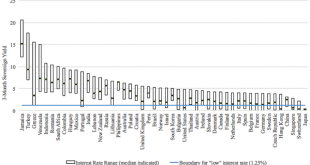

In-depth analysis on Credit Writedowns Pro. You are here: Financial Institutions » Low interest rates and banks’ net interest margins By Stijn Claessens, Nicholas Coleman, Michael Donnelly, 18 May 2016 This post was first published at Vox Since the Global Crisis, interest rates in many advanced economies have been low and, in many cases, are expected to remain low for some time. Low interest rates help economies recover and can enhance banks’ balance sheets and...

Read More »Universal Basic Income Is Inevitable, Unavoidable, and Incoming

The last time I saw universal basic income discussed on television, it was laughed away by a Conservative MP as an absurd idea. The government giving away wads of cash responsibility-free to the entire population sounds entirely fantastical in this austerity-bound age, where “we just don’t have the money” is repeated endlessly as a mantra. Money, they say, does not grow on trees. (Only as figures on the screen of a computer). In this world, universal basic income seems like a rather distant...

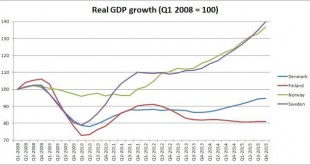

Read More »The Great Scandinavian Divergence

From @MineforNothing on Twitter comes this chart: Now, we know Finland is in a bit of a mess. A series of nasty supply-side shocks has devastated the economy. When Nokia collapsed in the wake of the 2007-8 financial crisis, ripping a huge hole in the country's GDP, the government responded with substantial fiscal support. This wrecked its formerly virtuous fiscal position: it switched from a 6% budget surplus to a 4% deficit in one year, and although its deficit has improved slightly since,...

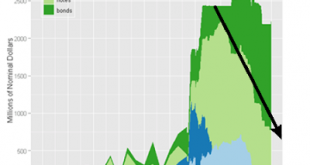

Read More »On Eccles and QE in the 1930s

So last weekend I was at the Eastern Economic Association meetings, and I presented with Steve Bannister (on and off contributor to NK) a paper on Quantitative Easing in the 1930s. It's been a while since we looked at this work, which started long ago (4 years at least). One point worth noticing is that while most accounts of Eccles performance at the Fed suggest that he didn't do much (see Meltzer in his A History of the Federal Reserve), we suggest that he was crucial in pushing...

Read More »The problem with words

Ah, those pesky words. They do not mean what we think they do. And sometimes we say one thing, but people think we mean another. And so it is that David Glasner, in a beautifully crafted takedown of my previous post, has managed to miss my point entirely.I did, in fact, read carefully all of David's quotation from Ralph Hawtrey, though I did not quote all of it. Hawtrey's point is that what appeared to be destructive competitive devaluation as countries left the gold standard was in fact...

Read More »Why China cares about Japan’s negative rates

In-depth analysis on Credit Writedowns Pro. By Frances Coppola originally posted at Coppola Comment Japan has just introduced negative rates on reserves, following the example of the Riksbank, the Danish National Bank, the ECB and the Swiss National Bank. The Bank of Japan has of course been doing QE in very large amounts for quite some time now, and interest rates have been close to zero for a long time. But this is its first experiment with negative rates. The new negative rate...

Read More »Robert Skidelsky: Lecture 2: Monetary Policy

Here Skidelsky gives lecture 2 of a series at the University of Warwick on economics. This lecture is a discussion of central banks and monetary policy, especially before the crisis of 2008.[embedded content]

Read More »Eurodespair

In my last post, I warned about "siren voices" calling for tighter monetary policy while the Eurozone economy is stuck in a toxic equilibrium of low growth, zero inflation and intractably high unemployment. Specifically, the so-called "German Council of Economic Experts (GCEE)" has called for the ECB to reduce or unwind QE: ...the European Central Bank should slow down the expansion of its balance sheet or even phase it out earlier than announced. Of course, the GCEE is only concerned...

Read More »The Slough of Despond

I'm bored.Bored with this crisis. Bored with endless calls for bank reforms. Bored with never-ending stories of inadequate bank resolution and legal battles which benefit no-one but lawyers. Bored with ineffectual monetary policy and fiscal gridlock. Bored with seeing the same things proposed over and over again, even things we know don't work and will never happen.Today, Mike Konczal wrote a piece on why restoring Glass-Steagall wouldn't solve anything. He's right, of course. But it is now...

Read More »The Fed’s IOER policy is not “paying banks not to lend”

Mainstream media get this wrong all the time. The latest to go down the "paying banks not to lend" rabbit hole is Binyamin Appelbaum in the New York Times. Because he didn't understand how IOER works, he didn't understand the Fed's strategy, and wrote a post that gets it quite seriously wrong. So I've written a Forbes post attempting to set things straight. Here's a taster: The FOMC has decided not to raise interest rates – for now. But it’s still widely expected that rate rises will come...

Read More » Heterodox

Heterodox