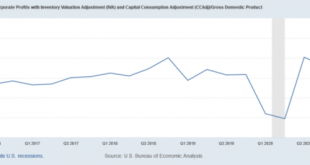

from Dean Baker That’s the question millions are asking, even if economic reporters are not. The classic story of a wage price spiral is that workers demand higher pay, employers are then forced to pass on higher wages in higher prices, which then leads workers to demand higher pay, repeat. We are seeing many stories telling us that this is the world we now face. A big problem with that story is the profit share of GDP has actually risen sharply in the last two quarters from already high...

Read More »Weekly Indicators for October 11 – 15 at Seeking Alpha

by New Deal democrat Weekly Indicators for October 11 – 15 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. There are a couple of signs that the inflationary surge may be at or just past its peak, mainly in that the costs for ship transportation, which have been soaring for months, have stopped doing so and in one case have reversed. Meanwhile, on the production side, some commodity costs are still increasing sharply. As...

Read More »How emerging markets hurt poor countries

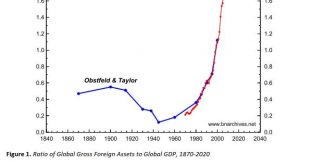

from C. P. Chandrasekhar and Jayati Ghosh It is by now well known that three decades of financial globalization have led to massive increases in income and asset inequalities in the United States and Europe. But in the developing world, the effects of financial globalization have been even worse: along with new inequality and instability, the creation of “emerging markets” to support investment in poor countries has undermined development projects and created a relationship in which poor...

Read More »Could the culture wars really be over?

It seems almost inconceivable that the culture wars that have dominated Australian public life for decades could end, and with victory for the progressive side on nearly every front. And I have made premature predictions to this effect before. But consider the following list of events over the last couple of years, many in the last few months. * After decades of quasi-legality in many states, abortion rights have been enshrined in law throughout Australia – attempts to...

Read More »Weekend read – Red Giant

from Shimshon Bichler and Jonathan Nitzan Introduction In 2012, we published a paper in the Journal of Critical Globalization Studies titled ‘Imperialism and Financialism: The Story of a Nexus’. Our topic was the chameleon-like Marxist notion of imperialism and how its different theories related to finance. Here is the article’s summary: Over the past century, the nexus of imperialism and financialism has become a major axis of Marxist theory and praxis. Many Marxists consider this...

Read More »The growth of hierarchically ordered non-market economic organisations (i.e. corporations)

from Terry Hathaway Contemporary political and economic discourse sees capitalist systems characterised as market economies, and references to both The Market and markets are ubiquitous; markets are seemingly everywhere. This situation is distinctly odd, as while economic relations have been more and more characterised as “markets”, many economies have seen both the withering away of traditional marketplaces and the concurrent growth of hierarchically ordered non-market economic...

Read More »Open thread October 15, 2021

China’s Evergrande Conundrum

from C. P. Chandrasekhar China’s Evergrande group, identified as the world’s most indebted property company with accumulated liabilities in excess of $300 billion, missed an interest payment instalment due on September 23, 2021 on bonds borrowed through US dollar bond markets. Though the company enjoys a 30-day grace period to pay up and avoid being in default, the absence as yet of any clarification on the missed instalment has increased uncertainty. Markets seem sceptical that the firm...

Read More »Three conceptualisations of the market

from Terry Hathaway – http://www.paecon.net/PAEReview/issue97/Hathaway97.pdf Watson (2018) shows that within neoclassical economics the shifting definition of the market has led to three conceptualisations of the market that are rolled into one another; the descriptive concept, the analytical concept, and the formalist concept. The descriptive concept can be seen in Smith where the idea is of “the market literally as a marketplace, with all the hustle and bustle of people going about...

Read More »“What is the true value of my property?”

from Blair Fix – http://www.paecon.net/PAEReview/issue97/Fix97.pdf Putting a fence around something and calling it “property” is step one of capitalization. But property alone is not enough. Romans had property. So did most feudal kingdoms. But these societies did not have capitalization. To capitalize property, there is a second step. You must mix property with finance. The word “finance” evokes a sense of awe – a sense of other-worldly complexity. But at its heart, finance is simple. It...

Read More » Heterodox

Heterodox