from Peter Radford Just how pejorative must we be in order to get attention? There are silly things in economics that need to be weeded out, so that something better can emerge. Sometimes I just say the whole thing is a waste of time, after all economics is not simply a body of thought, but it is also a social phenomenon, it has its own language, its own self-referential estimate of quality, its own hierarchy, and its own history that locks it tightly along a specific path. And, frankly,...

Read More »Comparing income inequality in the United States and France

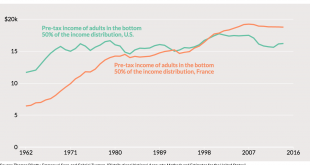

The bottom 50 percent of income earners makes more in France than in the United States even though average income per adult is still 35 percent lower in France than in the United States (partly due to differences in standard working hours in the two countries).9 Since the welfare state is more generous in France, the gap between the bottom 50 percent of income earners in France and the United States would be even greater after taxes and transfers. The diverging trends in the...

Read More »Mortgage apps, Headlines

New applications seem to be modestly increasing even as bank lending for real estate has been flat and decelerating: Hard to say which is worse for markets- if Trump remains as President or if he is removed:

Read More »Formal mathematical modeling in economics — a dead-end

from Lars Syll Using formal mathematical modeling, mainstream economists sure can guarantee that the conclusions hold given the assumptions. However, the validity we get in abstract model worlds does not warrantly transfer to real world economies. Validity may be good, but it isn’t enough. From a realist perspective both relevance and soundness are sine qua non. In their search for validity, rigour and precision, mainstream macro modellers of various ilks construct microfounded DSGE...

Read More »Late capitalism?

from David Ruccio Apparently, “late capitalism” is the term that is being widely used to capture and make sense of the irrational and increasingly grotesque features of contemporary economy and society. There’s even a recent novel, A Young Man’s Guide to Late Capitalism, by Peter Mountford. A reader [ht: ra] wrote in wanting to know what I thought about the label, which is admirably surveyed and discussed in a recent Atlantic article by Anne Lowrey. I’ll admit, I’m suspicious of “late...

Read More »Housing starts, Industrial production, Fed wage tracker

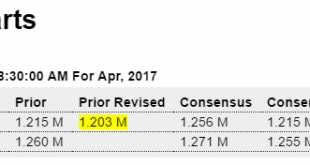

No surprise here, after seeing what mortgage lending has been doing: Highlights A topping out from lower-than-indicated expansion highs is the news from the April housing starts report where levels, though still healthy, are disappointing. Starts fell 2.6 percent to a 1.172 million annualized rate that is well below Econoday’s low estimate for 1.215 million. Downward revisions are a factor in the report, totaling 27,000 in the prior two months. The strength in the report is...

Read More »Bundesbank rejects 100%-money based on sophistry and false claims

from Norbert Häring In its April monthly report, Deutsche Bundesbank explains that banks create money ex-nihilo and rejects the proposal of 100%-money. The full English version is now online. The arguments employed to discredit 100%-money are a mix of sophistry and misleading or false statements. With some delay, Bundesbank has joined the Bank of England in explicitly stating that the treatment of banks and money creation in most textbooks is wrong and that banks are not intermediaries,...

Read More »Trump family and friends: in your pockets

from Dean Baker Donald Trump has openly said that he doesn’t care at all about the rules that prohibit the president and those around him from profiting from their government positions. In breaking with longstanding precedent, he is holding on to his business empire and having his children run it as he carries on with the business of being president. With the government forced to pay the bills for the Secret Service to stay at his golf resorts and hotels, Trump obviously feels no...

Read More »Open thread May 16, 2017

Structural econometrics

from Lars Syll In a blog post the other day, Noah Smith returned again to the discussion about the ’empirical revolution’ in economics and how to — if it really does exist — evaluate it. Counter those who think quasi-experiments and RCTs are the true solutions to finding causal parameters, Noah argues that without structural models empirical results are only locally valid. And you don’t really know how local “local” is. If you find that raising the minimum wage from $10 to $12 doesn’t...

Read More » Heterodox

Heterodox