Here are some things I think I am thinking about: 1) Crypto All Going To Zero? John Paulson of subprime mortgage fame has some negative thoughts on cryptocurrencies: “Cryptocurrencies, regardless of where they’re trading today, will eventually prove to be worthless. Once the exuberance wears off, or liquidity dries up, they will go to zero. I wouldn’t recommend anyone invest in cryptocurrencies,” I’m not sure why people need to take such extreme views on so many things financially related....

Read More »Three Things I Think I Think – I See Dead Mutual Funds

Here are some things I think I am thinking about. 1) I see dead people. I mean, dead mutual funds. Back in 2012 I wrote an article about how horrible mutual funds are. I said: Mutual funds are a dinosaur product. The higher fees, reduced tax efficiency, lack of liquidity, and weak performance continues to hurt the industry. And this is only just beginning. There’s still $24 trillion in global mutual funds just waiting to find a new home. This tidal wave of money will flow out of mutual...

Read More »Should House Prices be in the CPI?

The rapid rise in house prices has stirred up the old debate debate about how the BLS calculates housing’s contribution to the CPI. This is no small debate since the US housing market is essentially the economy, mortgage debt comprises 75% of all household debt AND shelter is 33% of the CPI. Some people claim that the existing methodology understates inflation and gives people a false impression of how much our living standards are being impacted. The BLS, on the other hand, argues that...

Read More »Three Things I Think I Think – Some Weekend Reading

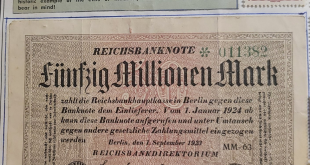

Here are some things I think I am thinking about: 1) Weimar Inflation! I was back home last week to see my family in DC and boy was that nice. My daughter got to meet her 10 nieces and nephews and I got to drink beer with my 7 brothers, sisters and parents. It almost felt like life was normal again. While I was there I was rummaging through my grandfather’s old stamp collection and I had to laugh at this little note he left on one page with a 50 million mark note from Weimar Germany. He...

Read More »Three Things I Think I Think – Deep Weekend Thoughts

1) How About That Jobs Report? Wowzers. That was something else. Yesterday’s Jobs Report was huge figure after huge figure. The unemployment rate collapsed to 5.4% and the US economy added almost a million jobs. Truly great numbers across the board. I said it in my recent interview – people are pouring back into the workforce. This momentum is really picking up now and that’s only going to continue as the stimulus winds down and the demand for labor picks up into year-end. Now, the really...

Read More »Three Things I Think I Think – Macro Thoughts

Here are some things I think I am thinking about: 1) MACRO IS USELESS! NO, MACRO IS GREAT! The most recent Howard Marks memo is a real rollercoaster of macro emotion. He starts off by declaring that macroeconomics is useless. But then spends 15 pages explaining some of his macro views and why they might be important. It’s easy to hate on macroeconomists. They didn’t predict the financial crisis and they pretty much don’t predict anything at all. But I think this is a misinterpretation of...

Read More »Three Things I Think I Think – Learning From Bad Inflation Takes

The great thing about Twitter is that the instant you put a bad take into the universe you will get roasted for it. The bad part about Twitter is that the instant you put a bad take into the universe you will roasted for it. I kid, kind of. There’s actually a lot to learn in saying the wrong things and I’ve surely benefitted from putting my wrong opinions out into the universe only to have someone correct me. So I guess you could say that there’s no such thing as a stupid take, only stupid...

Read More »The Fed Should Stop Using the Term “Transitory”

This website exists in large part because our government is extremely bad at communicating complex topics to the general public. I’ve tried to fill that void by explaining some of these more complex topics over the years. So I dedicate yet another post to our government, whose communication skills continue to leave something to be desired…. TRANSITORY – adjective 1: OF BRIEF DURATION : TEMPORARY 2: A GENERALLY POOR WAY TO DESCRIBE INFLATION The Fed keeps saying inflation will be...

Read More »How Does the Fed “Manipulate” Interest Rates?

Warning – hard money types are going to lose their minds over this article. I apologize in advance. It’s impossible to talk about interest rates without running into people who think the Fed has “manipulated” interest rates lower than they otherwise would be. As if the bond market has become nothing more than one huge completely manipulated Federal Reserve market. This is a really intuitively appealing argument and it’s not even completely wrong, but I want to add some important...

Read More »What is “Fractional Reserve Banking”?

The term “fractional reserve banking” is commonly used in a confusing manner in both mainstream economics and within lay conversations about economics. I hope this article with clear up some of the common confusions. Fractional reserve banking is the idea that banks take their reserves and lend them into some fraction based on the quantity of reserves they hold. This idea has been largely debunked since the financial crisis. In reality, banks do not lend their reserves, except to one...

Read More » Heterodox

Heterodox