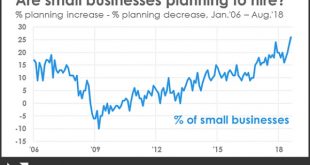

The Taboo against raising wages is still thriving among small businesses The National Federation of Independent Businesses (NFIB) put out its monthly confidence and hiring reports over the past few days. The confidence report soared to new high, so the economy is Teh Awesome and happy days are here again! Right? And look! It’s confirmed by the hiring report, which also shows record high plans to hire new workers: So how have those record hiring...

Read More »Subdued inflation helps gains in real average and aggregate wages

Subdued inflation helps gains in real average and aggregate wages With the consumer price report Tuesday morning, let’s conclude this weeklong focus on jobs and wages by updating real average and aggregate wages. Through July 2018, consumer prices are up 2.7% YoY, while wages for non-managerial workers are up 2.8%. Thus real wages have finally grown, ever so slightly, YoY: In the longer view, real wages have still been flat — up only 0.5% — for...

Read More »Kevin Hassett Needs Remedial Arithmetic

Kevin Hassett Needs Remedial Arithmetic Kevin DOW 36000 Hassett was sent out to the White House press to lie about real wage growth. Or maybe he just proved he seriously needs remedial math for another reason besides one that Brad DeLong notes: Glassman and Hassett get the math of the Gordon equation for valuing the stock market simply wrong. It’s not the earnings yield that shows up in the numerator, it’s the dividend yield. The book should have been...

Read More »New article on tax increment financing in Missouri shows impact of KS/MO border war

New article on tax increment financing in Missouri shows impact of KS/MO border war After several years of work, my colleague Susan G. Mason (Boise State University) and I have published a new article on TIF in Missouri, specifically in the St. Louis and Kansas City metropolitan areas. “Exploring Patterns of Tax Increment Financing Use and Structural Explanations in Missouri’s Major Metropolitan Regions” appeared in the July 2018 edition of the HUD...

Read More »Next Friday could be a very bad day somewhere along the East Coast

Next Friday could be a very bad day somewhere along the East Coast I think I may have mentioned once or twice that I am a nerd, right? So, last year during hurricane season I got hooked on a site called Tropical Tidbits. The neat thing about this site — well, from a nerdy point of view — is that it posts the GFS model forecast, updated every 6 six hours, for the next two weeks! While you normally don’t hear forecasts more than five days out, I noticed...

Read More »Brad DeLong hops aboard the “Employers have a Taboo against raising Wages” bandwagon

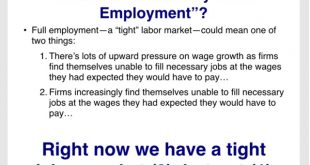

Brad DeLong hops aboard the “Employers have a Taboo against raising Wages” bandwagon For Labor Day Prof. Brad DeLong posted a talk on the implications (or not) of the US being near “full employment.” The arguments on a few of the pages will be familiar to readers of this blog: My only significant quibble here is that “Job Openings” rates from both the JOLTS reports and the NFIB (Small Business) survey have been soaring for over 2 years....

Read More »A thought for Labor Day, 2018

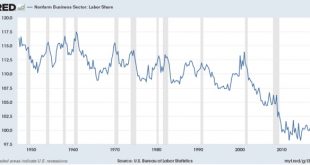

(Dan here…better late than not) by New Deal democrat A thought for Labor Day, 2018 US voters will continue to vote for alternating partisan “waves” in Congress, and for “outsiders” however chancey for President, until the problem depicted in the below graph is solved:

Read More »Has Trump Gone Over The Edge On Negotiating With Canada?

Has Trump Gone Over The Edge On Negotiating With Canada? He may well have. Facing the deadline for submitting his deal with Mexico to Congress on Friday, he did so. However, he did so without Canada signed on, the apparently intense negotiations in Washington between Canadian Foreign Minister, Chrystia Freeland and US Trade Representative, Robert Lighthizer having failed to come to an agreement. With both the Mexican leaders and major Republican...

Read More »Comments on personal consumption expenditures: the September anomaly and the Fed’s 2% inflation ceiliing

Comments on personal consumption expenditures: the September anomaly and the Fed’s 2% inflation ceiliing Let me make a few comments on yesterday’s (Aug. 30) report on personal income and spending. Well, actually, just the spending part for now. First, there is a long-time relationship going back 60 years in the data whereby the YoY% growth in retail sales is higher in the first part of an economic expansion, and lower in the latter part, compared with...

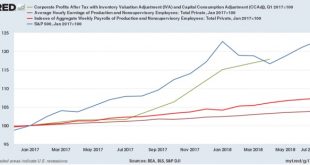

Read More »Corpoate profits after taxes set a new record. But the Fed is worried about wages

Yesterday (Aug. 29) in the Q2 GDP update corporate profits were reported for the first time. Since corporate profits are one of four long leading indicators identified by Prof. Geoffrey Moore, I have updated my look at them at Seeking Alpha. Usual shameless plug: reading this isn’t just educational, it puts a few pennies in my pocket. But of course corporate profits are a good way to measure how the producer sector is doing compared with...

Read More » Heterodox

Heterodox