Το σχέδιο ΔΗΜΗΤΡΑ και οι οικονομικές και πολιτικές αλχημείες του Γ.Βαρουφάκη Στ. Μαυρουδέας* & Θ.Χατζηραφαηλίδης** *καθηγητής Πολιτικής Οικονομίας, Τμήμα Κοινων. Πολιτικής, Πάντειο Πανεπιστήμιο ** υποψ. διδάκτορας, Τμήμα Οικονομικών, ΕΚΠΑ 1. Μηντιακοί «σωτήρες» σε καιρούς κρίσης Σε καιρούς κρίσης είναι συχνό το φαινόμενο εμφάνισης «σωτήρων» που υπόσχονται στις χειμαζόμενες λαϊκές μάζες την σωτηρία μέσω ευφάνταστων σχεδίων που θα μεταρρυθμίσουν το σύστημα και...

Read More »Google AI expert warns of massive uptick in productivity growth: No problems with Social Security

from Dean Baker We have long known that people in policy debates have difficulty with arithmetic and basic logic. We got yet another example today in the New York Times. The NYT profiled Geoffrey Hinton, who recently resigned as head of AI technology at Google. The piece identified him as “the godfather of AI.” The piece reports on Hinton’s concerns about the risks of AI, one of which is its implications for the job market. “He is also worried that A.I. technologies will in time upend the...

Read More »The econometric dream-world

from Lars Syll Trygve Haavelmo — with the completion (in 1958) of the twenty-fifth volume of Econometrica — assessed the role of econometrics in the advancement of economics, and although mainly positive of the “repair work” and “clearing-up work” done, he also found some grounds for despair: We have found certain general principles which would seem to make good sense. Essentially, these principles are based on the reasonable idea that, if an economic model is in fact “correct” or “true,”...

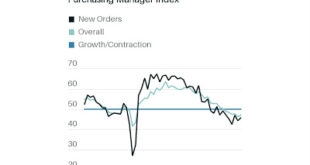

Read More »Manufacturing and construction start out the month’s data to the negative side

Manufacturing and construction start out the month’s data to the negative side – by New Deal democrat As usual, we start the month with reports on last month’s manufacturing, and construction from two months ago. The ISM manufacturing index has a 75 year record of being a very reliable leading indicator. According to the ISM, readings below 48 are consistent with an oncoming recession. And there, the news is not good. Not only has the index...

Read More »May Day

Yesterday was May Day, celebrated as the Labour Day public holiday here in Queensland*. And this week, appropriately enough I’m giving two presentations on the case for a four-day working week, one to the Committee for Economic Development of Australia, a business-oriented thinktank, and one to a parliamentary inquiry. I started writing a post about the prospect of a radical change in the relationship between workers and managers in the information economy, arising from the...

Read More »Leftists are not “anti-market”

from Peter Radford I have been reminded by Tyler Cowen of Bryan Caplan’s simplistic theory of left and right. It’s short and to the point. Leftists are, he says, “anti-market”. He is wrong. Leftists are anti-market obsession. They are anti-market fanaticism. They are anti-market worship. Specifically, they are opposed to the form of idealization used to articulate “the market” in economics. There’s a difference. And I assume Bryan Caplan knows as much. There has been a recent...

Read More »Open Thread April 29, 2023

Open Thread April 25, 2023, Angry Bear, angrybearblog.com Tags: open thread

Read More »David Brooks’ celebration of American capitalism

from Dean Baker Last week, David Brooks had a column that was quite literally a celebration of American capitalism. He makes a number of points showing the U.S. doing better than other wealthy countries over the last three decades. While his numbers are not exactly wrong, they are somewhat misleading. (I see Paul Krugman beat me to the punch, so I’ll try not to be completely redundant.) Brooks points to the faster GDP growth in the United States than in other wealthy countries. As Krugman...

Read More »Exploiting the South: power & knowledge

from Asad Zaman This is the first of a sequence of posts on the current economic crisis in Pakistan. Although the discussion is in the context of Pakistan, all the poor countries in grips of the modern neo-colonial global system face essentially the same problems. The financial basis of the system is outlined by Jason Hickel in Aid-in-Reverse: How the Poor Countries Develop the Rich. He describes how the poor countries receive 1.3 Trillion USD in financial inflows, aid, etc. from the...

Read More »Open Thread April 25, 2023

Open Thread April 20, 2023, Angry Bear angrybearblog.com Tags: open thread

Read More » Heterodox

Heterodox