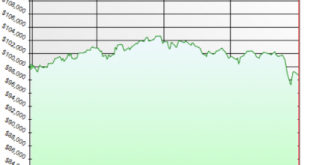

One thing that’s stood out during the most recent stock market turmoil is that bonds aren’t performing all that well either. US Treasury Bonds are up just 3.5% since stocks peaked and the aggregate bond index is up less than 1%. The concern here is that ultra low yielding bonds can’t decline sustainably below 0% and are therefore unlikely to provide much downside protection in the future whereas environments like the 2008 financial crisis and before offered investors far more protection...

Read More »There is no Defensible Argument for Raising Rates at Present

I am a little stunned by the Fed’s insistence on leaving a rate hike on the table in September. What is the purpose of this? Worse, I have yet to hear a strong argument justifying this view. So far the “logic” appears to amount to “we’ve been at 0% for too long”, “the Fed wants to raise rates so they can lower them later”, “we need to fend off financial instability” or “we just need to get that first hike out of the way”. These arguments display a total lack of risk/reward analysis....

Read More »Three Things I Think I Think – Crashing Up & Down Edition

Here are some things I think I am thinking about recently: 1) What a boring year! The Global Financial Asset Portfolio is down about 1.2% year to date. This might come as a shock to people who are glued to financial TV all day and think of the “market” as the stock market. Yes, some stock markets are down quite a bit, but the aggregate “markets” really haven’t budged much. And this goes to show how damaging it can be to constantly be obsessing over the daily moves of your investments....

Read More »There Are no Holy Grails

When the markets get volatile many strategies will start performing poorly. Even your most basic diversified low fee indexing strategy will start to look weak even though it likely beats most professional fund managers. And when these strategies start to weaken many investors will start getting impatient. You probably know that nothing works 100% of the time, but that still doesn’t stop the allure of the green grass elsewhere. I know, the gold strategy looks so good in the short-run. That...

Read More »The 1998 Playbook

I usually hate historical comparisons but every once in a while a time comes along where there are just too many similarities to ignore. And right now looks a lot like one of those times. The 1998 Asian Currency Crisis is looking all too familiar here. We had a bunch of countries with pegged currencies who were experiencing trade imbalances, foreign denominated debt crises, ultimately leading to economic slowdown, foreign currency turmoil, commodity turmoil and economic turmoil. 2015 is a...

Read More »The Disciplined Investor Podcast Interview

I was on the Disciplined Investor podcast over the weekend with Andrew Horowitz discussing China’s “black box” of finance and some of the ways in which investors can stress test their portfolios. We move into the area of robo-advising and how that may be hazardous to your health over the long-term. We also touched on the craziness in the markets, Modern Portfolio Theory and my concept of the “Savings Portfolio”. I come on around the 13 minute mark. I hope you enjoy it. Got a comment or...

Read More »Don’t Read this Post

The hardest part is not paying close attention. I know. You want to read everything. We have access to so much information. Real-time stock quotes and real-time news and it’s all jammed in our faces 24/7. But as I noted previously, all of this information isn’t making us better investors. It’s making us worse. Because it’s feeding off of every emotion we have. And when you let your emotions drive your investment strategy it always derails. Are you still reading? I told you to stop before...

Read More »The One Factor to Explain Them All

Yesterday’s post on hedge funds got me thinking again about how vague “risk factors” are. CAPM uses a one factor model showing that risk explained why certain assets performed better than others.¹ Basically, take more risk and you’ll generate a better return. That didn’t exactly explain things though. In fact, higher risk often correlates with worse returns.² Over the course of the last 25 years the idea of “factor investing” has really boomed. And investment companies loved this because...

Read More »Hedge Funds Aren’t Passive

This was a weird research piece arguing that hedge funds are “passive”. Here’s the basic conclusion from the paper: “Over the long run many hedge funds behave like alternative beta portfolios and maintain linear exposures to systematic risk factors.” The very smart Matt Levine notes that the researchers are being very specific here when they define active and passive management: “Active management should be manifest through nonlinear exposure to the systematic risk factors that drive...

Read More »Three Things I Think I Think – Thursday Edition

Here are some things I think I am thinking about. 1) Should We Get Awards Just for Participating? James Harrison made headlines this past weekend when he said his kids would be returning their “participation trophies”. I have to say that I don’t understand this trend in giving people an award just for showing up. Maybe I am too old school or something, but athletics, to me, is inherently competitive. Just like academic work prepares one for the mental competition of school, athletics...

Read More » Heterodox

Heterodox