House prices continue to rise, exacerbating unaffordability Now that we have both the Case Shiller and FHFA house price reports for June, let’s take a look at how they fit in to the overall market, and in particular on housing affordability. To begin with, let me repeat the general formula for the housing market: interest rates lead sales sales lead prices prices lead inventory Turning to the reports, in June, the 20-city Case Shiller house price index...

Read More »Marrying NAFTA and The TPP: The US-Mexico “Trade Agreement”

Marrying NAFTA and The TPP: The US-Mexico “Free Trade Agreement” I really am not sure where to begin with this latest farce, Trump’s announcement yesterday of a supposed US-Mexico Free Trade Agreement. Of course there was the farce of him trying to make the announcement with a live phone call between him and outgoing Mexican President Pena-Nieto (to be replaced on Dec. 1 by leftist populist Obrador), which took awhile to get going. There is the...

Read More »Even if the yield curve tightens no further, there will be consequences next year

by New Deal democrat Even if the yield curve tightens no further, there will be consequences next year Both my posts from yesterday morning and today dealt with two aspects of the implications of the Fed raising rates. The unifying idea beneath both of them is that the Fed’s raising rates is already having consequences in the economy; consequences that are likely to be amplified should the Fed continue on its present path. And we have a pretty good...

Read More »What the compressed yield curve means for employment

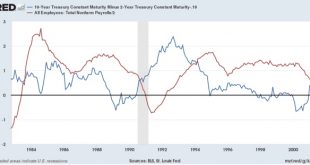

What the compressed yield curve means for employment Aside from the threat of a recession down the road, is there cause for concern by economic Progressives in the fact that the yield curve has tightened (i.e., the difference in interest rates between long and short term bonds has become very small)? In a word, Yes. Four times during the 1980s and 1990s the difference in the interest yield between 2 and 10 year treasury bonds got about as low as it is...

Read More »Are We Alone In The Galaxy (Or Maybe Even The Universe?)

Are We Alone In The Galaxy (Or Maybe Even The Universe?) In 1938 Orson Welles put on a radio show in New York City that dramatized the famous novel by H.G. Wells, _The War of the Worlds_. This novel is about an invasion of Planet Earth by intelligent beings from Planet Mars, with this invasion just barely being defeated. Several movies have been made of this famous novel, probably the first to present this now long-running sc-fi theme of our planet...

Read More »A new risk at the Fed: Donald Trump’s power to fire Fed Governors

A new risk at the Fed: Donald Trump’s power to fire Fed Governors Calling it “breaking with decades of presidential convention,” the New York Times reported last week on Donald Trump’s open criticism of recent Federal Reserve rate hikes. quoting him as telling donors at a fund-raiser in the Hamptons: that he had expected Mr. Powell to adhere to an easy-money monetary policy, by keeping interest rates low, when he nominated Mr. Powell in November to...

Read More »Pew Charitable Trust confirms the “rental (and ownership) affordability crisis”

Pew Charitable Trust confirms the “rental (and ownership) affordability crisis” In case you thought I was talking through my hat about the general lack of affordability of all types of housing, including both owning and renting, the Pew Charitable Trust has also stepped up with a nearly identical analysis. Go read the whole thing, but here are a few especially noteworthy excerpts: [A]ccording to the Harvard Joint Center for Housing Studies[, d]emand...

Read More »Can the Fed successfully steer between Scylla and Charybdis? An update

Can the Fed successfully steer between Scylla and Charybdis? An update As I type this, the spread between 2 year and 10 year Treasuries is back to 0.25%, the level below which I switch my rating on the yield curve from positive to neutral. Already the spread is tight enough that, even if it never inverts, it suggests a slowdown in the next 6-12 months, as happened in 1984 and 1995 in the graph below of real YoY GDP growth and the Fed funds rate:...

Read More »On the surge in CEO compensation

Economic Policy Institute has published a new study on the surge in CEO compensation: Summary What this report finds: This report looks at trends in chief executive officer (CEO) compensation, using two different measures. The first measure includes stock options realized (in addition to salary, bonuses, restricted stock grants, and long-term incentive payouts). By this measure, in 2017 the average CEO of the 350 largest firms in the U.S. received $18.9...

Read More »Accountable Capitalism Act

It’s called the Accountable Capitalism Act. Here’s the bill text. Yves Smith has a take on this…lots of talk in the news econ sections: Elizabeth Warren introduced her Accountable Capitalism Act in the Senate yesterday and set forth the logic of her bill in a Wall Street Journal op-ed. The Massachusetts senator described how as recently as the early 1980s, even conservative groups acknowledged publicly that corporations were responsible to employees and...

Read More » Heterodox

Heterodox