The common belief is that money is “easy” right now because interest rates are at 0% and QE^n has been in effect for 7 years. But there are many of us who have been arguing for years now that fiscal policy and/or monetary policy is too tight. That is, we actually haven’t done enough to get us back to full employment and the private sector has remained unusually fragile as a result. I know, I know. That sounds ludicrous. But it’s more logical than you might think. For instance, we know...

Read More »No, Young People Don’t Have a Higher Tolerance for Risk

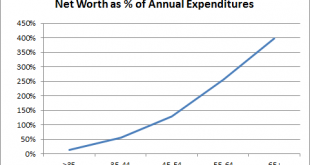

2015 is introducing a lot of young people to the idea of a bear market. And article after article is telling us that the downturn is no problem and that young people absolutely shouldn’t sell. This thinking is based on the vastly oversimplified concept of long run returns. That is, the stock market tends to generate positive returns in the long-term so a young investor should always remain overweight stocks and remain aggressive. Then, as they get older their risk profile should change...

Read More »The Misguided Interest Rate Obsession

Prices are very important in economics and finance for obvious reasons. And in modern economic models the price that is always most important is the price of money also known as the interest rate. The discussion over this price has really flared up in the last few months as the debate about the Federal Reserve and raising rates has picked up momentum. But what if it’s all misguided? What if interest rates are the wrong policy tool to focus on? From an operational perspective the Federal...

Read More »Did The Fed Make a Mistake Leaving Rates Unchanged?

Today’s market declines have a lot of people wondering if the Fed didn’t make a mistake yesterday by leaving rates unchanged. Here are some good thoughts from a trader in Asia who I really respect. He says the Fed made a mistake yesterday with their policy decision and delivery: Their message was that some improvement in the US economy would elicit a hike. We got the improvement but they moved NAIRU and more tellingly emphasized the risks that are building in the emerging economies. ...

Read More »Fed Leaves Rates Unchanged – Some Brief Thoughts

The Fed left interest rates unchanged at 0-0.25%. Here’s the key part of the statement: Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term. Nonetheless, the Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual...

Read More »Three Things I Think I Think – Stupid Markets Edition

Here are some things I Think I am thinking about: 1. The fact that markets are hard to “beat” does not make them smart. I noticed this comment on a recent Scott Sumner post claiming that markets must be smart because they make it difficult to become wealthy. He says: Markets are just amazingly wise. But that shouldn’t be surprising, because they must be smarter than us in order to make it tough to get rich. I see this a lot in academic circles. People often say the Efficient Market...

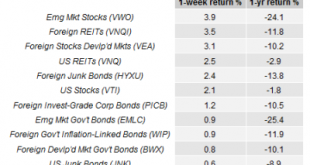

Read More »Nowhere to Hide…

How weird has 2015 been so far? This weird – every major asset class is negative on a one year basis (via Capital Spectator): I don’t have the exact data, but I would venture to guess that this just about never happens. Heck, even a long-term bond is barely positive on a 1 year basis. If you had told me that China might be falling apart in 2015, emerging markets were falling 25%+ and we’d have a flash crash I’d have guessed that long-term bonds were up 10%+ in that period. But no, even...

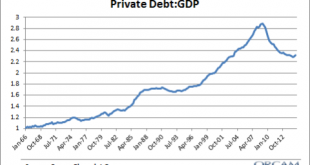

Read More »Are We on the Precipice of Another 2008?

When it comes to the recent market turmoil people are quick to make two comparisons – 1998 or 2008. Both were “crisis” type events that led to big stock market declines and substantial economic turmoil, but 2008 was far more traumatic. There are some important distinctions between the two environments so let’s look at the macro picture and see if we can’t better understand where we are and where we might be headed. I should start by pointing out that the only reason this website even...

Read More »Learning to Love Tax Cuts

Paul Krugman really hates tax cuts which is something that I find pretty weird for a Keynesian. Here’s his latest post showing that the 2013 Obama tax hike coincided with more private sector job creation than the 2003 Bush tax cut. He concludes that this “didn’t work” for Bush and that Jeb isn’t learning from big bro’s mistakes with his latest tax plan. I don’t see the correlation though. There is obviously a lot more to the economy than tax policy. And in 2003 we had a deficit that was...

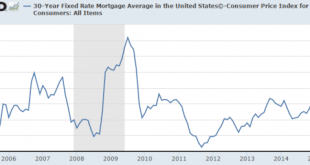

Read More »Have Savers Been “Punished” in the Low Interest Rate Environment?

There’s usually two forms of ideological rhetoric that accompany low interest rates. The first is that the Fed has “manipulated” interest rates lower. And the second is that the Fed is “punishing savers”. Let’s take a look at each of these ideas because I find them misleading at best and hypocritical at worst. The first misunderstanding has to do with Fed policy and its setting of interest rates. We should be very clear about the Fed’s role in the overnight market where they set interest...

Read More » Heterodox

Heterodox