I joined The Investor’s Podcast for the 9th time! I am officially the Alec Baldwin of the show, but far less handsome. We continued our talk about inflation and how to navigate these difficult times. If you missed the first Masterclass on Inflation please check it out here. I hope you learn something new from this: IN THIS EPISODE, YOU’LL LEARN: Why inflation will be moderate in the coming years.Why deflation is more likely than hyperinflation.Whether velocity of money is...

Read More »Is the Housing Market Going to Crash?

Here’s a new 3 Minute Money on housing. In this video I cover: The dynamics of the boom Why housing is so important to the broader economyThe risk that surging rates poseWhy this boom was different from the Housing Bubble boomwhat a potential bust might look like. I hope you enjoy it. [embedded content] About Post Author ...

Read More »Three Things I Think I Think – Bad Ideas

1) ESG – Still a Convoluted Mess. My long standing position on ESG (Environmental, Social & Governance) investing is that secondary markets are a not a great place to try to enact change. In short, it’s another form of active stock picking except now you’re letting your emotions get in the way. For instance, I might hate Exxon Mobil because they pollute the environment, but XOM also invests huge amounts of money into renewables. In fact, the only way they’ll survive in the future...

Read More »New 3 Minute Money – How Interest Rates are Set

Interest rates are one of the most important prices in the economy, but how are they determined and what is the mechanism by which they change? In this video we touch on the operational dynamics behind interest rate changes and how they filter through the economy. [embedded content] About Post Author ...

Read More »New 3 Minute Money – Why Do Banks Need Deposits?

I often talk about the importance of understanding banking and the relationship between inside money and outside money. And a common theme in this topic is that the money multiplier concept isn’t quite right. In fact, the textbook treatment of this direct causal relationship is completely wrong. But if the money multiplier is a myth and banks don’t multiply their reserves and deposits then why do banks even need deposits? This new video answers one of the most common questions when...

Read More »*New* White Paper – All Duration Investing

I’m excited to share a new research paper with you all. It’s the first one I’ve published in 6 years and it’s one of the few things I’ve written that I believe deserves the formalities of a paper. It’s called “All Duration Investing” and what I’ve done in this paper is quantified the actual “durations” of all asset classes. What’s nice about this approach is that you can now structure different asset classes in specific time horizons using a financial planning foundation. This allows us...

Read More »Inflation Debates – YoY vs MoM

A surprisingly controversial debate broke out in recent days when Joe Biden said there was no inflation. He was referring to the month over month reading which showed a slight decline in prices. The BLS measures inflation on a monthly basis and while the 12 month year over year comparison showed a 8.5% increase the monthly price was flat on a month over month basis. Twitter seemed especially argumentative about this point. I know, I know – it’s shocking to hear that people on Twitter...

Read More »Three Things I Think I Think

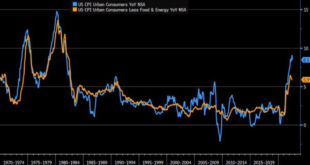

Here are some things I think I am thinking about: 1) Inflation has peaked. This morning’s CPI report is more evidence that disinflation is going to become a more prolonged and entrenched trend in the coming years. I said back in January that I thought inflation had peaked and so far we’ve had falling rates of core CPI and PCE inflation since then. It’s still early and it’s not necessarily going to be a quick process because we have a good amount of upward pressure from some...

Read More »Is the USA in a Recession?

New episode of Three Minute Money here. Is the USA in a recession? While the media has traditionally referred to a recession as 2 quarters of negative GDP the White House and NBER disagree that the recent 2 quarter decline is consistent with a recession. In this video we explore the technical definition of a recession and the primary indicators that the NBER uses to define a recession. We also explore why this feels like a recession even if it might not technically be a recession. Useful...

Read More »Three Things I Think I Think – What is a Recession?

Here are some things I think I am thinking about: 1) Are we in a recession? Today’s GDP reading officially shows two quarters of negative GDP. This has been a traditional media measure of “recession”, but the NBER has always been pretty vague about what a recession is. But one thing they’re clear about is that they they do not consider two quarters of negative GDP to be a recession. Instead, they say a recession is when there’s been a significant decline in economic activity. What to make...

Read More » Heterodox

Heterodox