Since the Brexit referendum was hailed by many as representative of a new force in global politics, it’s of interest even on the far side of the planet, and I’ve watched the slow-motion train wreck with appalled fascination. So, as far as I can tell, the Brexit deal Theresa May has come up with is pretty much the super-soft version. About the only immediate change it will produce is a return to blue passports in place of the EU burgundy, which, it appears, were always optional. And, it...

Read More »Truth and probability

from Lars Syll Truth exists, and so does uncertainty. Uncertainty acknowledges the existence of an underlying truth: you cannot be uncertain of nothing: nothing is the complete absence of anything. You are uncertain of something, and if there is some thing, there must be truth. At the very least, it is that this thing exists. Probability, which is the science of uncertainty, therefore aims at truth. Probability presupposes truth; it is a measure or characterization of truth. Probability...

Read More »A leading economist who took Uber’s money and delivered favorable results sees his reputation tarnished

from Norbert Häring A year ago, I described how the controversial and well-financed ride-hauling platform Uber pays economists with data and money to do Uber-related research. This research invariably leads to favourable results, which can be used to fend off criticism and regulation. One such study has now been ripped apart in the Industrial & Labor Relations Review (ILR), a top journal in labor-economics. Two fearless economists, Janine Berg, senior-economist at the International...

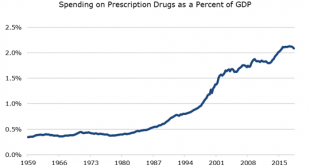

Read More »US drug prices started to explode in the 1980s, contrary to what the NYT tells you

from Dean Baker Austin Frakt had an interesting Upshot piece in the NYT saying that drug spending in the US began to sharply diverge from other countries in the 1990s. This actually is not very clear, since the comparison group dating back to the 1980s is small. I am actually more struck by the explosion in spending in the 1980s, with it nearly doubling as a share of GDP over the course of the decade. Note that drug spending had not been increasing at all as a share of GDP over the prior...

Read More »Take a hard look at the skeletons in the mainstream closet!

from Lars Syll Although prepared to admit that our empirical research procedures may be based on some very shaky assumptions, [some thoughtful scholars see] no point in saying much about this unless superior alternatives are presented. I understand this concern … Nevertheless, a hard look at the skeletons in the closet is beneficial, especially when there is a propensity to keep the door locked. Nothing is gained by avoiding that which the discipline must face up to sooner or later. If a...

Read More »Open post Nov. 13, 2018

Markets, policy, and institutions

from David Ruccio Teaching critical literacy. That’s what professors do in the classroom. We teach students languages in order to make some sense of the world around them. How to view a film or read a novel. How to think about economics, politics, and culture. How to understand cell biology or the evolution of the universe. And, of course, how to think critically about those languages—both their conditions and their consequences. I’ve been thinking about the task of teaching critical...

Read More »Thomas Sargent discovered his inner Marxist. Really. Two graphs.

Graph 1. Unemployment in the USA, % of the labor force, monthly data. One of the central and most pressing questions of macro-economics is how to estimate and explain unemployment. Thomas Sargent, card-carrying member of the neoclassical cabal and winner of the ‘Sveriges Riksbank Prize In Economic Sciences In Memory Of Alfred Nobel’ (SRPIESIMOAN) just made a shot at it. A somewhat Marxist shot, as far as I’m concerned. Which, considering the hard core neoclassical nature of the rest of...

Read More »1919: Keynes’s revolutionary plan for the global economy

12 November, 2018 This year is the 150th anniversary of the TUC, and the 70th anniversary of the Trade Union Advisory Committee to the OECD. As part of the celebration of these achievements, the TUC’s Economics and Social Affairs department organised an event “Lessons from the Great Financial Crisis” – on 12th November, 2018 – the day after Armistice day, and 100 years after the ending of the First World War. Several speakers, including ex-Prime Minister Gordon Brown, were invited to...

Read More »Hype and facts on free trade

from C. P. Chandrasekhar Voices questioning the claim that nations and the majority of their people stand to gain from global trade are growing louder. The one difference now is that the leading protagonist of protectionism is not a developing country, but global hegemon United States under Donald Trump. Free trade benefits big corporations with production facilities abroad, Trump argues, while harming those looking for a decent livelihood working in America. With time Trump has made...

Read More » Heterodox

Heterodox