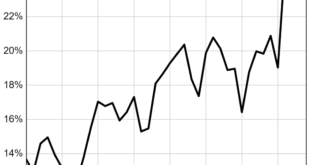

Corporate profits have received much more scrutiny in recent years. High inflation provoked on-going debates about the role of profit margins with terms like “greedflation” and “price gouging” levelled at corporations. People recognized that, at minimum, corporations are profiting from inflation. Analysis of 4,550 publicly-listed corporations found that 33% had record operating profits in 2021 or 2022.[1] Further, corporations with pricing power were found to be actively worsening...

Read More »A closer look at inflation (Part 2 of 2): how the Fed’s rate hikes actually *exacerbate* inflation in shelter

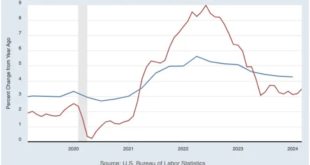

– by New Deal democrat Yesterday I discussed how virtually the entire issue of inflation remaining above the Fed’s target was the housing sector. Let me start today’s post where I left off yesterday: namely, that the net level of divergence between total headline inflation and shelter inflation of 1.15% is one of the highest such divergences in history, and the longest such big divergence. Here again is the graph: Today I want to discuss...

Read More »Inflation Is Scrambling Americans’ Perceptions of Middle-Class Life

Inflation Is Scrambling Americans’ Perceptions of Middle-Class Life, businessinsider.com, Jennifer Sor Yes, we have inflation. It is a given. Inflation is scrambling the lives of middle-class Americans. Income is not keeping up with the costs of maintaining a Middle-Class Life. I have sat here in AZ watching this play out in the nation. In many cases we are fighting a supply chain shortage which is entirely controllable in the US. Similar happened...

Read More »Another strong personal income and spending report, but beware the uptick in inflation

– by New Deal democrat The Bonddad Blog Personal income and spending has become one of the two most important monthly reports I follow. This is in large part because the big question this year is whether the contractionary effects of Fed tightening have just been delayed until this year, or whether the fact that there have been no rate hikes since last summer mean that the expansion will strengthen. Because real personal spending on services...

Read More »The Argentina of Javier Milei

[embedded content] A seminar organized by the Association for Heterodox Economics with myself, Ramiro Álvarez and the Argentine Senator Carolina Moisés.

Read More »Open Thread, April 12 2024 Inflation Increases – Look to Gasoline and Shelter

Consumer Price Index – March 2024 (bls.gov) “The BLS index for shelter rose in March, as did the index for gasoline. Combined, these two indexescontributed over half of the monthly increase in the index for all items. The energy index rose 1.1percent over the month. The food index rose 0.1 percent in March. The food at home index wasunchanged, while the food away from home index rose 0.3 percent over the month. Good reads on the March BLS...

Read More »Open Thread March 17 2024, January and February were rough months for inflation

Employ America’s current corecast is for a 2.86% YoY core PCE print for February. The six-month growth rate of core PCE, which was under 2% in December, should now be over 3% in February. Core services ex-housing inflation will be up on a year-on-year basis versus the previous meeting. Many FOMC members, especially among the moderates in the committee (Daly, Mester, Powell, Waller) have expressed a willingness to look through a hot January...

Read More »Inflation and Auto Insurance

Center for Economic Development and Policy Research, CEPR Dean Baker When we hear about inflation most of us probably think of items like food, gas, and rent, but when it comes to the Consumer Price Index (CPI), the most frequently cited measure of inflation, auto insurance has played a very large role in recent years. The index for motor vehicle insurance rose 0.9 percent in July. It was responsible for 0.024 percentage points of the 0.4...

Read More »Atonella Stirarti’s Godley-Tobin Lecture

There was a problem during the 7th Godley-Tobin Lecture. I disconnected everyone when I was trying to fix a problem with Professor Stirati's presentation, and I didn't notice until much later. The worst part is that the recording was lost. I'm posting here the PowerPoint presentation for those interested. We will also post the link for the published version of the lecture, which will be open also on the website of the Review of Keynesian Economics (ROKE).

Read More »Open Thread February 13 2024 Inflation cooled again in January . . .

but came in above Wall Street’s expectations, another sign that the Federal Reserve’s path to interest-rate cuts is far from settled. The Labor Department reported Tuesday that consumer prices rose 3.1% in January from a year earlier, versus a December gain of 3.4%. That marked the lowest reading since June. Inflation at 3.1% Reflects “Stubborn Pricing Pressure, Clouding Outlook for Fed Rate Cuts,” msn.com, WSJ article. Open Thread February 6...

Read More » Heterodox

Heterodox