’s foreign aid since 1970

Soon after the 2015 federal election, Prime Minister-designate Justin Trudeau affirmed that Canada was back as a “compassionate and constructive voice in the world” after a decade of Conservative governments. One of the most important means by which any industrialized country interacts with the developing world is via the amount, composition and effectiveness of its foreign aid, which can help boost human and economic development, mitigate humanitarian crises and reduce environmental...

Read More » Heterodox

Heterodox