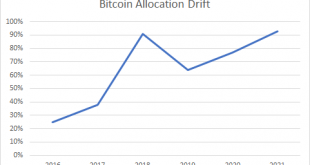

The Washington Post reports that some 401K providers are considering cryptocurrencies in their portfolios. The idea that alternative assets should be more widely available has become a more and more common refrain due to the fact that many of the best performing asset classes in the last 10 years are crypto and venture capital, two asset classes that are closed off to most traditional investment accounts like 401Ks and IRAs. Should this change? Let’s explore. For the purposes of this...

Read More »Three Things I Think I Think – Transitory Stuff

Here are some things I think I am thinking about: 1) “Transitory” inflation….Contrary to popular opinion, I am not the Director of Communications at the Federal Reserve. I don’t even work for the Federal Reserve. I’m just a lowly asset manager who happens to oversee a big chunk of fixed income so I worry incessantly about inflation and interest rates. That led me to obsess about how the Fed actually works and so here I am constantly writing about how the Fed works and how they think about...

Read More »Three Things I Think I Think – Bitcoin, Moar Bitcoin and Inflation

Here are some things I think I am thinking about: 1) Moar Bitcoin! Back when I was a young adventurous person I used to have an exciting portfolio filled with interesting individual stock bets. But then I learned a bunch of economics/finance, got old/fat and turned into a pretty boring indexer. So I just love it when other people make wildly insane bets that I can write blog posts about. And I think that’s why I love the MicroStrategy story so much. In case you haven’t been following...

Read More »Three Things I Think I Think – The More Things Change the More They Stay the Same

Here are some things I think I am thinking about: 1) Markets are crazy, part 2,343,325. I like to say that markets don’t really “cycle” like a sine wave. They tend to trend up and to the right with temporary shocks along the way. Whatever causes the shock (up or down) will always be different. But the responses are more or less the same. That is, people get greedy, then they get really greedy, then they get fearful and then they get really fearful. Timing all of this is damn near...

Read More »Everything Wrong with the “Money Printer Go Brrrr” Meme

You’ve probably seen some version of the following meme in the last few years. In case you haven’t it’s generally used to infer that Jerome Powell is printing money and hyperinflation is coming. I love a good meme and few things make me happier than hilarious nonsense on the internet. So I feel bad debunking this meme because it’s kind of funny and memes are mostly harmless, but this is one of those memes used by people who want you to believe something that isn’t right. Anyhow let’s get...

Read More »Three Things I Think I Think – Crypto, Crypto, Crypto

Here are some things I think I am thinking about. 1) So. Much. Crypto. I am about to write a post entirely about crypto. But before I do that I want to make it clear that this space gets WAY too much attention. I mean, we’re talking about an asset class that is incredibly small relative to the scope of the global financial asset portfolio. At just 1% of global financial assets the entire crypto space is about the size of Amazon. Amazingly though, the crypto space dominates the airwaves....

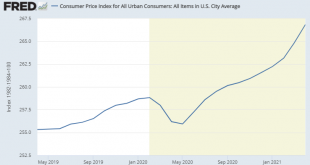

Read More »Let’s Talk About Inflation

Whooboy. What a CPI print. Here are some highlights in case you have a life and don’t drool over BLS reports: The all items index experienced its largest increase (4.2%) since Sept 2008. The used car index was up 10% in April, its largest increase since 1953. The core index (ex food and energy) was up 0.9% in April, its largest increase since April 1982. Fun. There will be a tendency in many circles to assume that this is the return of the 1970s or something like that. I think we need to...

Read More »Three Things I Think I Think – Losing Reserve Currency Status

Here are some things I think I am thinking about. 1. Is the Fed “Playing with Fire”? Stan Druckenmiller had an op-ed in the WSJ about how Fed policy has been too loose for too long. I think there are some reasonable perspectives here. I’ve been pretty vocal about the risk of inflation overshooting the Fed’s target this year. I also think there’s an increasingly convincing argument that the Fed’s policies have contributed to a lot of financial market craziness in the last year. It would...

Read More »The Scarcity of Money Myth

I’m here to ruin some long running narratives. I apologize in advance. Money is not scarce. It never has been and it never will be. More importantly, scarcity of money is not a strength.¹ It is a weakness. Sound weird? Yeah, I bet. Let me explain. Back in college I was kind of obsessed with commodities and commodity money. I’d been reading a lot of Austrian econ and all that stuff. But then I came across the endogenous money theories and I learned over time that money is not a physical...

Read More »Credo Wealth Interview on the Macro Landscape

I recently joined Deon Guows of Credo Wealth, a $5B wealth management firm in London, to discuss the macro landscape in the years to come. We hit on a huge number of topics. Check out the chapter time stamps in the YouTube video to navigate to specific parts. I hope you enjoy! [embedded content]

Read More » Heterodox

Heterodox