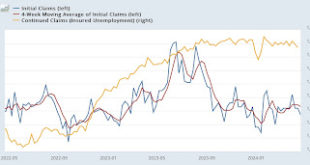

– by New Deal democrat The Bonddad Blog [Note: I’ll put up a post discussing Q1 GDP later today.] Initial and continuing claims continued their snooze-fest this week. Initial claims declined -5,000 to 207,000, continuing their nearly 3 month long range of between 200-220,000 per week. The four week average declined 1,250 to 213,250. This average has remained in the 200-225,000 range for over half a year! Finally, with the typical one...

Read More »One born every minute

And the grift goes on:“Jerry Dean McLain first bet on former president Donald Trump’s Truth Social two years ago, buying into the Trump company’s planned merger partner, Digital World Acquisition, at $90 a share. Over time, as the price changed, he kept buying, amassing hundreds of shares for $25,000 — pretty much his “whole nest egg,” he said.“McLain, the tree service owner in Oklahoma, said he believes the stock could “go to $1,000 a share, easy,”...

Read More »Manipulating Supply Chains and Manufacturing, for Corporate Influence and Profit . . . Redux

It is getting serious now. Kroger is willing to sell off more stores in order to consolidate with Albertsons. The one thing we keep on seeing is the manipulation of supply chain due to circumstance to achieve manufacturing shortfall, and influence, to maximize profits. Much of what we have and are experiencing was avoidable. The tools exist to give better perspectives of what is going on from start to finish of product. As you read through my telling...

Read More »The range-bound new home sales market continues

– by New Deal democrat The Bonddad Blog As per my usual caveat, while new home sales are the most leading of the housing construction metrics, they are noisy and heavily revised. That was true again this month, as sales (blue in the graph below) increased almost 9% m/m to 693,000 annualized, after February was revised downward by -25,000 to 637,000. As the five year graph below shows, after the initial Boom powered by 3% mortgage rates,...

Read More »Trump vs. Biden: Who Got More Done for Veterans?

by Suzanne Gordon and Steve Early Washington Monthly Trump has mocked veterans and privatized their health care. Biden honors them but hasn’t challenged Trump’s privatization policies. Currently, they are moving more and more veterans to commercial healthcare. This rather than restoring VA healthcare to a better place for veterans to be and at a lower cost. Think of Medicare Advantage. From mocking John McCain’s military service...

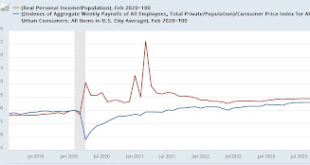

Read More »Real median wage and income growth through March continued the recent increasing trend

– by New Deal democrat The Bonddad Blog This is an update of some information I last posted several months ago. Real median household income is one of the best measures of average Americans’ well-being. However, the official measure is only reported once a year, in September of the following year. So right now the most recent official measure is for calendar year 2022 (when you might remember gas prices surged to $5/gallon). In other...

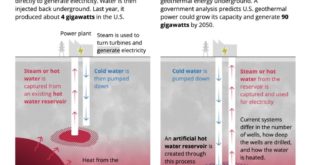

Read More »Former Shell employees resurrect dead well in ‘monumental’ move for geothermal energy

by Laurelle Stelle msn.com, The Cool Down Nice read on geothermal energy produced from pumping water into fracked rock formations in deep dry oil wells. In Texas, several innovative new companies are combining clean energy technology and the expertise of former oil and gas industry employees to create a whole new generation of geothermal power plants, Grist reported. Geothermal energy is a promising source of power because it’s so...

Read More »Managing risk

Decades ago, the artificial sweetener cyclamate was banned because it caused bladder cancer in rats. Later, it turned out that this was an artifact of (1) the tendency of cyclamate to form a precipitate with the male rat urinary globulin in the bladder, which leads to inflammation and promotes cancer, and (2) the fact that experiments were only done with male rats. Are cyclamates dangerous for humans? Who knows? The lesson here is not that we should...

Read More »New Deal democrats Weekly Indicators for April 15 – 19 2024

– by New Deal democrat The Bonddad Blog I neglected to put this up Saturday, so here it is now. My “Weekly Indicators” post is up at Seeking Alpha. There continues to be a fair amount of churn and noise in the short leading and coincident time range. Nevertheless, the underlying theme is one of positivity. Aside from the swoon in the stock market this past week, the other big move was in industrial commodities, which spike higher late in...

Read More »Credit where credit is due

Look, Mike Johnson is a right-wing Christianist theocrat, but he did the right thing on Ukraine aid. I get it. This was partly a power play on his part to show that he, and not MTG, is in control of the House. And if the deal was that Democrats will vote against a motion to vacate in return, I’m OK with that transaction. Mike Johnson and the politics of compromise Tags: Mike Johnson, the politics of...

Read More » Heterodox

Heterodox