Angry Bears New Deal democrat; July jobs report: Establishment survey weak (but still positive), Household survey (even more) recessionary. Last week: “In the past few months, my focus has been on whether jobs gains are most consistent with a “soft landing,” i.e., no further deterioration, or whether deceleration is ongoing. In the last several months I have also pointed out that the Household Survey is probably understating growth because of its...

Read More »Why Did the US give away $52bn to corporations like Intel?

A counter argument by Robert Reich about Pres. Joe Bidens 2021 CHIPS Act. Why Did the US give away $52bn to corporations like Intel? by Robert Reich The Guardian Congress will soon put final touches on the Chips Act, which will provide more than $52bn to companies that design and make semiconductor chips. The subsidy is demanded by the biggest chipmakers as a condition for making more chips in America. It’s pure extortion. The...

Read More »Boom in U.S. Construction of Manufacturing Facilities

This piece is a review on what is happening in increasing manufacturing capacity for computer, electronic, and electrical manufacturing. Where I am, there is increasing builds of facilities for each of those products. That being around the Phoenix area. One facility they have been working on for two years now and it appears to be near the end. Much of this is automated and probably much Labor. Semiconductor is basically growing wafer, populated the...

Read More »Establishment Jobs survey weak and Household Jobs survey almost recessionary

July jobs report: Establishment survey weak (but still positive), Household survey (even more) recessionary – by New Deal democrat In the past few months, my focus has been on whether jobs gains are most consistent with a “soft landing,” i.e., no further deterioration, or whether deceleration is ongoing. In the last several months I have also pointed out that the Household Survey is probably understating growth because of its large undercount...

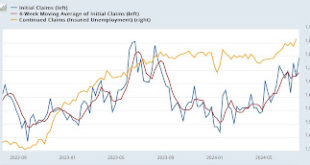

Read More »Jobless claims increase, no longer positive and neutral

Jobless claims increase; no longer positive but neutral (and likely still affected by unresolved seasonality) – by New Deal democrat I’m still on the road, so this will be an abbreviated report. Initial claims rose 14,000 to 249,000, the highest since last August. The four week moving average rose 2,500 to 238,000, the highest since last September. Continuing claims, with the usual one week lag, rose 33,000 to 1.877 million, the highest...

Read More »Contrast of Biden’s Last Act

As taken from The Atlantic’s David Frum to which I subscribe. Bidens address explains why he was relinquishing power by marking himself as a modern Cincinnatus in actions . . . and his Republican rival as a new Catiline. Two political myths inspired the dreams and haunted the nightmares of the Founders of the American republic. Both these foundational myths were learned from the history and literature of the ancient Romans. The story?...

Read More »Again not recessionary, but more evidence the Fed should start to lower rates now.

Coincident real GDP metric is good, but leading indicators from the GDP report are not: is the Fed listening? – by New Deal democrat Real GDP grew 0.7% in Q2, or a 2.8% annualized rate, a perfectly good number in line with the past three years: Probably even more importantly, the GDP deflator increased 0.6% for the quarter, or at an annualized rate of 2.3%. As the below graph shows, this is a perfectly normal rate going back to the start...

Read More »Firearm Violence Is a Public Health Crisis

Topic, we have not touched upon in a while at Angry Bear. The stats are there to support more rigid laws suppressing the illegal use of firearms and tighter controls on possession. I am sure there will be the naysayers. Ok, fine. Be polite in expressing an opinion. Don’t care about what Clarence thinks as he is no expert as well as the three-month Army wonder Samuel. My background? At one time I could part your hair at 500 yards with a stock...

Read More »New Deal democrat’s Weekly Indicators July 15 – 19 2024

– by New Deal democrat My “Weekly Indicators” post is up at Seeking Alpha. While several of the monthly updates I’ve discussed here in the past week have tiptoed in the direction of yellow caution flags, that’s not apparent at all in the high frequency data that is updated every week, much of which comes from private sources. In fact, this week for the first time in a long time, not a single coincident indicators was negative. A majority...

Read More »General Motors Lansing Grand River Plant Conversion to Electric Vehicles

General Motors Receives $500M Federal Grant to Electrify Lansing Grand River Plant by R.J. King DBusiness Magazine AB: Plant conversions from building gasoline and diesel driven vehicles to EVs. A timely move even if the newer models will require need modifications in later years. General Motors Co. today announced it has received a $500 million grant from the U.S. Department of Energy to assist in preparing its Lansing Grand River plant...

Read More » Heterodox

Heterodox