by New Deal democrat Weekly Indicators for September 20 – 24 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. With Delta definitely receding, it appears it had no meaningful impact on the consumer economy. What *is* continuing to happen, however, is that transportation bottlenecks are continuing to drive up related prices to levels not seen in a decade or more. As usual, clicking over and reading should bring you up...

Read More »The coming boom in inherited wealth

Are we creating a society Jane Austen might recognise? An updated version of an article I wrote a few years back, published in Inside Story Share this:Like this:Like Loading...

Read More »Time is running out for a new agricultural model for the global south

from Jayati Ghosh Climate change is posing immediate threats to humanity, and indeed to all living organisms on the planet, in extreme weather events across the globe. Other environmental stresses include rising water levels or falling water tables, desertification and salination. Agriculture—especially industrial agriculture requiring chemical inputs—is cause and victim of these changes. Cultivation patterns such as mono-cropping, with heavy reliance on groundwater and chemical inputs,...

Read More »Open thread Sept. 24, 2021

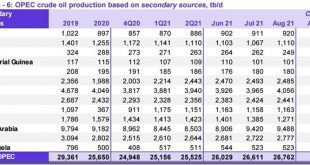

“August Global oil shortage, 2.77 million barrels daily, OPEC Output falls short 684,000 barrels per day”

“Global oil shortage at 2.77 million barrels per day in August as OPEC, Output falls short of quota by 684,000 barrels per day,” Commenter and Blogger, RJS, Focus on Fracking OPEC’s Monthly Oil Market Report “The Latest US Oil Supply and Disposition Data from the EIA” Monday of this week saw the release of OPEC’s September Oil Market Report, which covers OPEC & global oil data for August, and hence it gives us a picture of the global oil...

Read More »RWER issue no. 97

download whole issue Has economics become a new theology? 2Andri W. Stahel Beyond dollar creditocracy: A geopolitical economy 20Radhika Desai and Michael Hudson A black-swan shock exposes the deep fissures, endemic imbalances, and structural weaknesses of the U.S. economy 40John Komlos Fuck the market 62Terry Hathaway The ritual of capitalization 78Blair Fix Economic hypocrisies in the pandemic age 96Raphael Sassower The politics...

Read More »Revealed preference theory — an empty tautology

from Lars Syll The experiment reported here was designed to reflect the fact that revealed preference theory is concerned with hypothetical choices rather than actual choices over time. In contrast to earlier experimental studies, the possibility that the different choices are made under different preference patterns can almost be ruled out. We find a considerable number of violations of the revealed preference axioms, which contradicts the neoclassical theory of the consumer maximising...

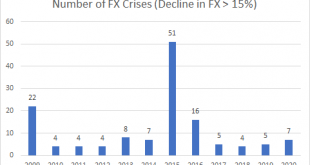

Read More »FX Crises and the Trajectory of Interest Rates

In this post, I want to get a sense of foreign exchange crises since 2008. The data that I am using is taken from the World Bank. It is not perfect. It is a bit spotty and could be improved upon. It is also annual data, so it will not pick up intrayear crises. But it is solid enough that it should give us a good first cut on the dynamics of foreign exchange crises. The first question to ask is simple enough: how many foreign exchange crises were experienced in this time period? For...

Read More »Carbon markets: another frontier for finance

from C. P. Chandrasekhar Carbon prices in the European Union (EU), or the value of one unit of an EU allowance (EUA) that gives the holder the right to emit one tonne of carbon dioxide (or its equivalent of other greenhouse gasses), are soaring. From 33.69 euros per tonne at the beginning of the year, the prices of EUAs traded through the EU’s emission trading system (ETS) had risen to a high of 62.75 euros on September 9, or by more than 80 per cent. Since the ETS was created to generate...

Read More »Is China Facing a Minsky Moment?

As Evergrande looks about to default on its debt many are asking whether this might be a Lehman moment for China. That is, are we about to see a wave of defaults that bring down the Chinese financial system as we did in Western countries in 2008? Much of the discussion is based on a misunderstanding. The Western financial system as it stood in 2008 was a largely laissez-faire system. There were, of course, regulations in place and there were also protections – most notably, deposit...

Read More » Heterodox

Heterodox