from Edward Fullbrook Determinism, the idea that everything that happens must happen as it does and could not have happened any other way, and atomism, the idea that the world is made up of entities whose qualities are independent of their relations with other entities, are fundament components of classical mechanics. Atomism is also central to the concept of mind developed in John Locke’s An Essay Concerning Human Understanding, published (1690) three years after Newton’s Principia....

Read More »Credit check with macro comments

Bank credit growth continues to decelerate, to where historically, after revisions, the economy would already be in recession. Housing and vehicles look like they are already reporting negative growth, and personal income growth has decelerated to about 0% growth, with personal spending holding positive only because people are dipping into savings, which historically has always been followed by a reduction in spending: Less borrowing to spend translates into less...

Read More »Different but Equal?

Here’s a fascinating recent article with the forbidding title of The landscape of sex-differential transcriptome and its consequent selection in human adults. I’ll provide the abstract, and then a translation into English. Here’s the abstract: Background The prevalence of several human morbid phenotypes is sometimes much higher than intuitively expected. This can directly arise from the presence of two sexes, male and female, in one species. Men and...

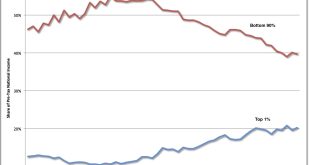

Read More »Haunted by surplus

from David Ruccio Inequality in the United States is now so obscene that it’s impossible, even for mainstream economists, to avoid the issue of surplus. Consider the two charts at the top of the post. On the left, income inequality is illustrated by the shares of pre-tax national income going to the top 1 percent (the blue line) and the bottom 90 percent (the red line). Between 1976 and 2014 (the last year for which data are available), the share of income at the top soared, from...

Read More »Not With a Bang, but a Whimper… Democratic Party Edition. An Op Ed.

A presidential candidate like Donald Trump should not be viable. Candidates he supports should not be viable. The existence of Donald Trump should be a boon for the Democrats. And, in fact, it has been. But it hasn’t been enough. Perhaps four (or eight?) years worth of results will tip the balance for Democrats, but it is reasonable to ask: why have Democrats been coming up short against Trump, both in the Presidential election and in special elections...

Read More »Open thread Nov. 3, 2017

Blaming inequality on technology: sloppy thinking for the educated

from Dean Baker The most popular explanation for the sharp rise in inequality over the last four decades is technology. The story goes that technology has increased the demand for sophisticated skills while undercutting the demand for routine manual labor. This view has the advantage over competing explanations, like trade policy and labor market policy, that it can be seen as something that happened independent of policy. If trade policy or labor market policy explain the transfer of...

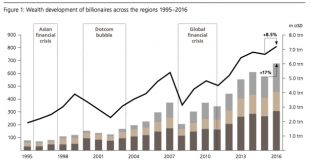

Read More »The gilded age: a tale of today*

from David Ruccio The timing could not have been better, at least for me. It just so happens I’m teaching Thorsten Veblen’s Theory of the Leisure Class this week. It should become quickly obvious to students that, as I have argued before on this blog, we’re now in the midst of a Second Gilded Age. This is confirmed in a new report by UBS/PwC, according to which, after a brief pause in 2015, the expansion in billionaire wealth around the world has resumed. Thus, billionaire wealth rose...

Read More »Duopolie

from Asad Zaman Varian start his intermediate micro text by stating the maximization and equilbrium are the core principles of micro. Krugman recently stated that I am a “maximization and equilibrium” kind of guy. The goal of this lecture is to show that these two principles fail completely to help us understand behavior is a very simple model of a duopoly. In last lecture (AM03), we introduced a simple duopoly model. Two ice-cream vendors buy ice-cream wholesale and can sell at any...

Read More »Private payrolls, Construction spending, Vehicle sales, Saudi output and pricing, Trump news headlines

2 month average is 167,500: Highlights ADP is calling for a limited snap back in the October employment report. ADP sees private payrolls rising 235,000 which is just on the high side of ADP’s usual estimates. Actual private payrolls fell 40,000 in September, pulled down by hurricane dislocations. Today’s results may, only on the margin, pull down expectations for Friday’s private payrolls where the consensus is currently 320,000. Service sector employment growth began...

Read More » Heterodox

Heterodox