Another big increase in consumer prices in February, as the yield curve tightens Consumer prices increased 0.8% in January, the fourth time in five months that it has exceeded 0.5%. YoY inflation is now 7.9%, the highest rate since 1982. My favorite measure, CPI ex energy, is also up 6.6% YoY, the worst since the 1981-82 recession as well: My rationale for tracking CPI ex-energy is that, unless energy costs filter through into the...

Read More »Consumers still spend, real income declines, leaving them vulnerable to price shocks

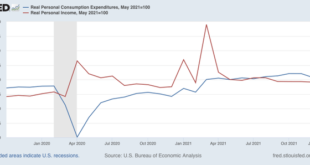

Consumers still spend, but real income declines, leaving them increasingly vulnerable to price shocks Nominal personal income was unchanged in January, while spending rose 2.1%. In real terms after inflation, personal income declined -0.5%, and personal consumption expenditures rose 1.5%, completely reversing December’s decline, and adding about 0.2%. I have stopped comparing them with their pre-pandemic levels (they are both well above that)....

Read More »The Gilded Lily

One micron is about ten gold leaves thick. The gilded age, one. Since, and yet, there are those who would return the nation to that time. To their minds, it was the best of times; that all that need be done was rid the nation of the odious Progressive and New Deal Era laws that in fact had had nothing to do with the age’s demise, and the labor unions that formed up during the period; then let the laws of capitalism and of free markets take their...

Read More »Climate Change, Front and Center, Government Wrestles With Itself

We as a nation are seriously confronted by a changing environment that is leaving more rain in some spots, and less in others. To the west of the Powell Meridian, drought scorched plains, to the east, floods, washouts. In both, crop failure and societal pressure of devastating loss of both property and life. Take for example a long term problem that has been exacerbated by the climate crises, the Yazoo River and it’s relationship with the...

Read More »The Frustration of Government Grants

There has been quite a lot of news over the past few years regarding agriculture specific to governmental assistance, from providing crop subsidies during the Trump Trade War to the Biden Administrations attempt to tamp down inflation via meat processing capacity increases, as well as an attempt to revive a few ideas that had been tabled by previous administrations. The largest focus for the USDA is without a doubt the SNAP food assistance program...

Read More »Omicron declines sharply

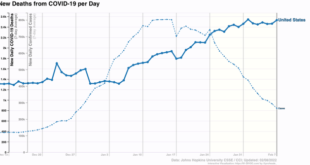

Coronavirus Dashboard for February 8: Omicron declines sharply; did Delta provide protection against the worst outcomes? As I mentioned yesterday, I haven’t posted a Coronavirus dashboard in awhile, and with Omicron in rapid retreat, it’s time for an update. To begin with, deaths are presently peaking at roughly 2450 a day, while nationwide cases are down almost 2/3’s: There are over a dozen States where numbers are now down close to, at, or...

Read More »Moral Hazard and Bank Bailouts

My mind goes back to 2008. I was recently tempted to ask why bad loans by banks are a public problem. I was tempted to say that the bank made the loan, so it is their problem. If enough debtors default that the bank fails, so what? Then I remember the very appealing logic of the argument that, while other banks are free to save Lehman if they choose, no public money should be involved. That didn’t work out very well. The tempting pure market let...

Read More »I Got Caught Up in America’s Absurd Health Care System

Lambert at Naked Capitalism has an interesting article up as taken from KHN entitled “I Write About America’s Absurd Health Care System. Then I Got Caught Up in It” as detailed by Bram Sable-Smith. As taken from the KHN article, Bram describes the beginnings of his dilemma of getting Insulin: “I’d been waiting since September for an appointment with an endocrinologist in St. Louis; the doctor’s office couldn’t get me in until Dec. 23 and...

Read More »Swimming in a Pool Filled With Peanut Butter

American capitalism has an everpresent desire for increased profits. Over the course of history, corporations had increased profits largely due to increased population growth. As we have seen from new data coming from the 2020 Census, population growth is beginning to stabilize and flatten, yet corporations are still expected to perform regardless of market conditions, and if population growth is no longer the cosmic funnel of operating revenues,...

Read More »Kip Sullivan and Ralph Nader Talk Tradition Medicare vs Medicare Advantage

This podcast came to me by way of Kip Sullivan, the expert on Traditional Medicare and Medicare Advantage. We have had a running dialogue for about a year now. Most recently, Angry Bear featured Kip’s PNHP Single Payer Healthcare Financing Series detailing why healthcare is expensive in the US. I have put up numerous posts on healthcare, Medicare, Medicare Advantage. This podcast by Kip and Ralph Nader gets into the take over of Traditional...

Read More » Heterodox

Heterodox