Read More »

The idea of progress seems one of the theoretical presuppositions of modernity.

from Ken Zimmerman (originally a comment) Uneconomic growth is growth that produces negative externalities which reduce the overall quality of life. This is also known as unsustainable growth, where the negative social and environmental consequences outweigh the short-term value of an extra unit of growth, making it uneconomic. But in spite of this quandary growth remains the primary goal. It holds that place because growth is equated with progress. The idea of progress seems one of the...

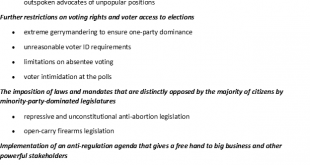

Read More »Capitalists beware: post-democracy America may not be a shining example of Hayekian liberalism

Dan Little has a post up at Understanding Society on what authoritarianism might look like in the United States. The whole thing is well worth reading, but here is one part: This seems about right, though of course speculative, but I have doubts about the big business piece. Yes, some business interests will be close to the ruling party or strongman, and they may gain some degree of regulatory relief, but it would be a mistake for...

Read More »Capitalists beware: post-democracy America may not be a shining example of Hayekian liberalism

Dan Little has a post up at Understanding Society on what authoritarianism might look like in the United States. The whole thing is well worth reading, but here is one part: This seems about right, though of course speculative, but I have doubts about the big business piece. Yes, some business interests will be close to the ruling party or strongman, and they may gain some degree of regulatory relief, but it would be a mistake for...

Read More »Put Labor last?

I gave up hope of getting much out of a Labor government when Albanese announced that he would implement Morrison’s top-end tax cuts, and it became clear that this meant abandoning most of the spending commitments Labor took to the 2019 election. But at least it seemed that Labor would be significantly better on climate policy. Now, that difference has been reduced to a minor point of semantics. Morrison has finally crabwalked his way to a 2050 net zero commitment. In deference to the...

Read More »Why economics is not an ecological science?

from Gregory A Daneke and WEA Commentaries As an academic discipline economics has actually been organized to have little use for the concepts of ecology (especially: population biology, systemic science, ethology, natural history or biogeography). With the rise of Neoclassical economics, it was specifically designed to be a sterilized, frictionless, and hermitically sealed void in which to suspend economic activity. But of course, this a-societal, a-political, a-historical enterprise...

Read More »Weekly Indicators for October 1 – 5 at Seeking Alpha

by New Deal democrat Weekly Indicators for October 1 – 5 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. As I point out from time to time, one of the biggest values in tracking data that is reported with high frequency, i.e., weekly as opposed to monthly or quarterly, is that you are able to spot changes in trends much more quickly. Apropos of which, the surge in consumer spending + shipping bottlenecks had caused...

Read More »Weekly Indicators for October 1 – 5 at Seeking Alpha

by New Deal democrat Weekly Indicators for October 1 – 5 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. As I point out from time to time, one of the biggest values in tracking data that is reported with high frequency, i.e., weekly as opposed to monthly or quarterly, is that you are able to spot changes in trends much more quickly. Apropos of which, the surge in consumer spending + shipping bottlenecks had caused...

Read More »A golden age of macro-economic statistics 2. Macro-based CO2 emissions.

I love the national accounts (NA). The NA focus on the money-economy. Total wages (who pays, who receives), profits, imports, exports, consumption, bank credit, the value and ownership of fixed and financial capital and (on the other side of the sectoral balance sheets) debts. By focusing on different kinds of money flows and stocks and by tracking flows between sectors the national accounts enable us to map the relations between economic sectors like construction and industry...

Read More »Weekend read – Combatting Global Warming: The Solution to China’s Demographic “Crisis”

from Dean Baker There have been numerous news articles in recent years telling us that China faces a demographic crisis. The basic story is that the market reforms put in place in the late 1970s, together with the country’s one-child policy, led to many fewer children being born in the last four decades. As a result, the number of current workers entering retirement exceeds the size of the cohorts entering the workforce, leading to a stagnant or declining workforce. This is supposed to be...

Read More » Heterodox

Heterodox