“FTC Previews Hard Evidence of Harms While Kroger and Albertsons Dangle Unenforceable Promises in Merger Hearing Opening Arguments,” Economic Liberties Kroger and Albertsons Dangle Unenforceable Promises in Merger Hearing Opening Arguments. Noteworthy in Day 1 of the hearing is Kroger uses Albertson’s pricing as the high mark to set its pricing between it and WalMart on the low end. It would seem such a combination of both stores would...

Read More »What if We were to Abolish the Super Rich?

Abolishing the Super Rich is a research piece, a book, and an opinion commentary by Tom Malleson. Associate professor Tom is at King’s University College at Canada’s Western University. Tom gives us a peek into his book entitled Against Inequality: The Practical and Ethical Case for Abolishing the Superrich (2023). The commentary/review of content reads nicely and the professor has his points in a row. Since we are an economics blog which touches...

Read More »How will the Trump and Harris budgets affect the national debt?

Here’s the Penn Wharton Budget Model breakdown for how much each candidate’s economic proposals will affect the national debt:“We estimate that the Trump Campaign tax and spending proposals would increase primary deficits by $5.8 trillion over the next 10 years on a conventional basis and by $4.1 trillion on a dynamic basis that includes economic feedback effects. Households across all income groups benefit on a conventional basis.”“We estimate that...

Read More »Kroger Engages in Theater – Kabuki Style

“Kabuki is a form of classical theater in Japan known for its elaborate costumes and dynamic acting. Phrases such as Kabuki theater, kabuki dance, or kabuki play are sometimes used in political discourse to describe an event characterized more by showmanship than by content.” Maybe I am wrong in calling it such. The style of play occurring between the two companies and the management give ne the impression of such. If you have been following...

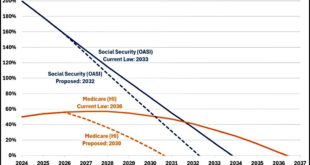

Read More »Eliminating taxes on Social Security is a bad idea

Normally, a sentence that begins “Donald Trump says . . . “ is not worth finishing, and that’s how a recent blog post over at jabberwocking.com begins. But finish it I did, and it turns out that DJT says he wants to eliminate all federal income taxes on Social Security. Currently, if SS is your only income, there already are no federal taxes on it. If you make additional income above your SS distributions, you can be taxed at normal federal rates on...

Read More »Bernie is wrong on Social Security

I like Bernie Sanders for many reasons, but this isn’t one of them:“As a result of those challenges, Sanders wants to see more Democrats vocally get behind measures like . . . removing the cap on Social Security taxation so the wealthy pay a full share of their income into the program.”This is a mistake. SS benefits are capped like taxes, so if you lift the cap on taxes and don’t lift the cap on benefits, SS becomes welfare instead of insurance.Look,...

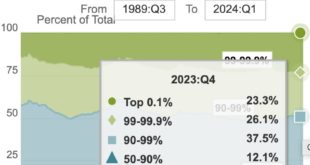

Read More »High taxes for thee but not for me

Everybody knows that California is a “high-tax” state, right? Well, yes and no. Depends on where you are on the food chain. If your household is the top 1%, then California tax rates are 2nd highest, while Texas and Florida are 43rd and 50th, respectively.OTOH, if your household income is in the second quintile as a % of family income, things change: “California is about average, with a tax rate lower than either Texas or Florida. Texas has the ninth...

Read More »IRS tops $1 billion Mark in past-due taxes collected from millionaires

A properly or funded IRS is reaching out to various high-income constituents to collect back taxes. It appears their efforts are paying off in increasing tax collections, Compliance efforts continue involving high-wealth groups, corporations, partnerships. IRS July 11, 2024 WASHINGTON — Continuing compliance efforts under the Inflation Reduction Act by the Internal Revenue Service is resulting in increasing tax collections. The IRS announced...

Read More »Pharmacy Benefit Managers (PBMs) are Hiking the Price of Drugs

A follow-up to the much longer report on Insulin (test on this later) and how PBMs impact pricing on other drugs. “Insulin A Drug Pricing Analysis,” Angry Bear. “Drug manufacturers alone set and raise drug prices, and PBMs are holding drug companies accountable by negotiating the lowest possible cost for drugs, including insulins, on behalf of patients.“ According to 46brooklyn, this is an overly simplistic view on drug pricing. It should be...

Read More »Actually Understanding Corporate Share Buybacks

Who gets the money? Follow the assets. by Steve Roth Originally Published at Wealth Economics This post by Judd Legum at Popular Information (read and subscribe!) prompts me to revisit the issue of share buybacks. This passage in particular: It seems eye-popping. But is it? Even (especially?) finance and econ types don’t really understand buybacks from a big-picture, macro, national-accounting perspective. Here’s a shot at explaining...

Read More » Heterodox

Heterodox