The flatter yield curve is not a recessionary signal, so what is it telling us? Much of this year’s earlier yield curve flattening represented a reversal of the 2016 steepening that accompanied surging economic growth and inflation expectations after the U.S. presidential election. Markets had bet that fiscal stimulus and infrastructure spending would spur growth and inflation. Long-term yields jumped in response. Those market expectations unwound over the course of 2017 when policy changes...

Read More »Edward Harrison — We are in the most dangerous period in the business cycle

The big picture then is this: a global economy into its ninth year of the business cycle that is starting to gain momentum with the US flirting with 3% growth and 4% unemployment with richly priced asset markets but a flattening yield curve. We’ve seen this picture before.… In retrospect, one could argue that the Fed’s late interest rate hike campaign was a policy error – that the Fed should have seen the flattening yield curve as a canary in the coal mine and resisted raising its policy...

Read More »Tom Rees — Bank of England hikes interest rates for first time in a decade

Bank of England increases interest rates for the first time in a decade in order curb high inflation squeezing UK households Base rate lifted from 0.25pc to 0.5pc; Mark Carney will give a press conference at 12.45pm to explain the central bank's decision Bank of England last hiked interest rates in July 2007; interest rates fell to historic lows to help the UK economy recover from the financial crisis Pound plunges on currency markets on dovish commentary from the central bank The...

Read More »Eric Tymoigne — Money and Banking Post 21: The Interest Rate

In Post 20, a lot is said about the role that the rate of return on financial instruments—the interest rate—plays on the pricing on securities, but little was said about what determines that rate of return. Two competing theoretical frameworks explain what influences the interest rate, one of them emphasizes the role of real factors and the other emphasizes monetary factors. New Economic PerspectivesMoney and Banking Post 21: The Interest RateEric Tymoigne | Associate Professor of Economics...

Read More »Central banks’ credibility problem

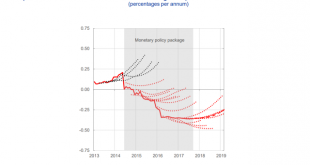

In a speech in London the other day, Peter Praet discussed the ECB's unconventional policy measures. I was there, and I have to say that he deviated considerably - and rather entertainingly - from the version of the speech on the ECB website. But his core message was still the same: "Rates are expected to remain at their present levels for an extended period of time, and well past the horizon of our net asset purchases. So, no interest rate hikes for a long time to come.But that's not what...

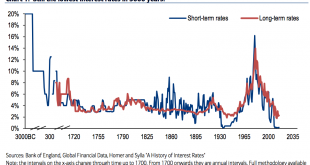

Read More »Elena Holodny — The 5,000-year history of interest rates shows just how historically low US rates still are right now

Business InsiderThe 5,000-year history of interest rates shows just how historically low US rates still are right now Elena Holodny

Read More »Kevin Erdmann — Leverage is not a sign of risk seeking, a continuing series

A contrarian view. Idiosyncratic WhiskLeverage is not a sign of risk seeking, a continuing seriesKevin Erdmann

Read More »The Alternative Federal Budget 2017

Your access to this site has been limited Your access to this service has been temporarily limited. Please try again in a few minutes. (HTTP response code 503) Reason: Exceeded the maximum number of page requests per minute for humans. Important note for site admins: If you are the administrator of this website note that your access has been limited because you broke one of the Wordfence blocking rules. The reason your access was limited is: "Exceeded the maximum number of page requests per...

Read More »Lessons from the Reagan Era on Managing Twin Deficits

Your access to this site has been limited Your access to this service has been temporarily limited. Please try again in a few minutes. (HTTP response code 503) Reason: Exceeded the maximum number of page requests per minute for humans. Important note for site admins: If you are the administrator of this website note that your access has been limited because you broke one of the Wordfence blocking rules. The reason your access was limited is: "Exceeded the maximum number of page requests per...

Read More »Raising interest rates is not that simple, Lord Hague

The present period of very low interest rates is widely assumed to be temporary, a consequence of the 2008 financial crisis and subsequent central bank action. Because of this, as the financial crisis fades into the mists of time, there is growing political pressure for "normalisation" of interest rates. Here, for example, is William Hague warning that central banks must start to raise rates or face losing their independence: The only way out is for the US Fed to summon the courage to lead...

Read More » Heterodox

Heterodox