from Lars Syll The belief in the power and necessity of formalizing economic theory mathematically has thus obliterated the distinction between cognitively perceiving and understanding concepts from different domains and mapping them into each other. Whether the age-old problem of the equality between supply and demand should be mathematically formalized as a system of inequalities or equalities is not something that should be decided by mathematical knowledge or convenience. Surely it...

Read More »The Nordhaus Racket: How to use capitalization to minimize the cost of climate change and win a ‘Nobel’ for ‘sustainable growth’

from Shimshon Bichler and Jonathan Nitzan The LA Times called the bluff: William D. Nordhaus won the Nobel prize in economics for a climate model that minimized the cost of rising global temperatures and undermined the need for urgent action. ‘The economics Nobel went to a guy who enabled climate change denial and delay’: It has been a scary month in climate science. Hurricane Michael and a frightening report from the U.N. Intergovernmental Panel on Climate Change underlined the potential...

Read More »Uploaded: ‘The role of money in economic theory’ by Wesley Claire Mitchell (1916)

Is economics basically about measured monetary variables like GDP or wages (recount that ‘total wage income’ is part of GDP)? Or is it, as neoclassical economists assume, mainly about what Thorstein Veblen called ‘hedonistic’ variables like ‘utility’? This discussion is still waging. Look here. It’s an old discussion. According to a man who decisively contributed to the way we measure the ‘money economy’, Wesley ClaireMitchell, economics is about measuring the ‘money economy’ (Mitchell...

Read More »Modern Monetary Theory

from Asad Zaman In a rapidly changing world, ways of thinking which served us well in other eras, become obstacles to understanding, and reacting appropriately to change. Traditional economic theories, currently being taught all around the world,blinded economists to the possibility of the global financial crisis.The Queen of England went to London School of Economics to ask why “no one saw it coming?”.The US Congress appointed a committee to study why economic theories “dismissed the...

Read More »Economics is an extremely powerful source of ideational content

from Jamie Morgan and the current issue of RWER What mainstream economics has become creates limits on what society can be because mainstream economics is an extremely powerful source of ideational content. This is not just a matter of what cannot be explored without models or datasets, since many things that can be explored in this way are not actually explored and some that are, are deformed. One well-known current example is inequality. This problematic was conceptually invisible...

Read More »Modern economics is sick

from Lars Syll Modern economics is sick. Economics has increasingly become an intellectual game played for its own sake and not for its practical consequences for understanding the economic world. Economists have converted the subject into a sort of social mathematics in which analytical rigour is everything and practical relevance is nothing … If there is such a thing as “original sin” in economic methodology, it is the worship of the idol of the mathematical rigour invented by Arrow and...

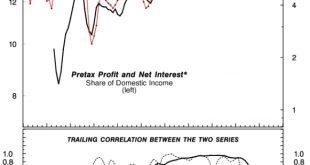

Read More »Can capitalists afford recovery? A closer look

from Shimshon Bichler and Jonathan Nitzan Our RWER blog post, ‘Can capitalists afford recovery: A 2018 update’, showed U.S. unemployment to be a highly reliable leading indicator for the capitalist share of domestic income three years later. An observant commentator, though, suggested otherwise (first comment by jayarava). Although true for much of the postwar period, this association no longer holds, s/he argued. ‘Something changed after the global financial crisis to decouple...

Read More »Open thread Nov. 2, 2018

‘Truly revolutionary’. The November 1918 armistice and labor relations

One hundred years ago World War I ended. This war changed everything. It did not only end the Austrian-Hungarian and the Ottoman empires and lead to the emergence of the USA as an international hegemon. It also transformed labor relations worldwide. According to the first Report of the Director of the new International Labour Office (ILO): “It would therefore be almost impossible to exaggerate the truly revolutionary character of the events which during the last years of the war or...

Read More »Elections matter … Right?

from Peter Radford Elections Matter … Right? Well, only if those being elected have an inkling of what their constituents actually want. And it seems that, here in America at least, there is a considerable gulf between what those who are elected think are the key issues and what those who do the electing think of as the key issues. The lack of overlap is distinctly upsetting. We are constantly being told that the US is a relatively conservative nation. This is why some of the...

Read More » Heterodox

Heterodox