This article represents my initial comments on the question of the stability implications of locking interest rates at zero. Martin Watts, an Australian academic, had an interesting presentation at the first Modern Monetary Theory (MMT) conference (link to videos of presentations). Although MMT fits within a broad-tent definition of "post-Keynesian" economics, there are still sharp debates with other post-Keynesians. One topic of debate is the effect of permanently locking the policy...

Read More »Tom Rees — Bank of England hikes interest rates for first time in a decade

Bank of England increases interest rates for the first time in a decade in order curb high inflation squeezing UK households Base rate lifted from 0.25pc to 0.5pc; Mark Carney will give a press conference at 12.45pm to explain the central bank's decision Bank of England last hiked interest rates in July 2007; interest rates fell to historic lows to help the UK economy recover from the financial crisis Pound plunges on currency markets on dovish commentary from the central bank The...

Read More »Brian Romanchuk — MMT And Automatic Stabilizers

The recent internet debates about Modern Monetary Theory (MMT) have been interesting, but the various critics of MMT have largely missed the elephant in the room: automatic fiscal stabilisers. In my view (which may not reflect the official "MMT Party Line"), one of the keys strengths of MMT is that it is largely built around the importance of automatic stabilisers, and institutional details. The conventional view is to acknowledge the existence of automatic stabilisers, but otherwise...

Read More »Brian Romanchuk — The Price Level Does Not Exist

It appears to be a mistake to refer to the price level when discussing the theoretical properties of an economy; at best, there are a few price levels in play at a given time. If we are referring to the measured level of a price index, such as the Consumer Price Index (CPI) there is no difficulty, however this aggregate price index should not be expected to correspond to any useful theoretical construct. This article explains my logic, and then looks at the practical implications of what...

Read More »Do Phillips Curves Conditionally Help to Forecast Inflation?

AbstractThis paper reexamines the forecasting ability of Phillips curves from both an uncon- ditional and conditional perspective by applying the method developed by Giacomini and White (2006). We find that forecasts from our Phillips curve models tend to be unconditionally inferior to those from our univariate forecasting models. Significantly, we also find conditional inferiority, with some exceptions. When we do find improvement, it is asymmetric – Phillips curve forecasts tend to be...

Read More »Tariffs, trade and money illusion

In the past few days, I have read three pieces from Economists for Brexit - now renamed "Economists for Free Trade" - extolling the virtues of "hard" (or "clean") Brexit and calling for the UK to drop all external tariffs to zero unilaterally after Brexit. Two are written by professors of finance (Kent Matthews and Kevin Dowd). The third is from the veteran economist Patrick Minford.All three of these pieces wax lyrical about the benefits to GDP and welfare from unilaterally reducing...

Read More »The Alternative Federal Budget 2017

Your access to this site has been limited Your access to this service has been temporarily limited. Please try again in a few minutes. (HTTP response code 503) Reason: Exceeded the maximum number of page requests per minute for humans. Important note for site admins: If you are the administrator of this website note that your access has been limited because you broke one of the Wordfence blocking rules. The reason your access was limited is: "Exceeded the maximum number of page requests per...

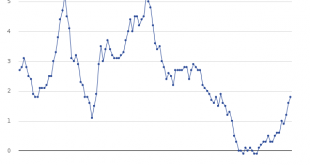

Read More »UK inflation and the oil price

Inflation is back.Here is the change in the consumer price index (CPI) for January 2017, according to ONS: Well, this doesn't look too serious. CPI is barely reaching the Bank of England's target of 2%. It has been much higher for most of the last decade, and yet the Bank of England has kept interest rates at historic lows.But consumer price inflation - the prices that people pay for goods in the shops - is only one side of the equation. On the other side is producer price inflation (PPI),...

Read More »Brexit, trade and echoes of the past

Brexit supporters have been severely critical of the OBR for its grim outlook for the UK post Brexit. The OBR is by no means the most negative of the professional forecasting bodies, and historically its forecasts have tended to err on the side of optimism, as Duncan Weldon observes. But it struggles to find anything good to say about post-Brexit Britain. In particular, it is distinctly negative about the future for Britain's external trade.Brexit is above all a shock to trade, since its...

Read More »What caused the great inflation moderation in the US? A post-Keynesian view

New paper by Nate Cline and Perry. From the abstract: Several explanations of the ‘great inflation moderation’ (1982–2006) have been put forth, the most popular being that inflation was tamed due to good monetary policy, good luck (exogenous shocks such as oil prices), or structural changes such as inventory management techniques. Drawing from post-Keynesian and structuralist theories of inflation, this paper uses a vector autoregression with a post-Keynesian identification strategy to show...

Read More » Heterodox

Heterodox