[embedded content]My interview with Scott LaMar from WTFI, on inflation and the problems with demand-pull and oligopolistic inflation, for those interested in another iteration of the same. It's a bit longer than previous ones, and we go on some additional detail.

Read More »CNBC: Fed Chair “Powell says more ‘restriction’ is coming”

Calculated Risks Bill McBride Fed Chair Jerome Powell is participating in a panel discussion today at the European Central Bank (ECB) Forum on Central Banking 2023 in Sintra, Portugal. Federal Reserve Chairman Jerome Powell talked tough on inflation Wednesday, saying at a forum that he expects multiple interest rate increases ahead and possibly at an aggressive pace. From Jeff Cox at CNBC: Powell says more ‘restriction’ is coming, including...

Read More »Supply Chain Backlog, Profit Taking, or Labor Driving Inflation?

Corporate profits have contributed disproportionately to inflation. How should policymakers respond? Economic Policy Institute, Josh Bivens The inflation spike of 2021 and 2022 has presented real policy challenges. In order to better understand this policy debate, it is imperative to look at prices and how they are being affected. The price of just about everything in the U.S. economy can be broken down into the three main components of...

Read More »Unmasking Inflation: Why the Conventional Wisdom is Failing Us

[embedded content]Interview I gave for INET in January. From their website:Matías Vernengo navigates the complex topic of inflation, discussing its implications on workers, and the economic policies that can potentially mitigate these effects. He explains the inflation of the 1970s and compares it to the more recent inflationary scenario provoked by global events. Vernengo evaluates the mainstream explanations - demand-pull and cost-push theories - and presents an alternative, heterodox...

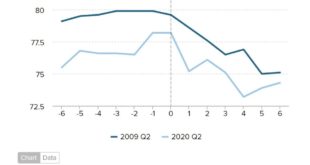

Read More »Inflation ex-shelter increasing at 1.0% annualized rate since last June; core inflation with actual house prices only up 3.0% YoY

Inflation ex-shelter increasing at 1.0% annualized rate since last June; core inflation with actual house prices only up 3.0% YoY – by New Deal democrat Two months ago, I “officially” took the position that inflation had been conquered, and that, properly measured, the economy had actually been experiencing deflation since last June. With revisions, the “actual deflation” is no longer the case; but for the second month in a row since then,...

Read More »Lavoie on Inflation Theory: Conflicting claims versus the NAIRU

New Paper by Julia Braga and Franklin Serrano. From the abstract: The conflicting claims approach to the theory of inflation so thoroughly surveyed and well presented in Chapter 8 of Lavoie’s (2022) book is deservedly becoming increasingly consensual among heterodox (and even some notable mainstream) macroeconomists. However, the relevance of a concept (and the very existence of) a NAIRU (Non-Accelerating Inflation Rate of Unemployment) derived consistently from the very premises of the...

Read More »My talk at UNAM on Demand-pull and Oligopolistic Inflation

[embedded content]My talk (in Spanish) at the Instituto de Investigaciones Económicas of UNAM (virtually) on inflation. The talk starts at minute 20 or so.

Read More »Distributive Conflict and the “New” Inflation

[embedded content]Franklin Serrano on inflation (in Portuguese). More or less what I have been saying on the issue, with some interesting discussions on the changes in the New Consensus Model, and the changing views of some of the key authors like Larry Summers.

Read More »Tom Palley on the Causes and Consequences of the War in Ukraine

By Thomas Palley(1) The origins of the Ukraine conflict lie in the ambitions of US Neocons. Those ambitions threatened Russian national security by fuelling eastward expansion of NATO and anti-Russian regime change in the Republics of the former Soviet Union.(2) The Ukraine conflict is now a proxy war. The US is using Ukraine to attack and weaken Russia.(3) Russia will eventually prevail. We may already be approaching “game over” because Ukraine’s forces have been eviscerated. Ukraine is...

Read More »Neoliberalism, Keynesian Economics, and Responding to today’s Inflation

Q&A Session The lecture here. Note that it missed a few minutes at the beginning and the slides are not showing, with Professor Stiglitz at the upper right corner. It is still pretty engaging and wroth reading. There is a link to the slides that are not showing up. The actual lecture will be published in the first issue of ROKE in 2024. [embedded content]I'll post link to the published version when it's done.

Read More » Heterodox

Heterodox