We are going to do a new 3 Minute Macro “Ask Me Anything” edition. It should be out next week or so. Please use the comments below to ask me anything and if you ask a really, really good question I’ll include it in the video. Each question will include up to a 3 minute response so anything is fair game. You can also email me here if you prefer that they be privately submitted.

Read More »Three Things I Think I Think – Silly Debates

Here are some things I think I am thinking about: 1) The 3 Most Important Charts Today We posted a new 3 Minute Macro video about the three most important investing charts today. I discuss last week’s employment report and why it changed market sentiment so substantially. Long story short – falling wages reduce the odds of a 1970’s style outcome. I’ve been saying that for the last few months, but the data is really starting to confirm that view. Yesterday’s update to the...

Read More »Three Things I Think I Think – Happy Disinflation Year?

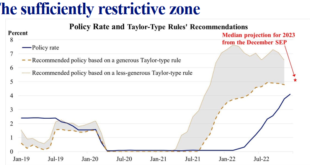

Here are some things I think I am thinking about: 1) 2023, the Year of Disinflation? In my annual outlook I said that 2023 was going to be the year of disinflation. My guess is that Core PCE ends the year around 3%. That’s higher than the Fed’s 2% target but it’s all moving in the right direction. I was pretty pleasantly surprised to see that James Bullard from the Fed, has a similar view of things. In a recent presentation he said that 2023 was likely to be a year of...

Read More »The Best of Pragcap in 2022

Here are some of my favorite posts from 2022. It was a busy year with my young kids so I didn’t write as much as I had hoped, but one of my goals is to start writing a lot more this year. I’ve missed it. In any case, here’s some of my favorites from this year. I hope 2023 is a great one for you. 1) What to do When the Market feels Crashy? This post was written almost a year ago as the bear market was starting. It touches on some important lessons to remember about bear markets and...

Read More »2023 Investment Outlook (Video)

Here is our 2023 investment outlook. I did this a little differently this year by providing a scenario analysis with different probability distributions. I think this is a much better way of analyzing potential outcomes and will allow you to better understand the range of outcomes. My overarching view is that the range of outcomes still remains very wide because we’re digesting the COVID boom which is evolving into a bust. This means that portfolio concentration is likely to be a high...

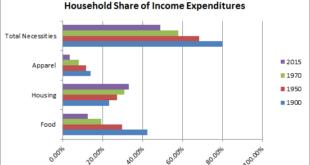

Read More »Needs, Wants and why We Always Feel Unfulfilled

By the age of 30 I was financially independent. My business was self sustaining, I enjoyed my work immensely and no one could tell me what to do. I wrote a best selling book. I wrote some great research. I spent years training for and finished a full Ironman despite having never run more than a few miles just a few years before that. I had a dreamy marriage to a woman who is way out of my league. All of my needs were taken care of. Life had transitioned into what I wanted. But as I get...

Read More »What Are Eurodollars and Why do they Matter? (Video)

Here’s a new edition of 3 Minute Macro on the topic of Eurodollars. Eurodollars are a somewhat opaque part of the financial world, but have become increasingly important in the last few decades as dollar deposits outside of the USA have grown. In this video we discuss the basic concept and why Eurodollars are important. I hope you enjoy it. [embedded content] Please follow and like us: About Post Author ...

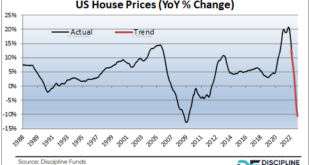

Read More »Three Things I Think I Think – Housing Risks

Here are some things I think I am thinking about: Housing, housing, housing. If I had to distill my current macro outlook down into a sentence or two it would be “watch everything housing related”. Housing is going to steer the US economy and inflation in the coming 24 months and the current high mortgage rates create an unusually high level of risk to both house prices and consumer demand. But let’s dig into this a little deeper. 1) Shelter and inflation. Today’s CPI report...

Read More »New Podcast Interview – The Bitcoin Layer

I joined Nik Bhattia on the Bitcoin Layer podcast to discuss the outlook for the macroeconomy in 2023. This interview includes: 1) The general economic outlook for 2023 2) Why 2023 is likely to be a year of disinflation 3) Is the current environment more like 2008 or the 1970s? 4) How the current environment could evolve into more of a credit crisis 5) Portfolio strategies for navigating the next few years 6) How to assign allocations to stocks, bonds and other assets...

Read More »Three Things I Think I Think – Who Can You Trust?

1) SBF, FTX, WTF. The big story of the week remains Sam Bankman-Fried and the collapse of crypto exchange FTX. I haven’t written much about this topic because, well, crypto is not nearly as important as the amount of airtime it gets. It’s 0.5% of the world’s financial assets, but seems to get 50%+ of the media airtime. Additionally, I don’t believe that 100+ volatility assets should be a large part of anyone’s savings so in the scope of my asset management approach crypto is a fringe...

Read More » Heterodox

Heterodox