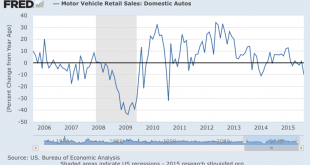

This is how they would start a downward price spiral if that’s what they wanted: Saudi Aramco Cuts Crude to Asia, U.S. Amid Weak Demand By Anthony Dipaola Oct 4 (Bloomberg) —Saudi Arabia cut pricing for November oil sales to Asia and the U.S. as the world’s largest crude exporter seeks to keep its barrels competitive with rival suppliers amid sluggish demand. Saudi Arabian Oil Co. reduced its official selling price for Medium grade crude to Asia next month to a discount of $3.20...

Read More »GDP transactions in secondary markets

There is a widespread view that much bank lending is unproductive, i.e. does not raise GDP – or if it does, it does so in an unsustainable way by inflating asset prices or increasing inflation, rather than by increasing production. Many proposals for bank reform therefore envisage restricting banks to “productive” lending, by which usually seems to be meant business finance and short-term consumer credit. Financial transactions on secondary markets, and the purchase of second-hand...

Read More »An unjustified rating

Anti-austerity demonstrators in Helsinki, Finland The ratings agency Fitch has affirmed the AAA rating on Finland's sovereign debt. But on reading Fitch's analysis, the justification for this is very hard to see.Finland's economic situation is, to say the least, dire. This is what Fitch has to say about it: The Finnish economy is adjusting to sector-specific shocks in key industries (electronics, communications and forestry), is already experiencing the impact of an ageing population...

Read More »Everything’s under control, China edition

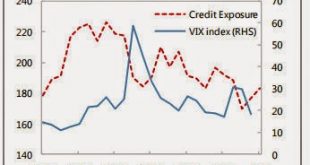

Daiwa Securities has forecast Armageddon. They say that over-investment in China in recent years has created a debt bubble so great that Chinese authorities would not able to manage its collapse, resulting in a debt deflationary spiral which would make 2008 look like a walk in the park. Such a meltdown would, in their words, "send the global economy into a tailspin".But they also outline another scenario, in which China's economy undergoes a nasty, possibly prolonged recession, from which...

Read More »A Finnish cautionary tale

Eurozone growth figures came out today. And they are horribly disappointing. Everyone undershot, apart from Spain which turned in a remarkable 1% quarter's growth, and Greece which somehow managed an even more incredible 0.8% (yes, I will write about this, but not in this post). France didn't grow at all, Italy all but stagnated at 0.2%, and even the mighty Germany only managed 0.4%. Despite low oil prices, falling commodity prices, weak Euro and the ECB's QE programme, Eurozone...

Read More »How do you say "dead cat" in Latvian?

This, my third post on Latvia, looks at its recovery from the 2008-9 recession.Latvia is often held up as the "poster child" for harsh austerity measures as the means of returning to strong economic growth. In order to hold its currency peg to the Euro, it embarked on a brutal front-loaded fiscal consolidation in 2009, sacking public sector workers, slashing public sector salaries, cutting benefits and raising taxes. Between 2010 and 2013 it cut its fiscal deficit from 10% of GDP to a...

Read More » Heterodox

Heterodox