The persistence of low interest rates has dominated the news. In general related to whether the Fed will or will not increase the interest rate by the end of the year. The Economist tried a few weeks ago to put things in perspective, and suggested not only that the current nominal rates close to zero are unprecedented, but it sort of indicated that the negative real rates are also to some extent a new phenomenon. The explanations for low rates can be found here, and the consequences,...

Read More »A dent in the surface of time

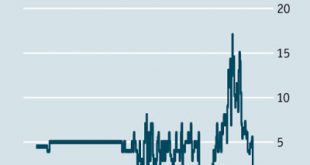

This chart has been fascinating me for ages. It was produced by the Bank of England to illustrate a speech by Andy Haldane. Shock, horror - we have the lowest interest rates for 5,000 years. Even in the Great Depression they were higher than they are now. These are, of course, nominal interest rates. Real interest rates are even lower - though not by much, since inflation is close to zero in all major economies.Note also the divergence of long-term and short-term interest rates. This is...

Read More »Bitcoin’s security pricing problem

I can't resist this. Blithely ignoring the utter mess he and his developers have managed to make of the cryptocurrency Ethereum, Vitalik Buterin has written a post on inflation and monetary policy. Wow. Is there no end to his talents? In this case, there is most definitely an end. Economics 101 is the end, pretty much. I don't claim to be the world's greatest economic expert - not by a LONG way - but the errors in this piece leapt out at me. Firstly, inflation. Here is Buterin on...

Read More »Low interest rates and banks’ net interest margins

In-depth analysis on Credit Writedowns Pro. You are here: Financial Institutions » Low interest rates and banks’ net interest margins By Stijn Claessens, Nicholas Coleman, Michael Donnelly, 18 May 2016 This post was first published at Vox Since the Global Crisis, interest rates in many advanced economies have been low and, in many cases, are expected to remain low for some time. Low interest rates help economies recover and can enhance banks’ balance sheets and...

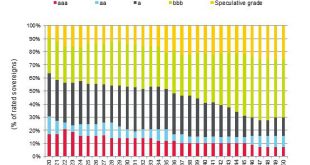

Read More »The safe asset scarcity problem, 2050 edition

This is a silly chart: Why is it silly? Just look at what it implies for government and investor behaviour - and the future of the ratings agency that issued it.S&P forecasts a serious shortage of safe assets by 2050 if the developed nations, in particular, do nothing to adjust their fiscal finances in the light of ageing populations. Clearly, therefore, the price of sovereign bonds in the three "A" categories will rise significantly. S&P doesn't indicate which nations would be the...

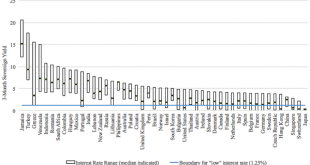

Read More »Germany’s negative-rates trap

Germany's Finance Minister Wolfgang Schaueble has long been critical of ECB monetary policy,. But now, as Reuters says, the gloves are off. In a speech at a prizegiving for an ordoliberal economics foundation last Friday, Dr. Schaeuble demanded that the ECB raise interest rates.The justification? Very low interest rates hurt Germany's savers, which are the bedrock of its economy.There is a political dimension to this. Dr. Schaueble's party, the CDU, is losing popularity and desperate for...

Read More »Don’t blame the boomers

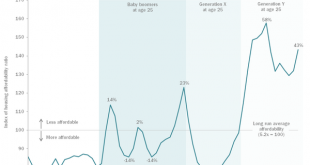

From Joe Sarling's blog comes this a lovely chart showing housing affordability by cohort since 1955: As can be seen, the current generation of young people - Generation Y - faces paying a far higher proportion of their incomes in mortgages or rent than any previous cohort. This does not, of course, take into account the considerable price difference between London and everywhere else: if London were excluded, I suspect their position would not look quite so dire. Nonetheless, this chart is...

Read More »Bill Black on CCTV America

Bill appeared on CCTV America discussing the American economy with Rachelle Akuffo. You can view it here. [Translate]

Read More »Why China cares about Japan’s negative rates

In-depth analysis on Credit Writedowns Pro. By Frances Coppola originally posted at Coppola Comment Japan has just introduced negative rates on reserves, following the example of the Riksbank, the Danish National Bank, the ECB and the Swiss National Bank. The Bank of Japan has of course been doing QE in very large amounts for quite some time now, and interest rates have been close to zero for a long time. But this is its first experiment with negative rates. The new negative rate...

Read More »The changing nature of banks, post-crisis edition

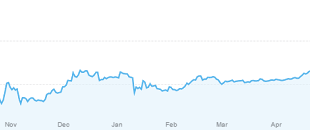

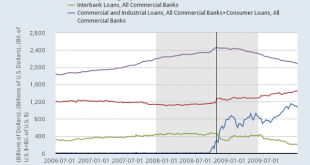

Courtesy of Dr. George Selgin comes this chart from FRED: Dr. Selgin has added a vertical line to indicate when the Fed imposed interest on excess reserves. I don't propose to discuss that here, since I have engaged in an interesting and spirited discussion with Dr. Selgin and others about it on both Forbes and Twitter. I am more interested in what else this chart shows. It is truly fascinating.The first thing to note is the fast rise in bank reserves from the latter part of 2008 onwards...

Read More » Heterodox

Heterodox