The starting point of MMT is that our thinking about money is conditioned by the view that money is based on gold, which leads us to ignore the radical differences between gold-backed money and “fiat” money, which comes into existence by government decree, and does not require any backing. With a gold-backed currency, the concept of a government deficit makes sense – the government must have gold, in order to spend it. However, with a fiat currency, a deficit must always be self-imposed;...

Read More »Peter Cooper — Job Guarantee as Nominal Price Anchor

I’ve been thinking about the job guarantee as it is envisaged by proponents of Modern Monetary Theory (MMT). My focus has been on various quantity effects of the policy that can be considered using the standard income-expenditure model as a base (for preliminary posts along these lines, see here and here.) Since the income-expenditure model takes the general price level as given, it does not directly shed light on the aspects of a job guarantee that would pertain to price stability. To...

Read More »The Crisis: causes and consequences.

The following article was written for the Progressive Economy Forum’s publication – Ten Years Since the Crash: Causes, Consequences and the Way Forward – circulated at Labour Party Conference in October, 2018. 13th September, 2018 To fix things we need to first tell ourselves the correct story about how we got here. Financialization is easily the least studied and least explored reason behind our inability to create shared prosperity – despite our being the richest and most successful...

Read More »Brian Romanchuk — Coming To Grips With Neoclassical Views On Inflation And The Cycle

The role of prices and inflation in neo-classical ("mainstream") economic theory is awkward for us non-mainstream inclined. The price level is simultaneously of critical important for explaining activity as well as being an outcome of other parts of the economy. This makes the subject of inflation extremely awkward for my planned book on business cycles -- as I am pushing the subject of inflation to a later book. Instead, I only aim to have a short chapter explaining the absence of...

Read More »Brian Romanchuk — Primer: Post-Keynesian Inflation Theory Basics

This article is an introduction to the post-Keynesian approach to inflation. It is largely based on Section 8.1.1 of Professor Marc Lavoie's Post-Keynesian Economics: New Foundations (link to my review). Similar to the work on stock-flow consistent models, we start out with what is essentially an accounting identity: a statement that is true by definition. We need to understand the implications of the accounting identity before we worry about the behavioural aspects (which are not pinned...

Read More »Brian Romanchuk — Inflation And Income Shares

This article is a small interlude in my my discussion of post-Keynesian inflation theories. The first article was unfortunately theoretically negative - it discussed the reasoning behind the post-Keynesian rejection of mainstream inflation theories. Bond Economics Inflation And Income Shares Brian Romanchuk

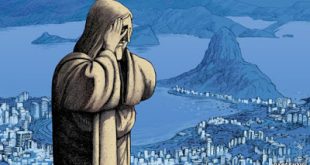

Read More »Distribution and Conflict Inflation in Brazil under Inflation Targeting

I can't watch this either For those interested in the Brazilian situation I highly recommend the recently published paper by Franklin Serrano and Ricardo Summa (Review of Radical Political Economics page here). From the abstract: In this paper, we analyze Brazilian inflation under the inflation-targeting system from a conflict inflation perspective and show how the inflation target system only worked well when there was a trend of exchange rate appreciation. Later, the strengthening of...

Read More »The Job Guarantee and the Economics of Fear: A Response to Robert Samuelson

The Job Guarantee is finally getting the public debate it deserves and criticism is expected. Building on several decades of research, the Levy Institute’s latest proposal analyzes the program’s economic impact and advances a blueprint for its implementation. Critics have taken note and are (thus far) restating the usual concerns, but with a notably alarmist tone. The latest, courtesy of the Washington Post’s Robert Samuelson, warns that the Job Guarantee would be 1) an expensive...

Read More »Bill Mitchell — US labour market tepid – there is plenty of scope fiscal expansion

On May 4, 2018, the US Bureau of Labor Statistics (BLS) released their latest labour market data – Employment Situation Summary – April 2018 – which showed that total non-farm employment from the payroll survey rose by just 164,000 in April, which was an improvement on the very modest rise in March. The Labour Force Survey data, however, showed that employment only rose by 3 thousand) in April 2018 but was accompanied by a substantial fall in the labour force (236 thousand) which meant that...

Read More »Arithmetic for Austrians

This piece grew from a number of conversations with people of Austrian economic persuasion, mostly Bitcoiners and goldbugs (which these days seem mysteriously to have converged). I thought of calling this "Monetarism for goldbugs", but decided to preserve the mathematical slant of the previous pieces in this series. But it's monetary arithmetic, of course. And as Austrians tend to obsess about "sound money", it is specifically sound monetary arithmetic. (Note: Someone has pointed out on...

Read More » Heterodox

Heterodox