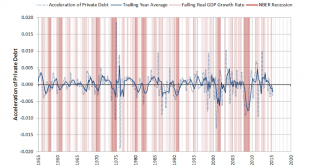

This shows how private sector credit deceleration is associated with recessions. It’s about the need for those spending more than their incomes to offset those spending less than their incomes. And most often private sector deficit spending decelerates some time after public sector deficit spending decelerates and fails to provide the income and net financial assets that supports private sector deficit spending. United States : JOLTSHighlightsIn a positive sign for labor demand, job...

Read More »Saudi statement, NFIB detail

This means they continue with their discount policy until their entire output capacity is being sold, and then continue to sell their full output capacity at ‘market prices’. That is, they no longer want the high priced producers to benefit from their willingness to to be swing producer and support prices by not selling their full output: Moving ahead, Opec — led by Saudi Arabia — plans to pump as much as it can towards meeting global oil demand, leaving higher-cost producers to make up the...

Read More »Saudi Output, Mtg Purchase Apps, NY ISM, ADP, International Trade, PMI services, ISM Non-manufacturing, Motor Vehicle Sales

If the Saudis are looking to pump more seems they have to continue to lower prices:Sure looks like housing still can’t get out of its own way: MBA Mortgage ApplicationsHighlightsMortgage applications are settling down after spiking and dipping sharply in volatility tied to new disclosure rules put in place last month. Both the purchase and refinance indexes fell an incremental 1.0 percent in the October 30 week with the purchase index up a very solid 20 percent year-on-year. Rates were...

Read More »Atlanta Fed, German Engineering Orders, Misc News, Redbook retail sales, North Dakota, Factory orders

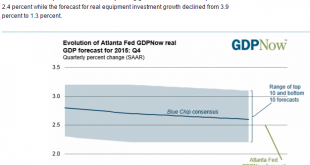

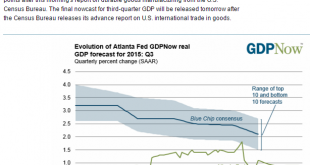

Down to 1.9 for Q4, after being very close for Q1, Q2 and Q3: German Engineering Orders Hit by Lower Demand From China By Nina AdamNov 2 (WSJ) — Germany’s VDMA engineering federation said Monday that its “plant and machinery makers are battling against global markets’ adversities.” German mechanical engineering orders slumped 13% year-over-year in September, hit by a 18% drop in foreign demand. Foreign orders from outside the eurozone were down 7% in the nine months through September from...

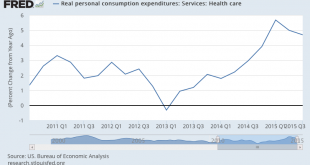

Read More »Health Care Expenditures, ISM Manufacturing, Construction Spending

My understanding is that this series includes premiums paid for health insurance and so GDP has gotten a one time boost from from the newly insured who are now paying insurance premiums via the affordable care act. So Q4 should see another reduction and growth and a lower contribution to GDP growth:This kind of personal consumption collapsed with the collapse in oil prices and oil capex: This is for September, and is slowing as previously discussed after permits peaked in June with the...

Read More »Brent Spot Chart, China, Atlanta Fed

Looks a lot more negative since the October 5 Saudi price cuts than the futures markets. These price are more indicative of prices of physical oil vs financial portfolio activities:Note the lack of results of ‘monetary policy’: China’s October factory, services surveys show economy still wobbly Nov 1 (Reuters) — Activity in China’s manufacturing sector unexpectedly contracted in October for a third straight month, an official survey showed on Sunday, fuelling fears the economy may still be...

Read More »Rail traffic, Personal Income, Credit Check

Rail Week Ending 24 October 2015: A Worse Week Among Bad Weeks Week 42 of 2015 shows same week total rail traffic (from same week one year ago) and monthly total rail traffic (from same month one year ago) declined according to the Association of American Railroads (AAR) traffic data. Intermodal traffic contracted year-over-year, which accounts for approximately half of movements. and weekly railcar counts continued in contraction. See how the growth rate slowed down just before year...

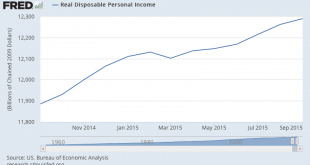

Read More »Personal Income and Outlays, ECI, Chicago PMI, Consumer Sentiment, GDP related

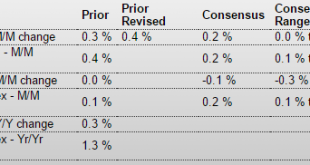

Income and spending and pricing low and lower than expected: Personal Income and OutlaysHighlightsInflation is not building based on the Fed’s favorite reading, the core PCE price index which inched a lower-than-expected 0.1 percent higher in September with the year-on-year rate steady and flat at only plus 1.3 percent. These results will not lift the odds for a December hike at the next FOMC.Income and spending data also came in below expectations, at plus 0.1 percent each vs expectations...

Read More »GDP, Pending Home Sales

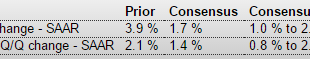

A weak number and Q4 not looking so good either. Domestic spending decelerating as incomes fade from reduced capex. Slowing investment, weak exports, and inventory reductions should also continue into Q4 as top line growth continues to fade. And lower prices speak to lower demand. Vehicle sales also looking to slow into Q4 as per recent vehicle loan stats and industry forecasts. GDPHighlightsSteady domestic spending helped to prop up GDP growth in the third-quarter which came in at an...

Read More »Atlanta Fed, Oil inventory, Chemical Index, Mtg Purchase Apps

Down to .8: Crude inventory that used to pile up from high cost shale production is coming down as drilling is way down and existing well output declines some 70% in its first two years. Meanwhile, US imports increase as domestic production decreases: Crude stocks at the Cushing delivery hub fell by 748,000 barrels, data from the industry group, the American Petroleum Institute, showed late on Tuesday.Iraq’s southern oil exports have reached 3.10 million barrels so far this month,...

Read More » Heterodox

Heterodox