Read More »

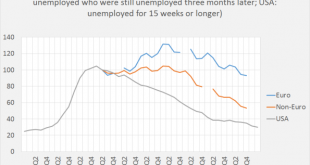

Involuntary unemployment in the Eurozone, the rest of the EU and the USA: elevated and high

In the USA and the EU, employment is up and unemployment is down. But unemployment is not yet low. Unemployment rates have to decline more (a bit in the USA, a lot in the EU) and participation rates have to recover (a lot in the USA, a bit in the EU). In the EU, there are large differences between countries (compare Spain with Germany). But on the macro level, there is still a large reservoir of involuntary unemployment and, looking at the participation rates, people who have given up...

Read More »Consumer credit, French fiscal policy, Mtg mkt index

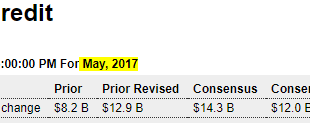

Higher than expected, and last month revised up, however the trend is still lower. This report is only through May. The weekly bank loan report is as of June 28, and shows the down trend continuing, which generally reflects a deceleration in consumer spending: Highlights Consumer spending has been modest but consumers did run up their credit-card debt in May helping to lift consumer credit outstanding by a larger-than-expected $18.4 billion. Revolving credit, which is where...

Read More »What do we owe Raf & Laura Brannigan?

Self Control is one of the defining music hits of the 1980s. It was first released in 1984 by Italian singer-songwriter Raf (his first single). It was also released almost contemporaneously by Laura Brannigan. The song includes these lyrics: You take my self you take my self control I I live among the creatures of the night I haven’t got the will to try and fight The first line of the quote I provided is wrong. Not in the sense that those words aren’t lyrics...

Read More »Credit check

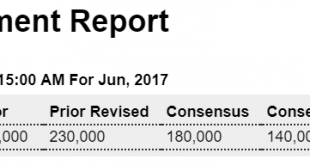

From bad to worse at the end of q2, increasing odds of a downside surprise for q2 gdp:

Read More »Here is a Little Economics Lesson

Here’s a little economics lesson: supply and demand. You put the supply out there, and demand will follow. — Rick Perry, U.S. Secretary of Energy While the media is having fun at the expense of Secretary Perry’s asinine “economics lesson” it is worth pointing out that the very same publications that ridicule Perry perpetually peddle the exact same theory under the guise of “debunking” the imaginary lump-of-labor fallacy. Here is The Economist from yesterday...

Read More »Employment, Health care

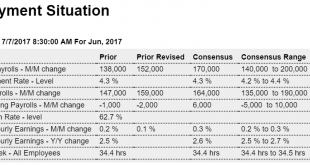

A better than expected number but as per the chart, the year over year rate of growth continued its downtrend which began about 2.5 years ago when oil capital expenditures collapsed. Since GDP growth is the sum of the ‘pieces’ that make up GDP, if any piece contributes less to growth than it did last year, another must contribute more or the growth of GDP will be lower. So far this year we’ve seen a slowing of growth vs last year in vehicle sales, home sales, consumer...

Read More »Open thread July 7, 2017

Poverty, Crime and Causality

I was bouncing around my twitter feed and landed on this tweet which in turn took me to a paper entiteld Childhood family income, adolescent violent criminality and substance misuse: quasi-experimental total population study. The paper appeared in the British Journal of Psychiatry in 2014. Here’s the basic summary: Background Low socioeconomic status in childhood is a well-known predictor of subsequent criminal and substance misuse behaviours but the causal...

Read More »ADP, ISM non manufacturing, Interview, Saudi output, credit chart, Inflation chart, claims chart, Mueller team news

Lower than expected and last month revised lower: Highlights ADP sees June private payrolls rising 158,000 which misses Econoday’s ADP consensus of 180,000. Econoday’s consensus for actual private payrolls in Friday’s employment report is 164,000 which isn’t likely to shift following ADP’s results. Estimates this year from ADP have been hit and miss with a wild upside miss in May. Decent number for this survey but still reflects trumped up expectations: Highlights ISM’s...

Read More » Heterodox

Heterodox