Weekly Indicators for April 17 – 21 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. There’s more *extremely* slow deterioration in some coincident indicators of recession, but at the same time, the downturn has been telegraphed for so long that some leading indicators are on the verge of turning bullish again. As usual, clicking over and reading will bring you up to the virtual moment on all of...

Read More »International Mother Earth Day April 22, 2023

Thank you Fred Dobbs and a Happy Mother Earth Day to You also. International Mother Earth Day, United Nations Mother Earth is clearly urging a call to action. Nature is suffering. Oceans filling with plastic and turning more acidic. Extreme heat, wildfires and floods, have affected millions of people. Even these days, we are still trying to get back on track from COVID-19, a worldwide health pandemic linked to the health of our ecosystem....

Read More »‘Where You Belong’ or Where Freedom Rings

I am not sure I would belong in this particular hell created by a newly elected Ottawa, Michigan County Board. The title (above [in case you forgot where it is]) change (left to right) embraces the newly elected leadership thoughts on how to run a county. The county can be found on the southwest side of Michigan. It includes the cities of Holland where the Tulip Festival is held and Grand Haven. Pretty area, my wife and I would grab lunch on the...

Read More »The economic tailwind from last autumn’s declining gas prices is probably over

The economic tailwind from last autumn’s declining gas prices is probably over – by New Deal democrat On Wednesday I discussed how gas prices, with an assist from higher stock prices leading to stock options being cashed in, was the primary reason why the coincident indicators hadn’t rolled over yet. I wanted to explore that a little more: was the boost from lower gas prices going to allow for a “soft landing,” or a “modified limited...

Read More »Jobless claims continue to warrant yellow caution flag – continuing claims shade closer to crimson

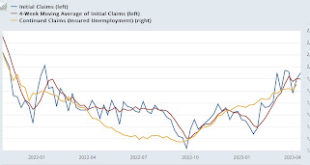

Jobless claims continue to warrant yellow caution flag, while continuing claims shade closer to crimson – by New Deal democrat Initial claims (blue in the graph below) continued their recent track into recession caution territory this week, as they rose 5,000 to 245,000, 12.9% higher YoY and the 5th time in the last 7 weeks that claims have been 240,000 or above. The last time they were at this level was in January 2022. The more important...

Read More »Coincident indicators hold on, mainly due to improvement in gas prices YoY

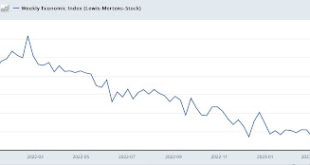

Coincident indicators hold on, mainly due to improvement in gas prices YoY – by New Deal democrat I’ve been paying particular attention lately to the coincident indicators, because the leading indicators have telegraphed a recession for about half a year – so why isn’t it here yet??? A good representation of coincident indicators remaining positive is the Weekly Economic Index of the NY Fed: It looked on track to turn negative at the...

Read More »The Economic Cost of Gun Violence

Since I pulled this article from Everytown, here is a bit of information about it. “We are the largest gun violence prevention organization in America. Made up of more than six million mayors, moms, teachers, survivors, gun owners, students, and everyday Americans who have come together to make their communities safer.” I am guessing there is a bend towards women in this organization. Not an issue. Tons of information on gun violence is within its...

Read More »New housing construction appears to have bottomed; expect further declines in construction employment ahead

New housing construction appears to have bottomed; but expect further declines in construction employment ahead – by New Deal democrat Pointing your attention to NDd’s calling out of the economic signs leading to job declines. ~~~~~~~~ For the past few months, I’ve noted that new home sales, which while very volatile frequently are the first metric to signal a change in trend, appeared to have bottomed by early last autumn. This...

Read More »Gun Violence vs Democracy

And Costs. Angry Bear is an economics blog. Sometimes, I wonder as I take on many topics not including an economic cost. Gun Violence does have an economic cost to it which impacts our economy. We just have not talked about it. The average annual cost for overall gun violence in the United States is $1,698 for every resident in the country. In states with stronger gun laws, the economic toll of gun violence is less than half this amount. Whereas...

Read More »‘Glorified debt collectors with the power to upend your life’

This You Tube clip is about 25 minutes long which is an awfully long time for blog-readers to sit still and listen to someone talk. Yes, yes I know. I am not the most exciting writer out here either. I am sure I have caused a yawn or two and perhaps put some to sleep. Numbers, manufacturing, and supply chain are not exciting topics. The “Pres” does not come down and congratulate you for opening lots up for the shop, getting parts for those lots, and...

Read More » Heterodox

Heterodox