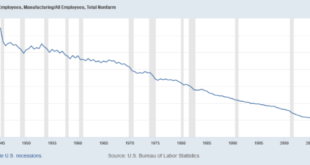

from Dean Baker The standard line in policy circles about the soaring inequality of the last four decades is that it is just an unfortunate outcome of technological change. As a result of technological developments, education is much more highly valued and physical labor has much less value. The drop in relative income for workers without college degrees is unfortunate and provides grounds for lots of hand wringing and bloviating in elite media outlets, but hey, what can you do?...

Read More »Open thread Sept. 9, 2022

Unemployment claims, PMI services, mtg applications and lending

No sign of recession, and lots of indications the rate hikes that are adding to deficit spending as supporting the economy and prices, and not depressing them, and more rate hikes will only do more of same. And it doesn’t end until the Fed understands it has had it all backwards: This is about 85% of the economy. No recession yet. More and more the data is telling me debt/gdp is plenty high for rate hikes to be supportive of total spending in the economy: Housing has been...

Read More »A bit of this, a bit of that: Stage 3 tax cuts, the Australian welfare state and Republican identity

I’ve been on holidays on the Sunshine Coast this week with my wife Nancy. I’d normally be racing in the SC 70.3 Ironman, but breaking my wrist a month ago put paid to any training (I’m recovering well, but slowly). We still had the accommodation booked, so we’re enjoying a relaxing time by the sea. Before we took off, I submitted a bunch of articles that have now come out. I already posted my piece on the Ethereum merge so, rather than bombard you with emails, I thought I would wrap...

Read More »Share buybacks — again?

from Peter Radford What isn’t said is often more telling than what is. The silence denotes either a disrespect for thorough analysis or an ignorance of issues beyond the ken of the speaker. Then, of course, a third option arises: that those issues are an embarrassment to the point being made and are thus best left unmentioned. For some reason stock buybacks appear to fall into such a zone of silence. There is some controversy currently about the topic because of the recent proposal to...

Read More »WEA Commentaries

WEA CommentariesVolume 12, Issue 2 download the whole issue Can university education in economics contribute to strengthened democracy and peace? Peter Söderbaum The Irish anomaly. Rethinking the concept and operationalization of ‘Gross Fixed Capital Formation’ Merijn Knibbe Benefits of fathers caring for children remain underestimatedin several European contexts Mitja Stefancic The WEA Textbook Commentaries Project What’s Capitalism got to do with it? David F Ruccio Please click...

Read More »Open thread Sept. 6, 2022

Econometric FUQs

from Lars Syll If you can’t devise an experiment that answers your question in a world where anything goes, then the odds of generating useful results with a modest budget and nonexperimental survey data seem pretty slim. The description of an ideal experiment also helps you formulate causal questions precisely. The mechanics of an ideal experiment highlight the forces you’d like to manipulate and the factors you’d like to hold constant. Research questions that cannot be answered by any...

Read More »The Bitcoin Monster, updated

A little while ago, I wrote about the impending shift of the Ethereum cryptocurrency from “proof of work” to “proof of stake”, with an energy saving of 99 percent. I’ve now expanded that post into an article for The Conversation, which has just come out. Read and enjoy (or skip, if you’ve heard enough about crypto). Share this:Like this:Like Loading...

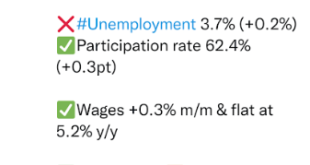

Read More »Employment, durable goods orders

No recession here either: Asymptotically approaching pre-Covid levels: Wage growth continues to lag (not cause) the growth rate of the CPI: Government had more employees under President Trump vs Presidents Obama and Biden? ;) This doesn’t look like a recession either:

Read More » Heterodox

Heterodox