My debut post at CapX develops a theme I have written about many times. Central bankers are tasked with controlling inflation, but they don't understand it. For the last decade, central banks in developed countries have been pursuing policies designed to raise inflation. Quantitative easing, cheap funding for banks, tinkering with yield curves, low and negative interest rates – all aim to raise inflation to the ubiquitous 2% target. Understandably, central banks’ inflation forecasts...

Read More »Inflation Is Always And Everywhere A Political Phenomenon

We don't understand inflation. Those who lived through the high inflation of the 1970s are convinced that inflation is always and everywhere caused by wage-price spirals. Germans, economic Austrians and Bitcoiners are convinced that inflation is always and everywhere caused by central bank money printing. Small-state supporters are convinced that inflation is always and everywhere caused by profligate governments borrowing and spending excessively. Hard money enthusiasts are convinced that...

Read More »David Andolfatto — Is Neo-Fisherism Nuts?

Backing into MMT. The point of all this is, IF higher inflation is desired (and I am by no means advocating any such policy), THEN why not keep the policy rate low and use "free lunch" fiscal policies as long as inflation remains below target? Why bother experimenting with the Neo-Fisherian prescription of raising the policy rate that's somehow supposed to make people magically expect higher inflation? The post is a just a bit wonkish (equations) but worth reading since this is coming up...

Read More »Bill Dudley — Budget Deficits Still Matter

Amazing. A major player at the Fed and key voice in setting monetary policy didn't know how the monetary system works based on correct operational understanding — which MMT provides and which he also proves ignorant about. And this when he was also serving on the FOMC and deeply involved in setting monetary policy for the US, which also affects the entire world, during the crisis and aftermath. Bloomberg OpinionBudget Deficits Still Matter Bill Dudley William C. Dudley is an American...

Read More »ECB forecasting is a joke

Over at Bruegel, Zsolt Darvas takes the ECB to task for systematic forecasting errors in the last five years. He shows that the ECB has persistently overestimated inflation and unemployment, and on this basis he questions the ECB's decision to end QE in December 2018. I share his concern that the ECB has tightened too soon, though as the ECB's QE program is seriously flawed and very damaging, I am not sorry to see the back of it.But I think that in focusing on the last five years, he has...

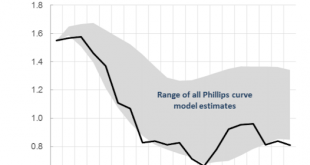

Read More »Mish Shedlock — Yet Another Fed Study Concludes Phillip’s Curve is Nonsense

The Phillips Curve, an economic model developed by A. W. Phillips purports that inflation and unemployment have a stable and inverse relationship. This has been a fundamental guiding economic theory used by the Fed for decades to set interest rates. Various studies have proven the theory is bogus, yet proponents keep believing.… Without the Phillips Curve, the current approach to monetary policy is groundless other than "discretionary." There is no rule.And it's not just the Phillips...

Read More »Bill Mitchell — Japan still to slip in the sea under its central bank debt burden

President Trump banned a CNN reporter only to find his position overturned by the judicial system. Well CNN is guilty of at least one thing – publishing misleading and alarmist economic reports about Japan. In a CNN Business article last week (November 13, 2018) – Japan’s economy has a $5 trillion problem – readers were told that the Bank of Japan has no “dwindling options to juice growth if a new crisis hits” because “it’s now sitting on assets worth more than the country’s entire...

Read More »To Secure a Future, Britain Needs a Green New Deal

This is an extract from a chapter in Economics For the Many (Verso, 2018) edited by Rt. Hon. John McDonnell MP. The chapter was written in August, 2017. If we are to secure a sustainable, stable and liveable future for the people of Britain, then implementation of the Green New Deal will be vital. Not just for the sake of the ecosystem, but also for the sake of rebuilding a stable, sustainable economy. The era of procrastination, of half measures, of soothing and baffling...

Read More »Brian Romanchuk — Do Central Governments Need To Issue Bonds (Again)?

The old "should the government issue bonds" debate has come up again. I would point the reader to this article at Mike Norman Economics, as well as the Richard Murphy article it refers to. I would argue that there is limited room for debate. The Treasury of the central government certainly can stop issuing bonds, conditioned on there being changes to the legal/regulatory framework for the central bank. The more important question is whether such a policy is a good idea. My argument is that...

Read More »On “the policy” and the Governor of the Bank of England

Extract from an article written for PEF Carney does not seem to be aware, but central bankers’ groupthink today unites once again around the “normalcy” of a single policy: financial globalisation, or unfettered financial capitalism. In other words, the deregulation and globalisation of markets in money, goods, services, property and labour is once again the dominant “policy”. And no central bank governor or Treasury politician or official deviates from it. The remedy for economic failures...

Read More » Heterodox

Heterodox