This website is, to a large degree, about impeachment and impeaching bad ideas out of the worlds of finance and economics. So, here are some impeachable ideas I’ve been thinking about lately: 1) Market Cap Weighted Index Funds are “immoral”. WHAT? Here’s an article on MarketWatch where someone who runs a “socially responsible investment” firm says that owning a simple index fund is “immoral”. The basic argument is that owning things like gun makers or cigarette makers in an index fund...

Read More »Three Things I Think I Think – Repo Madness!

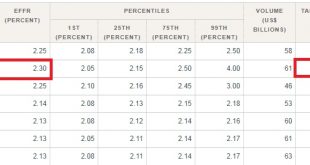

Here are some things I think I am thinking about: 1.2.3. The Great Repo “Crisis” of 2019. If you’ve opened the financial section of the newspaper in recent days then you’ve probably been blasted in the face with lots of confusing jargon about a liquidity “crisis” in the repo market. This sort of stuff really bugs me because it’s a market that is relatively opaque and just confusing enough that people can blow it out of proportion and make it sound like something really scary when in fact...

Read More »What is the Value of Financial Advice?

Vanguard released a new study showing that financial advice provides “meaningful” beneficial changes in behavior, performance and financial outcomes. They had previously published a study citing a 3% “advisor alpha”. I am not gonna lie – I always thought that number was BS and probably way too high. But is there a more reliable way to measure this? Let’s see. Investing is like being healthy – everyone knows how to do it, but implementing a plan and remaining disciplined is difficult. And...

Read More »Is This The Hardest Investing Environment Ever?

I was on the Stansberry Investor Hour last week with Dan Ferris discussing the markets and the broader macro environment. My segment starts at 29:30. Topics discussed: The general macro environment and why growth could remain sluggish. I was very bullish about bonds 24 months ago at the Stansberry Investment Conference, but that view has changed…. Bond math and why 0% yielding bonds make investing so difficult. FUN! Why I wouldn’t be surprised if markets don’t do much for a few years. Why...

Read More »Why Do Countries Borrow in Foreign Currency?

We’ve seen a number of foreign debt based crises in the last few years with both Turkey and Argentina suffering from substantial episodes of inflation related to foreign denominated debts. Without getting bogged down in the specifics of these cases I want to touch on a more general question: Why do countries borrow in foreign currency? I reached out to an international banker I know for his opinion on why this theme seems to keep occurring. Here’s what he had to say: Many countries have...

Read More »Three Things I Think I Think – Bubbles Edition

Here are some things I think I am thinking about: 1) Is there a bubble in passive investing? Michael Burry of Big Short fame, says there’s a bubble in passive investing. The basic argument is that passive investing has skewed the markets and caused small cap value stocks to underperform. Burry, unsurprisingly, is invested in many small value stocks. Soooooo. This seems to happen once every few years where an active manager blames index funds for their performance. They’re an easy...

Read More »Let’s Stop Talking About “Paying Off the National Debt”

When we talk about personal finance we often talk about paying off our debts to become financially free. But this is a fallacy of composition. While some households can pay off their debts, the economy actually relies on expanding debt (and assets) to have liquidity and growth. After all, debt isn’t necessarily bad. Yes, there are bad types of debt (like credit card debt which almost always have a negative long-term return), but there are also good types of debt (for instance, when someone...

Read More »Black Hole Monetary Economics

Economic nerds are converging on Jackson Hole for their (our?) annual meeting and the big story of the event will be a controversial opinion by Larry Summers, which he laid out on Twitter yesterday. He is presenting a paper in which he argues [gasp] that monetary policy isn’t as effective as the economics profession has been led to believe. This is nothing new to readers of this site and anyone sympathetic to Post-Keynesian economics. I had publicly argued with Paul Krugman about this...

Read More »Let’s Get Inverted

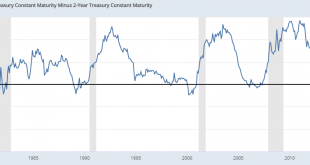

Alright, nerds. It’s time to put on our thinking caps and fill up our pocket protectors. We’re gonna talk about inverted yield curves. First things first – What is an inverted yield curve? An inverted yield curve is a description of the comparison between 10 year Treasury note yields and 2 year treasury note yields. Those are the only two instruments that matter here. If anyone else says an inverted curve is some version of some other set of instruments then take away their nerd badge....

Read More »Three Things I Think I Think – Recession Alert Edition

Here are some things I think I am thinking about. 1) About this negative yield thing….Interest rates just keep pumping lower. There’s now over $15 TRILLION worth of bonds in the world with a negative yield. Now, negative yields aren’t as crazy as some people think. There’s perfectly practical reasons for yields to be negative (for instance, if you believe inflation will be very low or negative). But check out this price action in 30 year Austrian Government Bonds: If that’s hard to see,...

Read More » Heterodox

Heterodox