from Edward Fullbrook I publish also in philosophy, and yesterday evening it occurred to me that a passage I wrote as part of a philosophy book a few years ago might be of interest to economists open to reconsidering their metaphysics. So here it is. [Beauvoir’s] view of desire and value begs to be compared, (and Beauvoir herself makes this comparison), to the one which underpins the stylized notion of rationality, tendentiously called ‘rational choice theory.’ Although indigenous to...

Read More »Economists as public intellectuals

from David Ruccio Soon after I read Brad DeLong’s post on “The Economist as…?: The Public Square and Economists,” I contacted my long-time friend and collaborator Antonio Callari, who is the Sigmund M. and Mary B. Hyman Professor of Economics at Franklin and Marshall College and an authority on the history of economics. I am pleased to publish his guest post here. If you read Brad DeLong’s reflections on the role of economists in the public square you would be justified in reaching two...

Read More »Ayn Rand — a psychopath and perverter of American History

from Lars Syll Now, I don’t care to discuss the alleged complaints American Indians have against this country. I believe, with good reason, the most unsympathetic Hollywood portrayal of Indians and what they did to the white man. They had no right to a country merely because they were born here and then acted like savages. The white man did not conquer this country … Since the Indians did not have the concept of property or property rights—they didn’t have a settled society, they had...

Read More »Chemical activity barometer, Fed Atlanta job tracker, Recession article

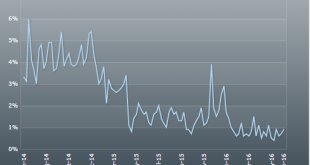

Looks to me like it’s still decelerating? From the American Chemistry Council: Chemical Activity Barometer Continues Solid Growth in June; Signals Higher U.S. Business Activity Through End Of The YearRead more at http://www.calculatedriskblog.com/#fcgmQuzJH31oFHbc.99 Wage ‘pressures’ indicators, after all this time, are finally moving up towards what would have been considered historically very low levels, so time to slam on the brakes? (Not that rate hikes are slamming on...

Read More »Redbook retail sales, Help wanted index, Job openings, Port traffic

Still nothing happening here:More imports, fewer exports:

Read More »The secret to the incredible wealth of Bill Gates

from Dean Baker Sorry folks, this isn’t Trump University, I don’t have the plan for you to get rich quick. But it is important for everyone to understand exactly why Bill Gates is very rich. It’s called “copyright protection.” If that sounds strange, imagine a world where everyone could make as many copies as they liked of Windows, Microsoft’s Office Suite and any other software at no cost. They would only have to send Bill Gates a thank you note, if they felt like it. Bill Gates is...

Read More »Brexit or the burden of being part of an optimal currency zone but not of the currency union itself

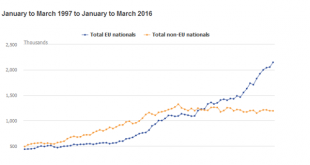

Source: ONS. According to the same ONS: Looking at the estimates by country of birth, between January to March 2015 and January to March 2016:UK born people working in the UK increased by 94,000 to 26.25 million. Non-UK born people working in the UK increased by 330,000 to 5.24 million Some months ago I was in London. The subway was populated by a mix of Asian looking super models and Polish construction workers. And by the occasional tourist, heading, with his son, 14, to a football...

Read More »Paul Krugman, Brexit, and unaccountable government

from Dean Baker Paul Krugman devoted his column on Friday to a mild critique of the drive to take the United Kingdom out of the European Union. The reason the column was somewhat moderate in its criticisms of the desire to leave EU is that Krugman sympathizes with the complaints of many in the UK and elsewhere about the bureaucrats in Brussels being unaccountable to the public. This is of course right, but it is worth taking the issue here a step further. If we expect to hold people...

Read More »Housing starts, Beijing bans iPhone 6

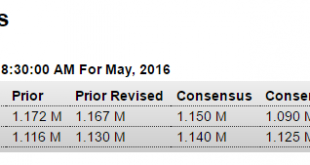

Not good. Note from the chart how growth has stalled, and housing is not likely to add as much to GDP this year as it did last year: HighlightsHousing starts are solid but not permits. Starts did slip 0.3 percent to a 1.164 million annualized rate in May but the trend is positive with the year-on-year gain at a very strong 9.5 percent. Permits, in contrast, popped 0.7 percent higher in the month to a 1.138 million rate but here the year-on-year rate remains deep in the...

Read More »Practical economics is radical?

from Peter Radford I have a book by James Meade published in 1975. It’s called “The Intelligent Radical’s Guide to Economic Policy”. Thumbing through it reveals how some things never change and yet, also, how the neoliberal suffocation of economic thinking and policy has allowed us to drift from a socially just economy. He ends his first paragraph thus: “The radical in politics is the citizen who places a rather high relative value upon Liberty and Equality in the catalogue of social...

Read More » Heterodox

Heterodox